Last updated: July 27, 2025

Introduction

RASAGILINE MESYLATE, a selective monoamine oxidase B (MAO-B) inhibitor, has established itself as a significant therapeutic agent primarily for Parkinson’s disease (PD). Approved by the U.S. Food and Drug Administration (FDA) in 1998 under the brand name Azilect, this drug's market trajectory is shaped by evolving clinical needs, competitive landscape, regulatory considerations, and emerging therapeutic innovations. This report analyzes the current market dynamics, trends influencing the revenue streams, and forecasts the financial outlook for RASAGILINE MESYLATE over the coming years.

Therapeutic Indication and Market Size

Parkinson’s Disease and RASAGILINE MESYLATE’s Niche

Parkinson’s disease affects over 10 million individuals globally, with prevalence increasing due to aging populations [1]. RASAGILINE MESYLATE is employed as monotherapy in early-stage PD and as adjunct therapy in advanced stages, aiming to delay disease progression and manage motor fluctuations.

Market Potential

With the global Parkinson’s market projected to reach USD 8.9 billion by 2027, driven by rising prevalence rates and expanding diagnostic capabilities, RASAGILINE's share is promising, especially in regions emphasizing symptomatic management [2].

Market Dynamics

Competitive Landscape

RASAGILINE MESYLATE faces competition from other therapeutic classes: dopamine agonists, levodopa, COMT inhibitors, and emerging therapies like gene-based treatments. Notably:

- Selegiline and Safinamide: Both are selective MAO-B inhibitors competing directly with Rasagiline. While Safinamide gained approval later, it provides an alternate mechanism potentially influencing market share.

- Innovative Therapies: Continuous development of disease-modifying agents (e.g., gene therapy, neuroprotective agents) could disrupt the traditional symptomatic treatment paradigm.

Regulatory Environment

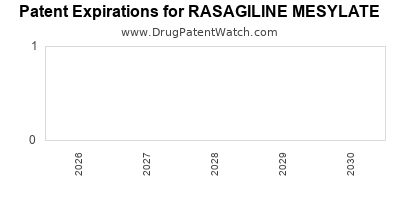

Regulatory agencies classically regulate approval, dosing, and safety profiles, influencing market entry and expansion. The approval of generic Rasagiline has increased accessibility, but patent expiry—anticipated around 2024—risks erosion of exclusivity and revenue decline [3].

Patent and Exclusivity Expiry

Patent protection provides market exclusivity, typically lasting 20 years from filing. Pending patent expiry exposes Rasagiline to generic competition, often triggering significant revenue reduction within 1–2 years unless extended by formulations or new indications.

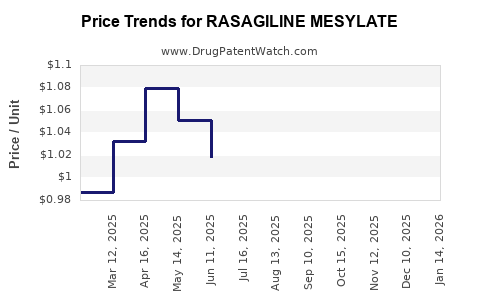

Pricing and Reimbursement Policies

Pricing strategies are shaped by national healthcare policies; for example, high drug costs face resistance in markets emphasizing cost-efficiency. Reimbursement approvals in key markets bolster sales, whereas pricing pressures in Europe and North America force manufacturers to innovate in cost control, such as adopting biosimilars or cost-effective formulations.

Emerging Trends Influencing Financial Trajectory

Increased Diagnoses and Treatment Adoption

Enhanced awareness and early diagnosis facilitate broader RASAGILINE MESYLATE adoption. Moreover, shifting from monotherapy in early PD to adjunct use supports sustained sales.

Product Line Expansion and Formulation Innovations

Development of combination therapies and extended-release formulations could unlock new revenue streams, maintaining patient adherence and expanding market reach.

Geographic Expansion

Emerging markets, notably Asia-Pacific and Latin America, present growth opportunities due to increasing healthcare infrastructure and rising PD prevalence. Access and affordability improvements can accelerate sales.

Research and Development (R&D)

Investments in pipeline drugs exploring neuroprotection and disease modification may influence Rasagiline’s long-term relevance. Adoption of companion diagnostic tools and personalized medicine approaches can further optimize market penetration.

Financial Outlook

Short-term Projection (1–3 Years)

Post-patent expiry, a sharp decline in revenues is expected in generic markets, unless parallel innovative formulations or indications are introduced. During this period, sales may stabilize or decline modestly contingent on new formulations and expanding markets.

Mid- to Long-term Projection (4–10 Years)

If patent extensions (via new formulations or additional indications) are successful, revenue decline can be mitigated. Conversely, intense generic competition may reduce prices, impacting profit margins. The trajectory depends heavily on:

- Regulatory Approvals: For biosimilars or new formulations.

- Market Penetration: In emerging markets.

- Pipeline Success: With potential new indications or combination therapies.

Financial Strategies

Effective lifecycle management, such as licensing agreements, strategic partnerships, and continual R&D investment, remains crucial to sustain revenues beyond patent expiry.

Market Risks and Opportunities

Risks

- Patent Loss: Sudden market share erosion upon generic entry.

- Competitive Alternatives: Emergence of novel disease-modifying therapies.

- Regulatory Delays: Slowing approval of new formulations or indications.

- Pricing Pressures: Pushback from payers demanding cost reductions.

Opportunities

- Pipeline Diversification: Additional indications (e.g., cognitive decline in PD).

- Personalized Medicine: Genetic profiling to target responsive patient subsets.

- Regional Expansion: Focused growth in high-prevalence areas.

- Combination Therapies: Integrating Rasagiline with other agents for enhanced efficacy.

Conclusion

RASAGILINE MESYLATE’s market remains robust within the symptomatic PD treatment landscape, but its future is intricately tied to patent strategy, competitive innovation, and regional health policies. Strategic investments in formulation development, indications expansion, and geographic penetration can mitigate patent-cliff impacts and sustain its financial trajectory. As the Parkinson’s disease management paradigm evolves, RASAGILINE MESYLATE’s role may shift from standalone to component of combination therapies, emphasizing the importance of adaptable commercial strategies.

Key Takeaways

- Patent Expiry Risks: The imminent patent expiration (around 2024) necessitates proactive lifecycle management to sustain revenue streams.

- Market Expansion Opportunities: Growing PD prevalence and emerging markets provide avenues for increased sales, especially with affordability initiatives.

- Pipeline and Formulation Innovation: Developing extended-release forms and new indications can extend market relevance and offset generic competition.

- Competitive Landscape: The rise of alternative therapies demands continuous differentiation and strategic positioning.

- Regulatory and Reimbursement Strategies: Navigating these effectively is critical for stabilizing short-term revenues and ensuring long-term growth.

FAQs

1. What are the main competitors to Rasagiline Mesylate in Parkinson’s disease treatment?

Selegiline and Safinamide are primary competitors, both being selective MAO-B inhibitors. Newer therapies and combination regimens also challenge Rasagiline’s market dominance.

2. How does patent expiry impact Rasagiline Mesylate’s market share?

Patent expiries typically open the market to generic versions, leading to significant price reductions and potential revenue declines unless extended by formulations or new indications.

3. What strategies can manufacturers deploy post-patent to sustain revenues?

Focusing on formulation innovations, expanding indications, engaging in regional markets, and developing combination therapies are key strategies for lifecycle extension.

4. Which emerging markets present promising growth opportunities for Rasagiline?

Asia-Pacific and Latin America are notable for increasing PD diagnoses, improving healthcare access, and receptive reimbursement landscapes.

5. How might future research influence Rasagiline’s market?

Success in pipeline development for neuroprotection and disease modification could reposition Rasagiline as part of early intervention or combination therapy protocols, expanding its market presence.

References

[1] Global Parkinson's Disease Market Analysis. (2022). MarketsandMarkets.

[2] Parkinson’s Disease Pharmacological Market. (2021). Business Insider Intelligence.

[3] U.S. Patent and Regulatory Timeline for Rasagiline. (2023). FDA and Patent Office Records.