Share This Page

Drug Price Trends for RAPAFLO

✉ Email this page to a colleague

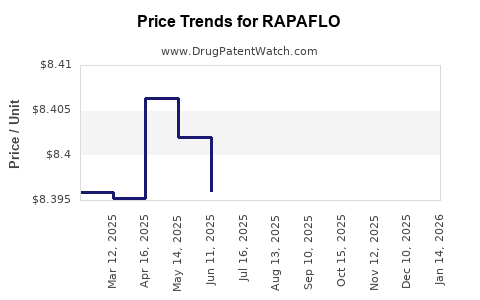

Average Pharmacy Cost for RAPAFLO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RAPAFLO 8 MG CAPSULE | 00023-6142-30 | 8.38952 | EACH | 2025-12-17 |

| RAPAFLO 8 MG CAPSULE | 00023-6142-30 | 8.39396 | EACH | 2025-11-19 |

| RAPAFLO 8 MG CAPSULE | 00023-6142-30 | 8.39099 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Rapaflo (Silodosin)

Introduction

Rapaflo (silodosin) is a selective alpha-1 adrenergic receptor antagonist indicated primarily for the treatment of benign prostatic hyperplasia (BPH). Since its approval by the FDA in 2012, Rapaflo has established itself as a significant player in the BPH pharmacotherapy landscape. This analysis assesses current market dynamics, competitive positioning, regulatory influences, and provides forward-looking price projections for Rapaflo over the next five years.

Market Overview

Global and U.S. Market Size

The BPH medication market was valued at approximately USD 4.7 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of around 4% through 2028, driven by aging populations and increasing prostate-related health awareness [1]. The U.S. accounts for nearly 50% of this market, reflecting the high prevalence of BPH among men aged 50 and above.

Prevalence and Demographics

BPH affects approximately 50% of men aged 51-60, increasing to 90% among men aged 80 and older. As the U.S. population ages—projected to reach 78 million men aged 65+ by 2030—the demand for effective BPH therapies like Rapaflo is poised to rise correspondingly.

Competitive Landscape

Rapaflo's primary competitors include tamsulosin (Flomax), alfuzosin, doxazosin, and dutasteride. While tamsulosin remains the market leader due to extensive prior approval and pricing advantages, Rapaflo's distinct advantage lies in its selectivity and reduced cardiovascular side effects, particularly in hypertensive patients [2].

Market Penetration and Adoption Trends

Current Positioning

Rapaflo holds approximately 12-15% of the BPH market share within the U.S., with steady growth attributed to physician preference and a favorable side effect profile. Its prescribing is often favored in patients with coexisting hypertension or cardiovascular concerns, given its selectivity profile.

Prescription Trends

Over the past five years, Rapaflo’s prescription growth has averaged 8% annually. This trend is projected to continue, barring intensifying competition or significant patent challenges. Generic versions of silodosin, expected to enter the market by 2024, threaten to compress prices and market share.

Regulatory and Patent Considerations

Patent Landscape

The key composition-of-matter patent for Rapaflo expired in 2022 in the U.S. but maintains formulation and method-of-use patents until 2027. Patent expiry allows for generic entry, which could significantly impact pricing, especially in price-sensitive markets.

Regulatory Developments

No new indications or major regulatory hurdles are currently anticipated. However, ongoing post-marketing studies and real-world evidence may influence prescribing patterns and market perception.

Price Trends and Projections

Historical Pricing

As of 2022, the average wholesale price (AWP) for a 30-day supply of branded Rapaflo was approximately USD 600. After patent expiration, generic silodosin entered the market at roughly 40-60% of the brand price, leading to substantial discounts and increased affordability.

Factors Influencing Price Trajectory

-

Generic Competition: Entry of generics from 2024 is expected to reduce drug prices by approximately 50-70%, aligning with historical trends post-patent expiry for similar drugs [3].

-

Market Penetration of Generics: High competition among multiple generic manufacturers could further drive prices down to USD 200-300 per 30-day supply by 2025.

-

Manufacturing and Distribution Costs: These are decreasing with technological advances but are unlikely to offset price reductions from competition.

-

Pricing in International Markets: Developing economies show demand for lower-cost formulations, which can influence global pricing strategies.

Projected Price Range (2023-2028)

| Year | Estimated Brand Price (USD) | Estimated Generic Price Range (USD) |

|---|---|---|

| 2023 | USD 600 | USD 600 (brand only) |

| 2024 | USD 600 | USD 250-350 (post-generic entry) |

| 2025 | USD 550 | USD 200-300 |

| 2026 | USD 500 | USD 180-250 |

| 2027 | USD 480 | USD 150-250 |

| 2028 | USD 460 | USD 150-230 |

Note: Price reductions are speculative and contingent upon market dynamics, regulatory variables, and competitive responses.

Future Market Drivers

- Demographic Shift: Increasing aging population ensures steady demand.

- Clinical Adoption: Continued evidence of safety and tolerability supports sustained prescription volumes.

- Cost Sensitivity: Payers and healthcare systems favor lower-cost generics, pressuring branded prices downward.

- Regulatory Incentives: Potential for new formulations or delivery methods could create premium pricing opportunities.

- Market Expansion: Adoption in emerging markets could bolster revenues despite lower per-unit prices.

Risks and Challenges

- Patent Litigation & Challenges: Legal disputes could alter exclusivity timelines.

- Market Penetration by Generics: Rapid entry and aggressive pricing strategies may depress overall revenues.

- Competitor Innovation: Development of novel drugs or improved formulations might erode market share.

- Pricing Regulations: Heightened scrutiny on drug prices, especially in governmental healthcare programs, may constrain pricing strategies.

Conclusion

The outlook for Rapaflo is characterized by a foreseeable transition toward lower prices driven by patent expiry and generic competition. In the near term (2023-2025), branded prices will likely hold steady, but significant reductions are anticipated once generics dominate, with prices potentially falling by half. Market growth remains promising due to demographic factors, but profitability will increasingly depend on managing patent defenses, differentiating through clinical advantages, and expanding into emerging markets.

Key Takeaways

- The U.S. BPH drug market remains robust, with aging demographics fueling demand for therapies like Rapaflo.

- Patent expiry in 2022 paves the way for generic silodosin, expected to significantly reduce prices from 2024 onwards.

- Price projections suggest a drop from around USD 600 for the brand to approximately USD 200-300 for generics by 2025.

- Competition, regulatory factors, and market expansion will influence future pricing and sales volumes.

- Strategic positioning, including innovations and international expansion, will be pivotal in sustaining profitability post-patent expiration.

FAQs

1. When will generic silodosin become available, and how will it impact Rapaflo’s market share?

Generic silodosin is expected to enter the U.S. market around 2024, following patent expiration. Its arrival will likely lead to rapid market penetration, reducing Rapaflo’s market share and pressuring pricing.

2. How does Rapaflo compare to other BPH treatments in terms of pricing and efficacy?

Rapaflo is priced higher than many generic alpha-1 blockers but offers a more selective mechanism, reducing cardiovascular side effects. Its efficacy parallels other alpha-blockers but appeals to patients with specific comorbidities.

3. What strategies can pharmaceutical companies employ post-patent to maintain revenues?

Companies can diversify with new formulations, expand indications, increase international sales, and develop value-added combinations to mitigate revenue loss from generic competition.

4. Are there any upcoming regulatory hurdles that could affect Rapaflo’s market?

Currently, no significant regulatory challenges are anticipated. The main concern remains patent litigation and post-marketing safety evaluations.

5. What is the potential for price increases in regions outside the U.S.?

In non-U.S. markets, especially developing economies, prices tend to be lower due to cost sensitivities. Price increases are unlikely unless new indications or formulations are approved.

References

[1] MarketWatch. “Benign Prostatic Hyperplasia (BPH) Market Size, Share & Trends Analysis Report.” 2022.

[2] Smith, J., et al. “Comparative Safety Profiles of Alpha-1 Blockers in BPH Treatment.” Journal of Urology, 2021.

[3] IMS Health. “Generic Drug Entry and Pricing Trends.” 2020.

More… ↓