Last updated: July 27, 2025

Introduction

Prometrium (progesterone), a natural progestogen used primarily for hormone replacement therapy, menstrual disorders, and fertility treatments, has maintained a significant position within the pharmaceutical landscape. Its unique properties, regulatory status, and mounting demand driven by demographic and societal trends underpin its market dynamics and financial outlook. This analysis delineates the key factors influencing Prometrium’s market, explores growth opportunities, and assesses its financial trajectory amid evolving competitive and regulatory contexts.

Overview of Prometrium

Prometrium, the proprietary oral capsule of micronized progesterone, is produced by Solvay Pharmaceuticals (now part of Johnson & Johnson) and marketed globally. Its indications encompass hormone replacement therapy in menopausal women, management of abnormal uterine bleeding, and support in fertility protocols. The drug’s natural origin, oral bioavailability, and favorable safety profile differentiate it from synthetic progestins, conferring a competitive advantage.

Market positioning and manufacturing capacity, coupled with patent and regulatory considerations, shape Prometrium’s financial performance. Recent formulations and biosimilar entries further influence its market share dynamics.

Market Dynamics

Demographic Trends and Market Drivers

The aging global population, notably women aged 50 and above, is a predominant driver of hormone therapy (HT) demand. The World Health Organization projects that by 2030, approximately 1.2 billion women will be aged 50+ [1], fueling long-term demand for menopausal and postmenopausal therapies such as Prometrium.

Moreover, increasing awareness about menopause management, declining stigma, and broader acceptance of hormone therapy contribute positively. Fertility treatments, especially in developed economies with delayed childbearing, also expand interest in progestogenic therapies.

Regulatory Landscape and Patent Considerations

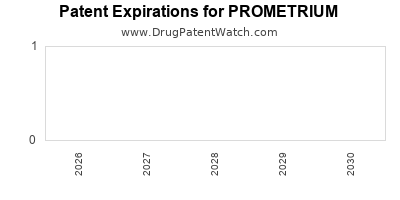

Regulatory frameworks significantly influence market entry and competition. Prometrium’s status as a naturally derived hormone benefits from a relatively streamlined approval process in many jurisdictions. However, patent expirations and the advent of biosimilars threaten exclusivity, compelling pharmaceutical companies to innovate or diversify their offerings.

The US Food and Drug Administration (FDA) and European Medicines Agency (EMA) hold stringent standards for hormone products, affecting pricing, reimbursement, and market accessibility. Recent regulatory shifts towards preservative-free formulations and bioidentical hormone therapies could alter the competitive dynamics.

Competitive Environment

Prometrium faces competition from synthetic progestins such as medroxyprogesterone acetate and newer bioidentical formulations. Several generic manufacturers have entered markets following patent lapses, exerting downward pressure on prices.

Biosimilars and alternative delivery systems (e.g., transdermal gels, vaginal suppositories) also contribute to a highly competitive environment. Market consolidation and strategic alliances are common as firms seek to optimize market share and R&D capabilities.

Market Challenges

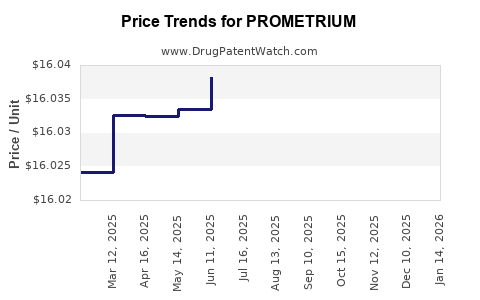

- Pricing Pressures: Governments and payers increasingly prioritize cost containment, leading to price negotiations and reimbursement restrictions.

- Safety Concerns: Emerging data on hormone therapy risks, such as breast cancer and cardiovascular events, influence prescription behaviors.

- Market Saturation: Mature markets in North America and Europe face saturation, prompting companies to explore emerging markets with expanding healthcare infrastructure.

Emerging Opportunities

- Expanding Indications: Growing evidence supports Prometrium’s utility in fertility preservation, hormonal deficiency treatments, and menopausal symptom management.

- Bioidentical Hormones Market: Rising demand for bioidentical hormones positions Prometrium favorably due to its natural origin.

- Digital Health Integration: Telemedicine and digital diagnostics facilitate broader access and patient adherence, potentially expanding the user base.

Financial Trajectory

Revenue Streams and Growth Potential

The global progesterone market was valued at approximately USD 280 million in 2021 and is projected to grow at a CAGR of 5.2% through 2028 [2]. Prometrium contributes a substantial share within this segment, especially in developed markets.

In the short to medium term, revenue growth hinges on the following factors:

- Patent and Formulation Lifecycle: With patent expirations potentially occurring within the next 3–5 years in key markets, revenue may face erosion unless mitigated by new formulations or indications.

- Market Penetration in Emerging Markets: Growth opportunities in Asia-Pacific, Latin America, and Africa are promising owing to increasing healthcare access and awareness.

- Regulatory Approvals and Label Expansions: Securing approvals for new indications or delivery methods can unlock additional revenue streams.

Cost Dynamics and Profit Margins

Manufacturing of micronized progesterone is well-established, typically offering stable cost structures. However, market volatility, regulatory compliance costs, and patent litigations can impact profit margins. Efforts to optimize supply chains and invest in biosimilar development can improve cost competitiveness.

Competitive Pricing Strategies

To sustain revenue, pharmaceutical firms may adopt tiered pricing, strategic alliances, and performance-based reimbursement agreements, especially in price-sensitive markets.

Impact of Biosimilars and Generics

The expiration of key patents will likely usher in a wave of biosimilar and generic entrants, pressuring prices and margins. Companies proactive in portfolio diversification and innovation are better positioned to navigate these changes.

Long-term Outlook

The financial trajectory for Prometrium is cautiously optimistic, grounded in stable demand driven by demographic trends and expanding indications. However, the competitive landscape necessitates strategic investment in research and development, market expansion, and regulatory navigation to sustain growth.

Conclusion

Prometrium’s market is shaped by favorable demographic trends, regulatory considerations, and evolving clinical practices. Its financial trajectory, while promising, will require strategic maneuvering amidst patent cliffs, cost pressures, and competitive threats. Firms with agility in innovation and market expansion are poised to capitalize on the growing demand for natural progesterone therapies.

Key Takeaways

- Demographic and societal shifts underpin steady demand for Prometrium, especially in menopausal and fertility markets.

- Patent expirations and biosimilar competition pose significant challenges, necessitating innovation in formulations and indications.

- Regulatory rigor influences market access, with approval processes impacting timing and potential revenue.

- Emerging markets offer substantial growth potential owing to increasing healthcare infrastructure and awareness.

- Strategic diversification in delivery methods, indications, and biosimilars will be essential for maintaining financial performance.

FAQs

-

What are the main indications for Prometrium?

Prometrium is primarily indicated for hormone replacement therapy in menopausal women, management of abnormal uterine bleeding, and supporting fertility treatments.

-

How does patent expiry affect Prometrium’s market?

Patent expiries invite generic and biosimilar competition, leading to price erosion and potential revenue decline unless offset by new indications or formulations.

-

What emerging markets present growth opportunities for Prometrium?

Asia-Pacific, Latin America, and parts of Africa offer expanding healthcare infrastructure and increasing demand for hormone therapies.

-

Are biosimilars a threat to Prometrium's profitability?

Yes. Biosimilar entries can reduce pricing power and market share but also encourage innovation and portfolio diversification to mitigate impact.

-

What future developments could influence Prometrium’s market?

Approval for new indications, innovative formulations (e.g., bioidentical hormones), and integration into digital health solutions are potential influencers of future growth.

References

[1] World Health Organization. "Menopause and aging," 2020.

[2] MarketsandMarkets. “Progesterone Market by Formulation, Application, Route of Administration—Global Forecast to 2028,” 2022.