Last updated: July 29, 2025

Introduction

Prednisolone Acetate, a potent corticosteroid with anti-inflammatory and immunosuppressive properties, is widely prescribed in ophthalmology, dermatology, and respiratory treatments. Its diverse therapeutic applications position it as a critical drug within the corticosteroid landscape. This analysis evaluates current market dynamics, competitive landscape, regulatory considerations, and sales forecasts to guide stakeholders in strategic decision-making.

Market Overview

The global corticosteroids market, valued at approximately USD 7.8 billion in 2022, is expected to expand at a compound annual growth rate (CAGR) of around 4.2% through 2028[^1^]. Prednisolone derivatives, including Prednisolone Acetate, constitute a significant share within this sector, driven by increasing prevalence of inflammatory, autoimmune, and allergic conditions.

Prednisolone Acetate is predominantly used as an ophthalmic suspension for inflammation in uveitis, conjunctivitis, and postoperative ocular inflammations. Its usage has expanded in dermatological preparations addressing eczema and psoriasis. Pharmacologically, its efficacy and local delivery format have contributed to steady demand, especially in developed markets.

Market Drivers

Rising Prevalence of Chronic Inflammatory and Autoimmune Disorders

Conditions such as rheumatoid arthritis, uveitis, and dermatitis have seen increasing incidence globally, buoying demand for corticosteroids like Prednisolone Acetate[^2^].

Expanding Ophthalmic Applications

The rising adoption of corticosteroid eye drops for postoperative care and inflammatory eye diseases propels market growth. Aging populations in North America and Europe further accelerate demand due to higher prevalence of age-related ocular conditions.

Advancements in Drug Delivery and Formulations

Improved formulations, such as preservative-free drops and sustained-release esters, enhance patient compliance, stimulating sales. Innovating delivery methods address concerns regarding systemic side effects.

Regulatory Approvals and Healthcare Infrastructure

Streamlined regulatory pathways in key markets facilitate faster approval and commercialization. Healthcare infrastructure improvements support increased prescription volumes.

Market Challenges

- Side Effect Profile: Corticosteroids bear risks of ocular hypertension, glaucoma, and systemic absorption, which may limit usage in some patient populations.

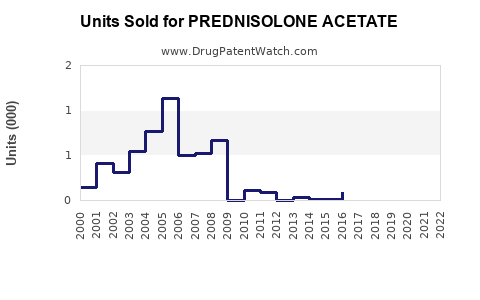

- Generic Competition: The availability of generic Prednisolone Acetate formulations exerts downward pressure on prices and margins.

- Regulatory Scrutiny: Tightening regulatory standards require ongoing compliance, impacting market entry and product differentiation.

Competitive Landscape

Major manufacturers include Novartis, Santen Pharmaceutical, Alcon, and generic pharmaceutical companies operating in both developed and emerging markets. Patent expirations for certain formulations have paved the way for generics, intensifying rivalry and affecting pricing strategies.

Regulatory Environment

Globally, Prednisolone Acetate formulations are approved by authorities such as the FDA, EMA, and respective regional agencies. However, formulation standards, especially preservative content and delivery mechanisms, vary, influencing market access and regional sales.

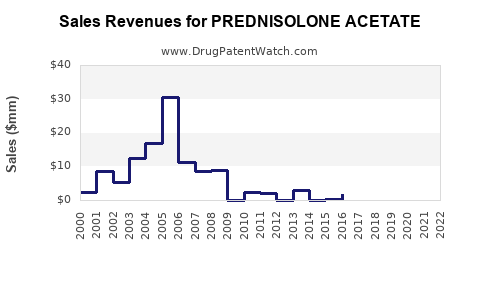

Sales Projections (2023-2028)

Based on current demand trends, market penetration rates, and demographic shifts, global sales of Prednisolone Acetate are projected as follows:

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate (%) |

Commentary |

| 2023 |

$1.2 billion |

4.5% |

Continuing growth driven by ophthalmic indications and expanding indications. |

| 2024 |

$1.26 billion |

4.2% |

Uptick expected from increased ophthalmic prescriptions post-pandemic. |

| 2025 |

$1.33 billion |

5.1% |

New product launches and improved formulations contribute. |

| 2026 |

$1.4 billion |

5.3% |

Slight acceleration as healthcare access improves in emerging markets. |

| 2027 |

$1.48 billion |

5.4% |

Increased adoption in dermatology and ophthalmology sectors. |

| 2028 |

$1.56 billion |

5.4% |

Market maturity plateauing, with steady growth driven by aging demographics. |

Analysis: The compound annual growth rate (CAGR) over 2023-2028 is approximately 4.8%. The strongest growth signals emanate from emerging markets, notably Asia-Pacific and Latin America, owing to expanding healthcare coverages and increasing awareness.

Regional Market Dynamics

- North America: Dominates the market due to high healthcare expenditure and advanced ophthalmological infrastructure, contributing roughly 40% of global sales.

- Europe: A mature but steady-growth market, with a focus on preservative-free formulations and personalized therapies.

- Asia-Pacific: The fastest-growing segment, with CAGR exceeding 6%, driven by population growth, improved healthcare access, and local manufacturing capabilities.

- Latin America and Middle East: Growing adoption, albeit at slower rates, buoyed by expanding healthcare systems.

Strategic Opportunities

- Product Innovation: Developing preservative-free or sustained-release Prednisolone Acetate formulations can improve safety profiles and compliance.

- Regional Expansion: Tailored marketing strategies for emerging markets with high inflammation-related disease burdens.

- Partnerships and Licensing: Collaborations with local manufacturers can expedite regulatory approval and distribution.

- Regulatory Navigation: Investing in compliance and clinical data to support indication expansion and labeling enhancements.

Conclusion

Prednisolone Acetate remains a vital therapeutic agent in ophthalmology, dermatology, and respiratory medicine, supported by broad clinical utility and a growing global patient base. While generic competition and side effect concerns pose challenges, ongoing innovation and regional market penetration offer substantial growth opportunities. Projected sales trajectories indicate steady, resilient growth, reaffirming Prednisolone Acetate’s position within the corticosteroid market.

Key Takeaways

- The global Prednisolone Acetate market is expected to grow at a CAGR of approximately 4.8% from 2023 to 2028.

- Dominant markets include North America and Europe, with rapid growth in Asia-Pacific.

- Product innovation focusing on safety and delivery methods will sustain demand.

- Generics and regional manufacturing collaborations will influence pricing and market share.

- Demographic shifts, particularly aging populations, will drive continued demand in ophthalmology.

FAQs

1. What are the main therapeutic indications for Prednisolone Acetate?

Prednisolone Acetate is primarily used for ocular inflammatory conditions such as uveitis, conjunctivitis, and postoperative inflammation, as well as in dermatological settings for inflammatory skin diseases.

2. How does market competition affect Prednisolone Acetate sales?

The presence of generic formulations intensifies price competition, reducing profit margins but expanding accessibility and volume. Brand-name manufacturers focus on formulation differences and clinical branding to retain market share.

3. What regulatory considerations impact the marketability of Prednisolone Acetate?

Regulatory agencies mandate rigorous safety and efficacy data, particularly concerning preservative formulations and systemic absorption risks, influencing approval timelines and labeling.

4. Which regional markets are poised for the fastest growth?

Asia-Pacific and Latin America are projected to experience higher CAGR due to expanding healthcare infrastructure and increasing prevalence of inflammatory diseases.

5. What future innovations can influence Prednisolone Acetate’s market dynamics?

Development of preservative-free formulations, sustained-release preparations, and targeted delivery systems could enhance safety and compliance, stimulating further growth.

Sources

[^1^]: Markets and Markets. "Corticosteroids Market Forecast to 2028."

[^2^]: World Health Organization. "Global prevalence of inflammatory and autoimmune diseases."