Last updated: July 29, 2025

Introduction

Propylthiouracil (PTU) is an antithyroid medication used primarily to manage hyperthyroidism, especially in cases where other treatments are contraindicated or ineffective. Approved for decades, PTU’s market landscape is influenced by evolving clinical guidelines, regulatory frameworks, and competitive pharmaceutical innovations. Amidst a complex interplay of demand drivers and regulatory challenges, understanding PTU’s market dynamics and financial trajectory offers strategic insights crucial for pharmaceutical companies, investors, and healthcare stakeholders.

Market Overview and Therapeutic Profile

Propylthiouracil, chemically known as 6- Propyl-2-thiouracil, functions by inhibiting the synthesis of thyroid hormones, notably T3 and T4. Its therapeutic application is chiefly in hyperthyroidism management, including Graves’ disease and thyroid storm (an acute severe hyperthyroid state). PTU's FDA approval dates back to the 1940s, consolidating its status as a long-established treatment option, especially in specific populations such as pregnant women, where methimazole, another antithyroid agent, poses teratogenic risks.

Despite its longstanding clinical utility, PTU’s market share has experienced fluctuations over recent years, largely due to safety concerns and evolving clinical guidelines, which have implications for its market dynamics.

Market Dynamics

1. Regulatory and Safety Considerations

Safety concerns constitute a primary driver influencing PTU’s market trajectory. Notably, the drug’s association with severe hepatotoxicity has prompted regulatory agencies like the FDA to issue warnings and restrict its use in certain populations. In 2010, the FDA updated labeling to highlight the risk of acute liver failure, leading to a decline in prescriptions in developed markets.

Similarly, the European Medicines Agency (EMA)recommended caution with PTU use, particularly noting risks in pediatric and adult populations. These regulatory constraints have curtailed its use as a first-line therapy, relegating it mainly to specific indications such as pregnancy when methimazole is contraindicated or unavailable.

2. Clinical Practice Trends

Current clinical guidelines primarily favor methimazole as the first-line antithyroid agent outside pregnancy, given its favorable safety profile. PTU’s role is confined mainly to:

- Pregnancy: Due to teratogenicity associated with methimazole, PTU remains preferred during the first trimester.

- Thyroid storm: PTU’s rapid onset makes it suitable in acute settings.

- Patients intolerant to methimazole.

This shift has limited PTU’s application, constraining its market growth in mature economies.

3. Market Segmentation and Geographic Variation

The global market exhibits marked variation:

- North America and Europe: Stringent safety standards and clinical preferences limit PTU usage predominantly to specific populations, leading to a contracting market share.

- Asia-Pacific: Growing prevalence of hyperthyroidism, combined with limited healthcare infrastructure and differing regulatory environments, sustains a moderate demand for PTU. Countries like India and China utilize PTU extensively, especially outside pregnancy, due to cost-effectiveness and local prescribing habits.

- Emerging Markets: Limited access to newer, safer drugs sustains a niche yet steady market for PTU.

4. Competition and Alternatives

The ascent of newer treatments constrains PTU's dominance:

- Methimazole: Offers longer duration and fewer side effects, prompting widespread adoption.

- Radioactive Iodine Therapy: Increasingly preferred for definitive management of hyperthyroidism.

- Surgical Interventions: Thyroidectomy remains an option where pharmacotherapy fails.

These alternatives diminish PTU’s market share, especially in developed nations.

5. Manufacturing and Supply Chain Factors

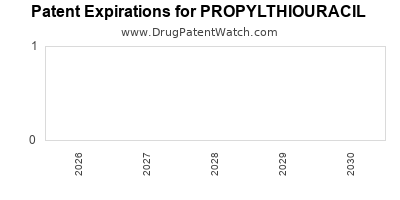

PTU's production is affected by patent status (although off-patent), manufacturing costs, and regulatory approvals. The emergence of generic formulations has facilitated wider availability, especially in cost-sensitive regions.

Financial Trajectory and Market Forecasting

Current Market Valuation and Trends

The global hyperthyroidism therapeutics market was valued at approximately USD 850 million in 2021, with antithyroid drugs constituting a significant segment. PTU’s contribution has declined with the increasing preference for methimazole, reflecting a decline in revenues in mature markets. Nonetheless, PTU remains integral in specific niches, such as during early pregnancy, maintaining an estimated revenue contribution of USD 50–100 million annually in select regions.

Forecasts and Growth Drivers

Short-term Outlook (2023-2028):

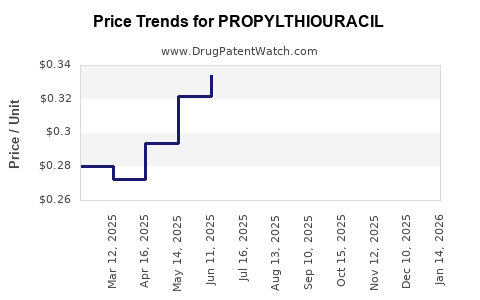

The market is expected to decline modestly, driven by safety concerns and the dominance of alternative therapies. According to industry analysts, PTU’s global revenues might contract at a CAGR of -3% to -5% over this period, mainly in Western countries.

Long-term Outlook (2028 onward):

Potential stabilization or slight rebound may occur in emerging markets due to:

- Increasing hyperthyroidism prevalence attributable to aging populations.

- Growing awareness and screening programs.

- Regulatory relaxations in developing regions, facilitating wider availability.

Innovative Formulations and Registrations:

Limited pipeline development exists for PTU, with most research directed towards safer, more effective hyperthyroidism treatments. Nonetheless, existing formulations may benefit from manufacturing efficiencies and regional regulatory approvals, sustaining its market presence.

Regulatory and Market Entry Considerations

Companies seeking to capitalize on PTU’s niche markets should prioritize:

- Navigating safety labeling and regulatory requirements.

- Developing biosimilar or generic formulations to improve cost competitiveness.

- Developing formulations suited for pregnancy use, aligned with current safety profiles.

- Engaging in market-specific strategies focusing on regions with limited treatment access.

Key Market Opportunities and Challenges

| Opportunities |

Challenges |

| Growth potential in emerging markets |

Stringent safety regulations reducing market access |

| Developing targeted formulations for pregnancy use |

Competition from newer, safer antithyroid agents |

| Partnership opportunities with local generic manufacturers |

Declining utilization in developed economies due to safety concerns |

| Potential for formulation innovation to reduce hepatotoxicity |

Limited pipeline development, decreasing remanence in global markets |

Conclusion

The market landscape for propylthiouracil is characterized by a declining trajectory in mature markets owing to safety concerns and evolving clinical practices favoring alternatives. Nevertheless, PTU’s niche applications—particularly in pregnancy and acute hyperthyroid management—sustain its relevance in global health. Strategic focus on emerging markets, formulation innovation, and targeted regulatory navigation could prolong its market viability.

Key Takeaways

- Propylthiouracil’s global market is contracting, primarily driven by safety concerns and the dominance of alternative therapies like methimazole and radioactive iodine.

- Its primary role remains in pregnancy management and thyroid storm treatments, sectors with ongoing demand.

- Market growth potential exists in emerging economies where hyperthyroidism prevalence is rising, and healthcare infrastructure favors cost-effective drugs.

- Manufacturers should focus on safety profile improvements, regional regulatory strategies, and developing formulations suited for specific indications.

- Future growth hinges on balancing safety considerations with strategic regional deployment, especially in underpenetrated markets.

FAQs

Q1: What are the main safety concerns associated with propylthiouracil?

Propylthiouracil has been linked to severe hepatotoxicity, including acute liver failure, which has led to regulatory warnings and restrictions, particularly in developed markets.

Q2: In which patient populations is PTU still the preferred treatment?

PTU remains the first-line treatment during the first trimester of pregnancy and in cases of thyroid storm or when patients cannot tolerate methimazole.

Q3: How does the market share of PTU compare to methimazole?

Methimazole has surpassed PTU as the preferred antithyroid agent in most regions due to a better safety profile, leading to significantly reduced PTU prescriptions.

Q4: What are the major regions where PTU maintains a significant market presence?

Emerging markets in Asia, such as India and China, maintain notable usage due to cost considerations and differing clinical practices.

Q5: What are the prospects for PTU in the next decade?

While declining in mature markets, PTU’s role in specific niches and emerging regions may sustain its presence, with potential growth driven by regional healthcare needs and formulations tailored for safety.

Sources:

[1] U.S. Food and Drug Administration. "FDA Drug Safety Communication: New safety information for propylthiouracil (PTU)." (2010).

[2] European Medicines Agency. "Review concludes that propylthiouracil should be used only when necessary." (2015).

[3] Global Data. "Hyperthyroidism Market Analysis, 2021."

[4] National Institutes of Health. "Hyperthyroidism Treatment Guidelines."

[5] MarketWatch. "Pharmaceuticals Market Forecast 2022-2032."