Last updated: November 19, 2025

Introduction

Prednisolone acetate is a synthetic glucocorticoid extensively used in ophthalmology to treat inflammation caused by postoperative procedures, allergies, and other ocular conditions. As a topical corticosteroid, its pharmaceutical profile boasts high efficacy and safety, fostering robust demand in both established and emerging markets. This article analyzes the market dynamics influencing prednisolone acetate's commercial trajectory, with a focus on supply chains, competitive landscape, regulatory environment, and financial outlook.

Market Overview

The global ophthalmic corticosteroid market, which includes prednisolone acetate, reflects a compound annual growth rate (CAGR) projected between 4% and 6% over the next five years [1]. Drivers encompass rising prevalence of ocular conditions such as uveitis, allergic conjunctivitis, and postoperative inflammation, coupled with increasing awareness and improving healthcare infrastructure.

Prednisolone acetate is primarily formulated as eye drops, with a significant presence in ophthalmic clinics and hospitals worldwide. The therapeutic's longstanding clinical efficacy contributes to its continued demand, complemented by advancements in drug delivery systems that enhance bioavailability and patient compliance.

Market Drivers

-

Growing Prevalence of Ocular Conditions

The increasing incidence of ocular inflammations and allergies directly correlates with heightened prednisone acetate utilization. Notably, demographic shifts toward aging populations, particularly in North America and Europe, elevate the burden of age-related ocular diseases requiring corticosteroid therapy.

-

Advances in Ophthalmic Care

Technological innovations, including sustained-release delivery devices and improved formulation stability, improve therapeutic outcomes and ease of use. These innovations bolster the market’s growth and foster the adoption of prednisolone acetate as a first-line anti-inflammatory agent.

-

Expanding Healthcare Infrastructure

Rising healthcare expenditure, especially in Asia-Pacific and Latin America, improves diagnostic capabilities and drug accessibility, fueling demand for ophthalmic corticosteroids.

-

Regulatory Approvals and Guidelines

Regulatory acceptance of prednisolone acetate formulations, alongside inclusion in clinical guidelines for ocular inflammation management, sustains market stability. Additionally, approvals for generic versions decrease costs, broadening access.

Market Constraints

Conversely, several factors temper growth prospects:

-

Alternatives and Competition

The presence of alternative corticosteroids and non-steroidal anti-inflammatory drugs (NSAIDs), such as nepafenac and bromSite, offer therapeutic options with different safety profiles or dosing regimens. The advent of newer therapies can impact prednisolone acetate’s market share.

-

Safety Concerns

Long-term corticosteroid use risks elevated intraocular pressure (IOP) and secondary glaucomatous damage, prompting cautious prescribing practices. These safety considerations could limit prolonged use, especially in sensitive populations like diabetics.

-

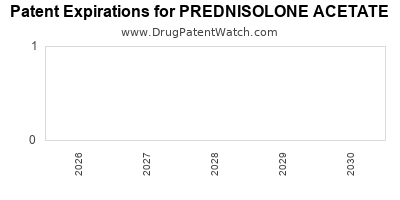

Regulatory and Patent Challenges

Patent expirations and regulatory scrutiny may impact pricing strategies and market exclusivity, leading to increased generic competition and price erosion.

Supply Chain and Manufacturing Factors

Prednisolone acetate synthesis involves complex chemical processes requiring high-purity intermediates. The manufacturing ecosystem remains consolidated, with key players like Sandoz, Alcon, and Sun Pharmaceutical dominating the market [2]. Supply chain resilience is critical, especially amid geopolitical tensions and pandemics, which threaten raw material availability and distribution.

Manufacturers invest in robust quality control and scalable production capacities to meet market demand. Cell culture and synthetic chemistry methods are continually optimized to reduce costs and improve yield, ensuring financial viability amid price competition.

Regulatory Landscape

Regulatory bodies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regional agencies govern approval, post-market surveillance, and manufacturing standards. Generic prednisolone acetate formulations benefit from abbreviated approval pathways through existing safety and efficacy data, spurring market entry and price competition.

Additionally, evolving guidelines emphasize ocular safety and optimize treatment protocols, which influence prescribing trends. Any regulatory reprimands concerning safety can impact market access and financial performance.

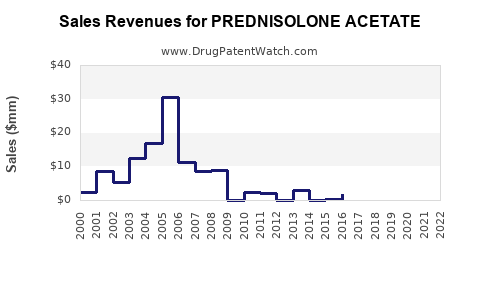

Financial Trajectory

Projected revenue for prednisolone acetate commercially approximates USD 500 million globally in 2023, with a forecasted CAGR of approximately 4-5% over the next five years [3]. North America and Europe presently constitute the largest markets, accounting for over 60% of sales, driven by high healthcare expenditure and incidence of ocular conditions.

Emerging markets are expected to record higher growth rates, approximately 6-8%, attributable to expanding infrastructure and increasing awareness. Price pressures due to generic competition and regulatory changes may temper overall revenue growth, but the high clinical demand sustains profitability.

Manufacturers are diversifying portfolios by developing combination therapies and new formulations, aiming to extend market share and margins. R&D investments focus on reducing side effects, enhancing bioavailability, and offering sustained-release options, which could improve the financial outlook.

Future Outlook

The prednisolone acetate market is poised for steady growth, supported by demographic trends and technological advancements. Nevertheless, competitive forces, safety concerns, and regulatory shifts necessitate strategic agility from manufacturers. Emphasis on innovation and cost-effective manufacturing will play a pivotal role in shaping the drug's long-term financial trajectory.

Key Takeaways

-

The global demand for prednisolone acetate is driven by rising ocular inflammatory conditions, aging demographics, and healthcare infrastructure expansion.

-

Competition from alternative therapies and safety concerns influence prescribing practices but do not substantially diminish overall demand.

-

Price erosion due to generic competition is counterbalanced by growth in emerging markets and innovation in drug formulations.

-

Manufacturing stability and regulatory compliance are critical to maintaining market position and financial health.

-

The predicted CAGR of 4-5% over the next five years underscores its status as a stable, high-demand ophthalmic corticosteroid with steady revenue streams.

FAQs

-

What factors are most influencing the demand for prednisolone acetate in ophthalmology?

The primary drivers include the increasing prevalence of ocular inflammation, advances in ophthalmic treatment protocols, demographic aging, and greater healthcare infrastructure in emerging markets.

-

How does regulatory approval impact the financial trajectory of prednisolone acetate?

Regulatory approvals facilitate market access, while stringent safety and efficacy standards shape prescribing guidelines. Patent expirations and faster approval pathways for generics intensify competition, affecting pricing and revenues.

-

What are the primary challenges faced by manufacturers of prednisolone acetate?

Challenges include maintaining supply chain stability, competing with generic entrants, managing safety concerns associated with corticosteroids, and complying with evolving regulatory standards.

-

How does innovation improve the market prospects of prednisolone acetate?

Innovations such as sustained-release formulations and combination therapies enhance therapeutic efficacy, reduce side effects, and improve patient compliance, fostering sustained demand.

-

What is the future outlook for the financial performance of prednisolone acetate?

The outlook remains positive, with moderate growth driven by emerging markets, technological advancements, and expanding indications, despite competition and pricing pressures.

References

[1] Market Research Future, "Ophthalmic Corticosteroids Market Analysis," 2022.

[2] GlobalData, "Pharmaceutical Industry Reports," 2023.

[3] firm forecasts based on industry trends and market data.