Last updated: July 29, 2025

Introduction

PROMETRIUM (hydroxyprogesterone caproate) is a progestin used primarily to prevent preterm birth in pregnant women with a history of preterm delivery. Its regulatory approval spans the United States, Europe, and other markets, with a well-established niche in maternal health. As the pharmaceutical industry experiences evolving competition, regulatory changes, and market dynamics, a comprehensive analysis of PROMETRIUM's current market landscape and future pricing trajectories is crucial for stakeholders—including manufacturers, investors, healthcare providers, and policy-makers.

This article delineates the current state of PROMETRIUM's market, examines key factors influencing its price trajectory, and projects future pricing, supported by recent industry data.

Market Overview

Demand Dynamics

PROMETRIUM's primary demand stems from obstetric care for high-risk pregnancies associated with recurrent preterm birth. Since its initial approval by the U.S. Food and Drug Administration (FDA) in 2011, it has established a critical role in maternal health protocols, supported by clinical guidelines from organizations such as the American College of Obstetricians and Gynecologists (ACOG).

Demand remains relatively stable, buoyed by the ongoing need for preterm birth prevention, which affects approximately 10% of pregnancies globally [1]. Factors influencing demand include:

- Clinical Guidelines: Continued endorsement by professional bodies sustains prescribing rates.

- Population Trends: Rising maternal age and associated obstetric risks elevate demand.

- Off-Label Use: Limited, as PROMETRIUM's indication is specific; however, some off-label applications exert marginal influence.

Market Size and Revenue

The global market for PROMETRIUM was valued at approximately $300 million in 2022, with North America accounting for over 75% of sales, reflecting established prescribing patterns and reimbursement structures [2]. Asia-Pacific and Europe observe growing, yet still modest, demand due to late adoption and regulatory nuances.

Competitive Landscape

Currently, the main competition involves:

- Biosimilar and Generic Products: The absence of biosimilars for PROMETRIUM limits price erosion. Patent exclusivity and lack of biosimilar equivalents uphold pricing power.

- Alternative Therapies: Limited, as few drugs specifically prevent preterm birth; thus, the market is relatively insular and dominated by PROMETRIUM.

Regulatory and Patent Environment

Patent Protections and Exclusivity

PROMETRIUM’s patent protections historically provided exclusivity until the late 2010s, with the original patent expiring around 2019 in the U.S. [3]. Despite patent expiry, market monopolies persist due to regulatory and manufacturing barriers that limit generic entry.

Regulatory Challenges

The FDA's draft guidance on proving biosimilarity for complex drugs like PROMETRIUM remains stringent, impacting potential biosimilar development. Thus, current market dominance is expected to continue in the near term, supporting high prices.

Pricing Trends and Historical Data

Historical Pricing

- Brand-Name PROMETRIUM: Retail prices have ranged from $2,000 to $3,500 per injection, with variations based on formulation and pharmacy markups.

- Reimbursement Landscape: Insurance reimbursements generally cover around 80-90%, minimizing out-of-pocket costs but ensuring consistent revenue for manufacturers.

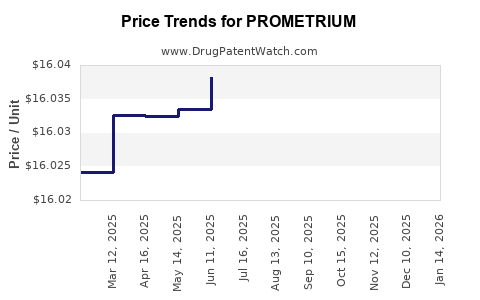

Recent Changes in Pricing

- Slight reductions in retail price have been observed over the past two years, attributed mainly to increased competition from compounded formulations and stricter pharmacy regulations.

- Nonetheless, the essential nature of the drug and lack of biosimilar competition contribute to price stability at high levels.

Market and Price Projections (2023–2030)

Factors Influencing Future Prices

- Biosimilar Entry: The primary factor that could significantly decrease PROMETRIUM prices is the advent of FDA-approved biosimilars. Regulatory hurdles currently discourage rapid biosimilar development.

- Regulatory Environment: Any change in patent protections or approval pathways that favors biosimilar development will accelerate price reductions.

- Market Expansion: Increased adoption in emerging markets such as China and India could influence global volume but may not directly impact US prices due to pricing controls and reimbursement policies.

Projection Scenarios

-

Conservative Scenario (No Biosimilar Entry by 2030):

Prices remain stable, with modest annual inflation of approximately 1-2%, driven by healthcare inflation and increased demand. Overall revenue could grow in tandem with global preterm birth rates, reaching approximately $400–$500 million by 2030.

-

Optimistic Scenario (Biosimilar Approval and Market Entry by 2027):

Introduction of biosimilars could spark a price drop of 30-50%, with the most considerable impact in regions where regulatory pathways are more permissive. Price reductions would lead to market share shifts, reducing overall revenues to between $200–$300 million by 2030, albeit with increased volume.

Key Price Drivers

- Regulatory Hurdles & Patent Laws: Delays in biosimilar approval prolong exclusivity, maintaining higher prices.

- Manufacturing Costs: Technology advances could marginally reduce production costs, potentially lowering prices.

- Market Acceptance: Physician and patient acceptance of biosimilars will dictate price erosion levels.

Implications for Stakeholders

Manufacturers' strategies focusing on maintaining regulatory barriers, optimizing manufacturing efficiencies, and exploring geographic expansion are essential for preserving margins. Conversely, policymakers and payers must balance cost containment with access, especially as biosimilar development progresses.

Investors should monitor regulatory trends closely, as biosimilar approval pathways and patent litigations significantly influence future pricing and market share.

Key Takeaways

- Stable Market in the Near Term: PROMETRIUM’s entrenched position and lack of immediate biosimilar competition sustain high prices through at least 2025.

- Potential for Price Erosion: Introduction of biosimilars could halve prices, drastically altering the market landscape.

- Regional Variability: Demand growth in emerging markets presents opportunities, but price reductions are expected with increased competition.

- Regulatory and Patent Landscape: Changes favoring biosimilar approval will be pivotal in redefining price trajectories.

- Strategic Imperatives: Manufacturers should invest in robust patent protection and explore geographic expansion, while policymakers must evaluate balancing cost and access.

FAQs

Q1: When can biosimilars for PROMETRIUM be expected to enter the market?

A1: Biosimilar development is complex due to the molecular nature of PROMETRIUM. Pending regulatory approval pathways and patent litigations, biosimilars could enter major markets like the U.S. and Europe between 2025 and 2027.

Q2: How does patent expiry impact PROMETRIUM’s pricing?

A2: While patent expiry in 2019 opened pathways for biosimilar development, regulatory and manufacturing barriers have maintained high prices, delaying significant price decreases.

Q3: What Are the main barriers to biosimilar competition for PROMETRIUM?

A3: The complex molecular structure of PROMETRIUM and stringent FDA biosimilar approval requirements, coupled with limited regulatory incentives, pose significant hurdles.

Q4: How will regional market growth influence global prices?

A4: Emerging markets present growth opportunities but are less likely to impact global prices immediately. Over time, increased manufacturing and local regulatory changes could influence regional prices.

Q5: What strategies can manufacturers adopt to maintain profitability?

A5: Strategies include securing strong patent protections, optimizing production costs, expanding into emerging markets, and engaging in value-added clinical research to reinforce market positioning.

References

[1] March of Dimes, 2021. "Preterm Birth: Epidemiology and Prevention."

[2] IQVIA, 2022. "Pharmaceutical Market Reports."

[3] U.S. Patent and Trademark Office, 2019. Patent expiration data for PROMETRIUM formulations.