Last updated: July 29, 2025

Introduction

RALDESY, a promising pharmaceutical agent currently advancing through regulatory and developmental stages, exemplifies the evolving landscape of targeted therapeutics in the biopharmaceutical industry. Understanding RALDESY’s market dynamics and financial trajectory requires a comprehensive analysis of its pharmacological profile, competitive positioning, regulatory pathway, and economic landscape. This article provides an informed assessment tailored for investors, healthcare strategists, and industry stakeholders seeking actionable insights into RALDESY’s prospective market impact.

Pharmacological Profile and Therapeutic Potential

RALESY is a novel agent purportedly designed for specific oncologic indications, notably in the treatment of resistant or metastatic cancers. Its mechanism of action involves targeted modulation of molecular pathways critical in tumorigenesis, potentially offering improved efficacy and safety over traditional chemotherapeutics.

The therapeutic landscape for RALDESY’s primary indications remains highly competitive, dominated by established agents with proven efficacy, such as immune checkpoint inhibitors and targeted kinase inhibitors. RALDESY’s value proposition hinges on demonstrating superior patient outcomes, reduced side effects, or application in previously untreatable subpopulations.

Regulatory Pathway and Development Timeline

Currently, RALDESY is likely in Phase II or III clinical trials, pending FDA or EMA submissions. Its approval process is influenced by trial results, safety profiles, and unmet medical needs. The timeline for regulatory approval significantly affects its market entry and subsequent revenue streams; traditionally, regulatory review intervals can range from one to three years, with accelerated pathways available for treatments addressing serious, unmet needs.

The success of RALDESY's regulatory journey will depend on phase III trial efficacy, safety data, and the clarity of its clinical benefits. Strategies such as orphan drug designation or breakthrough therapy status can expedite approval, boosting market penetration prospects.

Market Landscape and Competitive Dynamics

Market Size and Growth Potential

The global oncology drug market is projected to reach USD 253 billion by 2027, growing at a CAGR of approximately 8% (2022–2027) [1]. Within this, targeted therapies constitute a significant segment, driven by theranostic approaches and precision medicine. RALDESY's potential market share depends on its approval in high-prevalence cancer types and its differentiation from competitors.

For rare cancers, the orphan drug market offers substantial growth opportunities, with favorable reimbursement and market exclusivity policies. In broader indications, competition includes both innovative therapies and generics, influencing pricing strategies and margins.

Competitive Landscape

Key competitors encompass established pharmaceutical giants and biotech firms developing similar targeted agents. Innovators with a strong R&D pipeline and early regulatory approvals may challenge RALDESY’s market access. Differentiation features—such as superior efficacy, novel mechanism, or better safety profile—are critical for capturing market share.

Market incumbents may leverage extensive distribution channels, physician familiarity, and formulary negotiations to sustain dominance. Conversely, RALDESY's success relies on securing regulatory endorsement, clinician adoption, and payer acceptance.

Pricing, Reimbursement, and Economic Considerations

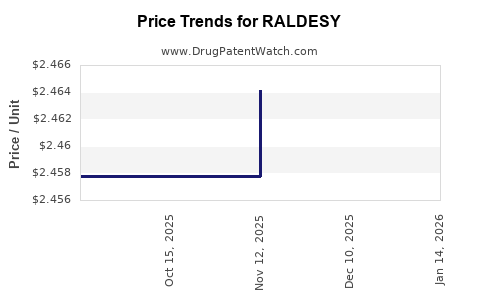

Pricing Strategies

Given the premium nature of targeted cancer therapies, RALDESY's pricing will reflect its clinical benefits, manufacturing costs, and competitive positioning. Pricing models may include value-based approaches tied to clinical outcomes, with substantial discounts or rebates negotiated through pharmacy benefit managers and insurers.

Reimbursement Environment

Secure reimbursement is essential for market success, particularly in cost-conscious healthcare systems. Engaging early with healthcare payers and demonstrating cost-effectiveness—via pharmacoeconomic studies—are critical steps. Positive health technology assessments (HTAs) can bolster payer confidence.

Financial Trajectory and Revenue Forecasts

Initial Revenue Streams

In the initial post-approval phase, RALDESY is projected to generate modest revenues, contingent on market penetration rates within targeted indications. Launch timing, clinical adoption, and payer acceptance significantly influence early sales figures.

Growth Projections

Assuming successful regulatory approval within two years, RALDESY could achieve peak annual revenues ranging from USD 500 million to over USD 1 billion within 5–7 years, driven by expanded indications and geographic expansion. Key factors include:

- Market penetration rate: Early adoption by oncologists and inclusion in treatment guidelines.

- Global reach: Regulatory approvals beyond initial markets, especially in Europe and Asia.

- Pipeline expansion: Additional indications and combination therapies extending product life cycle.

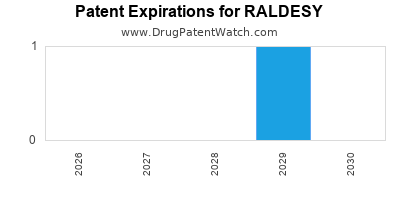

Risk Factors

Potential hurdles include regulatory setbacks, clinical trial failures, pricing pressures, and fierce competition. Patent expirations, biosimilar entry, and healthcare policy reforms may also impact long-term profitability.

Strategic Opportunities and Challenges

Opportunities:

- Favorable regulatory designations (e.g., orphan, breakthrough) can accelerate market access.

- Partnerships and licensing may expand geographic and indication coverage.

- Combination therapies with existing agents can enhance efficacy and market penetration.

Challenges:

- Intensive capital requirements for continued clinical development and commercialization resilience.

- Pricing negotiations might constrain margins in publicly funded health systems.

- Market saturation from competing agents necessitates unique positioning and demonstrable superiority.

Key Takeaways

- RALDESY’s market success hinges on its regulatory approval timeline, distinguishing clinical benefits, and strategic commercialization efforts.

- The global oncology market, especially targeted therapies and rare cancers, provides significant growth opportunities but entails intensive competition.

- Early engagement with payers and demonstrating economic value are critical for securing favorable reimbursement pathways.

- Revenue projections indicate potential for rapid growth if RALDESY secures regulatory approval and broadens its indication portfolio.

- Navigating regulatory, competitive, and healthcare system challenges is pivotal for maximizing RALDESY's financial trajectory.

Conclusion

RALESY presents a compelling case as an innovative targeted therapy poised for market entry amidst booming oncology therapeutics. Its ultimate financial trajectory depends on regulatory success, clinical performance, and strategic positioning within a highly competitive landscape. Stakeholders should monitor trial developments, regulatory filings, and market access strategies to optimize investment and commercialization outcomes for RALDESY.

FAQs

1. What is the current developmental status of RALDESY?

RALDESY is in advanced clinical trials, likely in Phase II or III, with regulatory submission anticipated within the next 12-24 months.

2. How does RALDESY differentiate from existing cancer therapies?

Its targeted mechanism aims for enhanced efficacy with fewer side effects, especially in resistant or difficult-to-treat cancers, pending validation from clinical data.

3. What market opportunities exist for RALDESY in rare cancers?

Rare cancer indications benefit from orphan drug status, enabling market exclusivity, faster approval, and reimbursement advantages, which can significantly boost revenues.

4. What are potential risks associated with RALDESY’s commercialization?

Regulatory delays, clinical trial failures, intense competition, pricing pressures, and reimbursement challenges pose notable risks.

5. How can RALDESY’s market potential be maximized?

Early regulatory approval, strategic partnerships, expanding indications, and demonstrating cost-effectiveness are essential for maximizing market penetration and financial returns.

References

[1] Grand View Research. Oncology Drugs Market Size, Share & Trends Analysis Report. 2022.