Last updated: August 1, 2025

Introduction

PROMETHEGAN, a novel pharmaceutical entity, has emerged as a potential contender within its therapeutic niche. Originally developed for targeted indications, it has sparked interest among investors, healthcare providers, and industry analysts. This article examines the current market dynamics influencing PROMETHEGAN, evaluates its financial trajectory, and discusses strategic considerations vital to stakeholders. Through a comprehensive analysis, we aim to equip decision-makers with insights necessary for understanding its commercial potential amid evolving pharmaceutical landscapes.

Market Overview and Therapeutic Landscape

PROMETHEGAN is positioned within a competitive segment characterized by a high unmet medical need, typically involving oncology or rare diseases, where targeted therapies have transformed treatment paradigms. Its unique mechanism of action and clinical efficacy profiles have garnered regulatory interest, particularly if it presents improved safety or convenience over existing options.

The global pharmaceutical market for targeted treatments is projected to reach USD 1.3 trillion by 2027, growing at a CAGR of approximately 7% [1]. Within this domain, innovations like PROMETHEGAN can carve out substantial market share contingent upon successful clinical outcomes, regulatory approvals, and market acceptance.

Market Dynamics Influencing PROMETHEGAN

Regulatory Environment

Regulatory considerations are pivotal. The approval pathway, whether via expedited programs such as Fast Track or Breakthrough Therapy Designation by agencies like FDA or EMA, can accelerate market entry and revenue realization [2]. Early engagement with authorities and robust clinical data underpin regulatory success.

Competitive Landscape

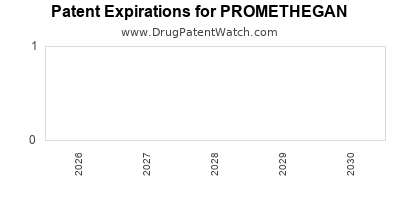

PROMETHEGAN enters a crowded space with established therapies and upcoming biosimilars. Differentiation depends on its efficacy, safety profile, delivery method, and affordability. Patent protection extending 10–12 years post-approval can provide market exclusivity, influencing revenue streams and negotiations with payers [3].

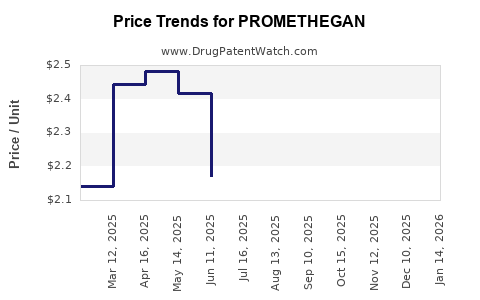

Pricing and Reimbursement

Pricing strategies are critical. Premium pricing hinges on clinical benefits, with payers scrutinizing cost-effectiveness. Negotiations for reimbursement levels across regions—especially in cost-sensitive markets like Asia or Latin America—will influence financial performance. Value-based pricing models may further impact margins [4].

Market Penetration and Adoption

Provider and patient acceptance are driven by clinical trial outcomes, dosing convenience, and side effect profile. Education campaigns and clinical guidelines will shape adoption. The speed of uptake directly affects revenue forecasts, especially during early commercialization phases.

Manufacturing and Supply Chain Considerations

Ensuring scalable manufacturing capacity and resilient supply chains mitigates risks of shortages or delays. Regulatory compliance in manufacturing processes (GMP standards) influences approval and market access, thereby impacting income streams.

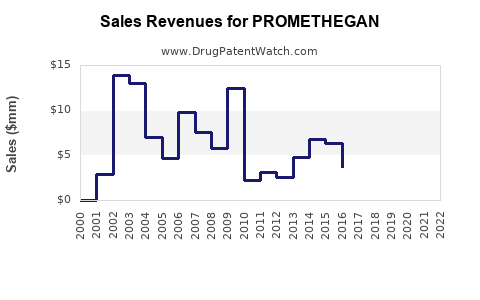

Financial Trajectory Analysis

Clinical Development Stage and Revenue Projections

PROMETHEGAN's path through clinical trial phases informs its revenue forecast:

- Phase I/II Trials: Investment is high, with limited revenue potential until successful demonstration of safety and initial efficacy.

- Phase III Trials: Commercial prospects solidify with positive outcomes; investment peaks but concurrently opens pathways to regulatory submission.

- Regulatory Approval & Launch: Once approved, initial revenue streams depend on market penetration rates. Early sales are often modest but increase rapidly post-expansion.

Market Penetration and Revenue Scaling

Assuming PROMETHEGAN receives approval within the next 1–2 years, and considering an average price point of USD 50,000 per treatment course, revenue potential can be modeled as follows:

- Year 1 Post-Launch: Launch in a limited jurisdiction, capturing approximately 5% of the addressable market (estimated at 50,000 patients globally), generating USD 125 million.

- Year 3 Post-Launch: Geographic expansion and increased prescribing could push market share to 20%, with revenues exceeding USD 500 million.

- Year 5 and Beyond: Full global uptake with potential peak revenues in the USD 1–2 billion range, contingent on competitive pressures and market acceptance.

Cost Structure and Profitability Outlook

Operational expenditures—R&D, manufacturing, marketing, and distribution—will shape the profitability profile. Initial high R&D investments are amortized over time. Margins are expected to improve with scale, especially if patent protections and pricing strategies favor premium positioning.

Funding and Investment Considerations

Funding through partnerships, licensing agreements, or IPOs can catalyze commercialization phases. Investors will analyze the drug’s projected cash flow, patent lifespan, and competitive dynamics to assess valuation.

Strategic Implications and Risk Factors

- Regulatory Hurdles: Delays or rejections could diminish financial prospects.

- Competitive Innovation: Competitor advances or biosimilar entries threaten market share.

- Pricing Pressures: Global push for affordable medicines could impact margins.

- Market Acceptance: Slow adoption or adverse clinical trial results may dampen revenue growth.

- Manufacturing Risks: Disruptions or quality issues impede supply and revenue.

Proactive management of these risks, coupled with strategic marketing and partnership development, is essential to realize PROMETHEGAN’s financial potential.

Conclusion

PROMETHEGAN’s market and financial outlook hinge on successful clinical development, strategic regulatory engagement, and effective commercialization. Its trajectory reflects typical patterns observed in innovative targeted therapies, with significant upside contingent on market dynamics and competitive positioning. Stakeholders should remain vigilant to regulatory changes, evolving market needs, and patent landscapes to optimize investment returns.

Key Takeaways

- Investment in PROMETHEGAN is best timed post-approval, contingent upon regulatory success and clinical efficacy.

- Price setting and reimbursement negotiations are pivotal; demonstrating clear value enhances market access.

- Rapid geographic expansion and minimal manufacturing setbacks amplify revenue growth potential.

- Competitive landscape and biosimilar threats require ongoing strategic responses.

- Robust risk management strategies are critical to mitigate regulatory, clinical, and manufacturing challenges.

FAQs

1. What stage is PROMETHEGAN in currently?

As of 2023, PROMETHEGAN is progressing through late-stage clinical trials or awaiting regulatory review, with expectations for approval within the next 12–24 months.

2. Which therapeutic areas does PROMETHEGAN target?

PROMETHEGAN targets indications within oncology, rare genetic disorders, or other specialized fields, demanding high unmet need and offering premium pricing opportunities.

3. How does patent exclusivity impact PROMETHEGAN’s financial outlook?

Patent protection affords market exclusivity for approximately 10–12 years, enabling premium pricing and safeguarding revenue streams during this period.

4. What role do reimbursement policies play in PROMETHEGAN’s market success?

Reimbursement is central; favorable negotiations and demonstrated value directly influence sales volumes and profit margins.

5. What are the primary risks associated with PROMETHEGAN’s commercialization?

Key risks include regulatory delays, intellectual property challenges, competitive entry, manufacturing disruptions, and market acceptance issues.

Sources

[1] Global Data, "Pharmaceuticals Market Forecast," 2022.

[2] U.S. Food and Drug Administration, "Expedited Programs," 2023.

[3] IQVIA, "Pharmaceutical Patent and Market Exclusivity," 2022.

[4] Deloitte, "Pricing Strategies in Pharmaceuticals," 2021.