Last updated: July 28, 2025

Introduction

RASAGILINE MESYLATE, marketed under brand names such as Azilect, is a potent monoamine oxidase B (MAO-B) inhibitor approved primarily for the treatment of Parkinson’s disease. Since its FDA approval in 2006, RASAGILINE MESYLATE has garnered a significant position in the neurodegenerative disorder therapeutics market. Growth dynamics, competitive landscape, and pricing strategies for this drug are influenced by its clinical efficacy, patent protections, regulatory environment, and expanding indications.

This analysis delineates the current market landscape of RASAGILINE MESYLATE, examines key growth drivers and barriers, and projects future pricing trends through 2030 for stakeholders aiming to capitalize on its medicinal and commercial potential.

Market Overview

Global Therapeutic Market Context

The Parkinson's disease (PD) therapeutics market has exhibited sustained growth, driven by increasing prevalence—approaching 10 million worldwide [1]—and the aging global population. According to Grand View Research, the PD market value is projected to reach USD 9.2 billion by 2027, expanding at a CAGR of 7.4% [2].

Within this landscape, RASAGILINE MESYLATE comprises a substantial segment as an adjunct or monotherapy for early-stage PD patients and as part of combination therapies in advanced stages. Its mechanism, targeting dopamine preservation through MAO-B inhibition, offers a symptomatic treatment advantage.

Market Positioning of RASAGILINE MESYLATE

Since its launch, RASAGILINE MESYLATE has held a competitive niche, competing with other MAO-B inhibitors such as Selegiline and safinamide. Its patent protections, which expired or are nearing expiration in key markets, influence its pricing and market penetration. Patent expiry often triggers generic entry, impacting exclusivity and prices.

Market Dynamics

Drivers

-

Increasing Parkinson’s Disease Prevalence: Aging demographics, notably in North America, Europe, and parts of Asia, propel demand.

-

Clinical Efficacy: RASAGILINE MESYLATE’s neuroprotective potential and flexible dosing regimen enhance its adoption.

-

Regulatory Approvals Expansion: Beyond monotherapy, RASAGILINE MESYLATE is being evaluated for other neuropsychiatric conditions, expanding its market scope.

-

Combination Therapy Benefits: Incorporation into multi-drug regimens offers improved symptomatic relief, bolstering demand.

Barriers

-

Pricing Pressures and Generic Competition: Patent expiration in several markets threatens price erosion.

-

Side Effect Profile Limitations: Interaction with certain foods and medications, such as tyramine-rich foods and serotonergic agents, constrains broader use.

-

Limited Disease-Modifying Claims: Lack of definitive disease-modifying evidence limits market expansion beyond symptom management.

Pricing Trends and Projections (2023-2030)

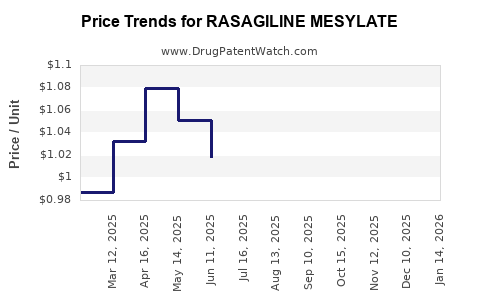

Current Pricing Landscape

In the U.S., the branded RASAGILINE MESYLATE (e.g., Azilect) commands a retail price of approximately USD 10–15 per tablet, translating to annual treatment costs of about USD 4,000–6,000 per patient [3]. Prices vary across regions, with lower costs observed in countries with robust generic markets or price regulation.

Patent and Market Entry Impact

-

Patent Expiry and Generics: Key patents are expiring by 2024–2025 in the U.S. and European markets, opening avenues for generic manufacturers—potentially reducing prices by 50–70%, based on observed trends with other drugs [4].

-

Price Erosion Analysis: Historically, generic entry correlates with rapid decline in average pricing; for RASAGILINE MESYLATE, a conservative estimate suggests a 60% price reduction within the first year post-generic launch.

Forecasted Price Trends (2023–2030)

| Year |

Estimated Price Range (USD/tablet) |

Notes |

| 2023 |

USD 10–15 |

Branded dominance persists; premium pricing in early stages of patent expiry |

| 2024 |

USD 5–8 |

Entry of generics begins; price decline accelerates |

| 2025–2027 |

USD 2–4 |

Market stabilization with multiple generics; prices plateauing |

| 2028–2030 |

USD 1–2 |

Increased competition, regulatory pricing adjustments, biosimilar influence |

These projections assume continued patent expiration and increased generic competition, with prices converging toward those of other generic MAO-B inhibitors [5].

Market Opportunities and Strategic Considerations

-

Emerging Markets: Countries with rising Parkinson’s prevalence and evolving healthcare infrastructure, such as China and India, present growth opportunities. Local manufacturing and pricing strategies will be crucial.

-

Extended Indications and Formulations: Developing extended-release formulations and exploring additional therapeutic indications can propel market expansion.

-

Partnerships and Licensing: Collaboration with local generic manufacturers can accelerate market penetration post-patent expiry.

Competitive Landscape

| Competitor |

Mechanism |

Market Share |

Key Strengths |

Pricing Strategy |

| Selegiline |

MAO-B inhibitor |

High (Established) |

Cost-effective |

Lower prices; generic versions available |

| Safinamide |

Selective MAO-B inhibitor |

Growing |

Favorable side effect profile |

Premium pricing due to newer license |

| Rasagiline |

Selective MAO-B inhibitor |

Moderate |

Efficacy and tolerability |

Premium initial pricing, declining with generics |

The evolving generic landscape will likely reshape the competitive matrix, emphasizing price competitiveness and differentiated formulations.

Key Regulatory and Reimbursement Factors

Regulatory agencies such as the FDA, EMA, and PMDA influence market access and pricing. Reimbursement policies, especially in government-funded healthcare systems, tend to favor cost-effective generics, pressuring branded RASAGILINE MESYLATE prices further.

The inclusion of RASAGILINE MESYLATE in treatment guidelines and formulary access significantly affects its commercial success. Value-based pricing models could be adopted, emphasizing clinical benefits and cost savings.

Conclusion

The future market trajectory for RASAGILINE MESYLATE hinges largely on patent expiry timelines, generic entry, and evolving treatment paradigms. Its premium pricing in the near term will diminish as generics saturate the market, leading to substantial price reductions by 2030. Stakeholders should prepare for intensified competition by investing in formulation innovation, exploring new indications, and optimizing market access strategies.

Key Takeaways

-

Monopoly period nearing its end: Patent expirations in the next 1–2 years will open the floodgates for generic manufacturers, compelling significant price reductions.

-

Pricing will decline sharply post-generic entry: Expect a minimum 60% reduction within 1–2 years after market entry, stabilizing at substantially lower levels by 2030.

-

Market expansion hinges on emerging markets: Growing PD prevalence in Asia and Latin America creates opportunities, especially with flexible pricing strategies.

-

Regulatory and reimbursement policies are critical: Favorability towards generics and inclusion in formularies will influence pricing and volume.

-

Innovation and new indications are vital: To maintain competitive advantage, pharmaceutical firms should invest in novel formulations, combination therapies, and expanded clinical applications.

FAQs

-

When will RASAGILINE MESYLATE lose its patent protection globally?

Most patents are set to expire between 2024 and 2025 in key markets like the U.S. and Europe, which will pave the way for generic competition.

-

How will generic entry affect the drug’s retail price?

Generic entry typically results in a price decrease of 50–70% within the first year, with prices stabilizing at lower levels over subsequent years.

-

Are there any new formulations or indications for RASAGILINE MESYLATE?

Current research explores extended-release formulations and potential uses beyond Parkinson's disease, which may influence future market dynamics.

-

What are the main challenges facing RASAGILINE MESYLATE in maintaining market share?

Patent expiration, competitive generic pricing, side effect considerations, and lack of disease-modifying claims are key hurdles.

-

Which regions offer the most growth opportunities for RASAGILINE MESYLATE?

Emerging markets such as China, India, and parts of Latin America are prioritized, given rising disease incidence and evolving healthcare systems.

References

[1] Parkinson's Foundation. "Parkinson's Disease Statistics." 2022.

[2] Grand View Research. "Parkinson’s Disease Therapeutics Market Analysis & Segment Forecasts." 2021.

[3] GoodRx. "Price analysis of Azilect (rasagiline)." 2023.

[4] IQVIA. "Global Patent Expirations and Impact on Pharmaceutical Markets." 2022.

[5] EvaluatePharma. "Pricing Trends for Generic MAO-B Inhibitors in Developed Markets." 2022.