REYVOW Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Reyvow, and when can generic versions of Reyvow launch?

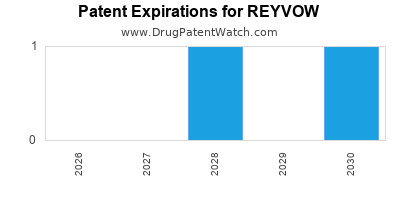

Reyvow is a drug marketed by Eli Lilly And Co and is included in one NDA. There are four patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and eighty-seven patent family members in forty-seven countries.

The generic ingredient in REYVOW is lasmiditan succinate. One supplier is listed for this compound. Additional details are available on the lasmiditan succinate profile page.

DrugPatentWatch® Generic Entry Outlook for Reyvow

Reyvow was eligible for patent challenges on January 31, 2024.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be December 5, 2037. This may change due to patent challenges or generic licensing.

There is one Paragraph IV patent challenge for this drug. This may lead to patent invalidation or a license for generic production.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for REYVOW?

- What are the global sales for REYVOW?

- What is Average Wholesale Price for REYVOW?

Summary for REYVOW

| International Patents: | 187 |

| US Patents: | 4 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 84 |

| Drug Prices: | Drug price information for REYVOW |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for REYVOW |

| What excipients (inactive ingredients) are in REYVOW? | REYVOW excipients list |

| DailyMed Link: | REYVOW at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for REYVOW

Generic Entry Date for REYVOW*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Paragraph IV (Patent) Challenges for REYVOW

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| REYVOW | Tablets | lasmiditan succinate | 50 mg and 100 mg | 211280 | 1 | 2024-01-31 |

US Patents and Regulatory Information for REYVOW

REYVOW is protected by four US patents and one FDA Regulatory Exclusivity.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of REYVOW is ⤷ Get Started Free.

This potential generic entry date is based on patent 11,053,214.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Eli Lilly And Co | REYVOW | lasmiditan succinate | TABLET;ORAL | 211280-001 | Jan 31, 2020 | RX | Yes | No | 7,423,050 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Eli Lilly And Co | REYVOW | lasmiditan succinate | TABLET;ORAL | 211280-002 | Jan 31, 2020 | RX | Yes | Yes | 12,257,246 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Eli Lilly And Co | REYVOW | lasmiditan succinate | TABLET;ORAL | 211280-001 | Jan 31, 2020 | RX | Yes | No | 12,071,423 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Eli Lilly And Co | REYVOW | lasmiditan succinate | TABLET;ORAL | 211280-003 | Dec 18, 2020 | DISCN | Yes | No | 11,053,214 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Eli Lilly And Co | REYVOW | lasmiditan succinate | TABLET;ORAL | 211280-002 | Jan 31, 2020 | RX | Yes | Yes | 11,053,214 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for REYVOW

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Eli Lilly And Co | REYVOW | lasmiditan succinate | TABLET;ORAL | 211280-001 | Jan 31, 2020 | 8,748,459 | ⤷ Get Started Free |

| Eli Lilly And Co | REYVOW | lasmiditan succinate | TABLET;ORAL | 211280-003 | Dec 18, 2020 | 8,748,459 | ⤷ Get Started Free |

| Eli Lilly And Co | REYVOW | lasmiditan succinate | TABLET;ORAL | 211280-002 | Jan 31, 2020 | 8,748,459 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for REYVOW

When does loss-of-exclusivity occur for REYVOW?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 17373784

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2019010934

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 43772

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 19001426

Estimated Expiration: ⤷ Get Started Free

China

Patent: 0291079

Estimated Expiration: ⤷ Get Started Free

Patent: 5385893

Estimated Expiration: ⤷ Get Started Free

Patent: 5385894

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 19005290

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 190251

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0211557

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 24540

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 51617

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 019000139

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 19040190

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 1991112

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 51617

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 56820

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6598

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 61240

Estimated Expiration: ⤷ Get Started Free

Patent: 20500936

Estimated Expiration: ⤷ Get Started Free

Patent: 22000451

Estimated Expiration: ⤷ Get Started Free

Patent: 23123678

Estimated Expiration: ⤷ Get Started Free

Patent: 24178323

Estimated Expiration: ⤷ Get Started Free

Jordan

Patent: 0190129

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 51617

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 6855

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 8091

Estimated Expiration: ⤷ Get Started Free

Patent: 2547

Estimated Expiration: ⤷ Get Started Free

Patent: 19006520

Estimated Expiration: ⤷ Get Started Free

Patent: 21014139

Estimated Expiration: ⤷ Get Started Free

Moldova, Republic of

Patent: 51617

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 920

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 2906

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 191134

Estimated Expiration: ⤷ Get Started Free

Patent: 241297

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 019501252

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 51617

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 51617

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 415

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 51617

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1903449

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 190075130

Estimated Expiration: ⤷ Get Started Free

Patent: 210102497

Estimated Expiration: ⤷ Get Started Free

Patent: 230008257

Estimated Expiration: ⤷ Get Started Free

Patent: 250070124

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 89476

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 71290

Estimated Expiration: ⤷ Get Started Free

Patent: 1833097

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 19000174

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 4433

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering REYVOW around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Costa Rica | 20220005 | ⤷ Get Started Free | |

| Japan | 2020500936 | ⤷ Get Started Free | |

| Japan | 7301209 | ⤷ Get Started Free | |

| Canada | 2478229 | PYRIDINOYLPIPERIDINES UTILISEES COMME AGONISTES DE 5-HT1F (PYRIDINOYLPIPERIDINES AS 5-HT1F AGONISTS) | ⤷ Get Started Free |

| Japan | 7110446 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for REYVOW

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2413933 | CA 2023 00001 | Denmark | ⤷ Get Started Free | PRODUCT NAME: LASMIDITAN ELLER ET FARMACEUTISK ACCEPTABELT SALT DERAF; REG. NO/DATE: EU/1/21/1587 20220819 |

| 2413933 | LUC00295 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: LASMIDITAN ET SES DERIVES PHARMACEUTIQUEMENT ACCEPTABLES (RAYVOW); AUTHORISATION NUMBER AND DATE: EU/1/21/1587 20220819 |

| 2413933 | SPC/GB23/001 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: LASMIDITAN; REGISTERED: UK EU/1/21/1587(FOR NI) 20220819 |

| 2413933 | 122023000004 | Germany | ⤷ Get Started Free | PRODUCT NAME: LASMIDITAN ODER EIN PHARMAZEUTISCH ANNEHMBARES SALZ DAVON; REGISTRATION NO/DATE: EU/1/21/1587 20220817 |

| 2413933 | 2023C/503 | Belgium | ⤷ Get Started Free | PRODUCT NAME: LASMIDITAN; AUTHORISATION NUMBER AND DATE: EU/1/21/1587 20220819 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

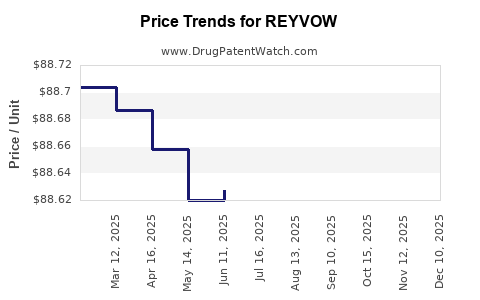

Market Dynamics and Financial Trajectory for REYVOW

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.