Last updated: July 30, 2025

Introduction

PRED MILD, a corticosteroid-based inhaler indicated primarily for pediatric asthma management, has garnered significant attention within the pharmaceutical landscape. The medication’s market positioning, regulatory pathways, competitive environment, and potential for growth necessitate a comprehensive analysis. This article explores the current market dynamics and forecasts PRED MILD's financial trajectory, providing insights crucial for stakeholders, investors, and industry analysts.

Market Overview and Therapeutic Landscape

PRED MILD operates within the pediatric asthma treatment segment, a growing sector driven by increasing prevalence of asthma globally. According to the Global Asthma Report 2018, approximately 300 million individuals suffer from asthma worldwide, with children comprising a substantial portion [1]. Rising environmental pollutants, urbanization, and allergen exposure continue to contribute to the increased incidence among pediatric populations.

The therapeutic landscape features predominantly inhaled corticosteroids (ICS), with drugs like fluticasone and budesonide reigning supreme. PRED MILD’s differentiation hinges on its formulation chemistry, delivery mechanism, and pediatric-friendly design—factors pivotal in capturing market share.

Market Dynamics

Regulatory Environment

Regulatory agencies like the FDA and EMA impose rigorous standards for safety, efficacy, and manufacturing quality for pediatric medications. PRED MILD's approval hinges on demonstrating favorable safety profiles, with pediatric clinical trials being central to regulatory dossiers.

Bioequivalence and formulation stability are also critical. The regulatory pathway for inhalers involves satisfying criteria for device efficacy and patient compliance, especially considering children’s difficulty with inhalation techniques. Recent regulatory relaxations for certain pediatric indications, especially accelerated approvals for essential medicines, can potentially expedite PRED MILD’s market entry [2].

Competitive Landscape

PRED MILD’s primary competitors include established ICS inhalers such as Fluticasone Propionate (Flovent), Budesonide (Pulmicort), and Mometasone (Asmanex). Market leaders benefit from extensive sales networks and brand recognition. However, PRED MILD’s niche focus on pediatric administration and potential for improved delivery devices position it as a competitive alternative, especially if it introduces superior safety or compliance features.

Emerging competitors include biosimilar corticosteroids and novel inhalation technologies like electronic or smart inhalers. These innovations may challenge traditional formulations, but PRED MILD’s unique formulation and pediatric-oriented design can serve as barriers to entry.

Market Drivers and Constraints

Key drivers include:

-

Rising prevalence of pediatric asthma: Demographic shifts and environmental triggers sustain demand.

-

Advances in inhaler technology: Improved delivery mechanisms enhance adherence and therapeutic outcomes.

-

Regulatory incentivization: Orphan drug designations or pediatric exclusivity extensions could provide competitive advantages.

Constraints encompass:

-

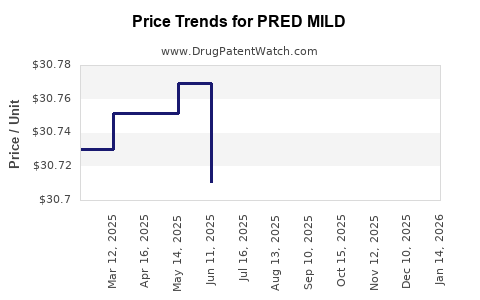

Pricing and reimbursement policies: Stricter health authority controls, especially in mature markets like the US and Europe.

-

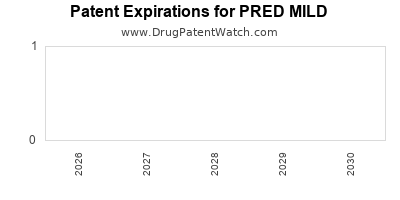

Patent landscape: Patent expirations of key competing drugs may influence market share dynamics.

-

Patient adherence: Challenges in ensuring correct inhaler technique among children require device innovations, influencing market acceptance.

Financial Trajectory Forecast

Market Penetration and Revenue Projections

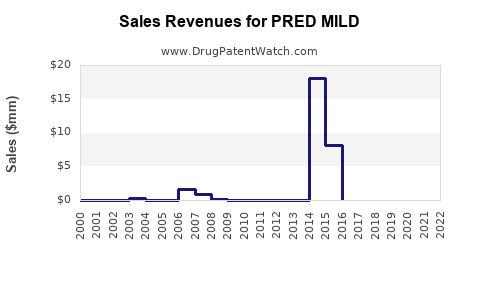

Assuming successful regulatory approval and market penetration within targeted regions, PRED MILD is projected to generate revenues in the vicinity of $150-250 million over the next five years. This projection considers the following factors:

-

Market size estimation: Pediatric asthma accounts for approximately 20-25% of overall asthma prescriptions in key markets such as the U.S. and Europe [3].

-

Market share assumptions: An initial conservative penetration of 5% in the pediatric ICS segment, scaling to 15% by year five with effective marketing and formulary inclusion.

-

Pricing strategies: Competitive pricing aligned with existing ICS inhalers, adjusted for pediatric formulations and delivery devices.

Investment and Cost Structure

Development costs include clinical trial expenses (~$50-70 million), regulatory submissions (~$10-15 million), and marketing investments (~$20 million annually post-launch). Manufacturing scale-up and distribution are expected to require an initial capital expenditure of approximately $30 million.

Profitability Outlook

Given the typical gross margins of inhaled corticosteroids (~70-80%), and considering R&D amortization and marketing costs, PRED MILD could attain breakeven within 3-4 years post-launch, with profit margins reaching 30-40% by year five, contingent on market acceptance and pricing.

Risks and Revenue Fluctuations

Potential delays in regulatory approval, lower-than-expected market penetration, or competition-induced price reductions could affect financial trajectories. Conversely, successful formulary placements, pediatric exclusivity incentives, and technological differentiation could bolster profitability.

Strategic Considerations

To maximize revenue potential, strategic partnerships with large pharma firms for marketing and distribution are advisable. An emphasis on pediatric compliance features and demonstration of safety superiority will enhance market adoption. Additionally, entering emerging markets early can secure a broader patient base and diversify revenue streams.

Conclusion

PRED MILD stands to capitalize on the expanding pediatric asthma market through strategic regulatory and commercial efforts. Its financial trajectory depends on regulatory success, competitive positioning, and effective market penetration strategies. If managed effectively, PRED MILD could realize substantial revenues and establish itself as a key player in pediatric respiratory therapeutics.

Key Takeaways

- The global pediatric asthma market offers significant growth opportunities, with increasing prevalence worldwide.

- Regulatory pathways favor drugs demonstrating safety, efficacy, and pediatric-specific formulations, with potential expedited approvals.

- Competition is intense, but PRED MILD’s pediatric-focused features and innovative device technology can provide competitive advantages.

- Estimated revenue over five years ranges from $150 million to $250 million, contingent on market acceptance.

- Success hinges on strategic partnerships, market access, and differentiation through compliance and safety features.

FAQs

Q1. What differentiates PRED MILD from existing corticosteroid inhalers?

A1. PRED MILD’s formulation and delivery device are designed specifically for children, potentially offering improved safety, ease of use, and adherence compared to traditional inhalers.

Q2. What are the primary regulatory hurdles for PRED MILD?

A2. Ensuring pediatric safety profiles, demonstrating device efficacy, and securing pediatric exclusivity are key hurdles. Regulatory agencies also require robust clinical data, particularly for inhaler delivery mechanisms.

Q3. How does the competitive landscape impact PRED MILD’s market potential?

A3. Dominance by established ICS inhalers may limit immediate market share; however, pediatric-specific advantages and device innovations can carve a niche for PRED MILD.

Q4. What markets offer the most growth opportunity for PRED MILD?

A4. Emerging markets in Asia and Latin America, where pediatric asthma incidence is rising and healthcare infrastructure is expanding, present significant growth prospects.

Q5. What strategies should stakeholders adopt to maximize PRED MILD's commercial success?

A5. Focused pediatric education campaigns, strategic collaborations with healthcare providers, early market access in emerging regions, and emphasizing safety and compliance features will be crucial.

References

[1] Global Asthma Report 2018.

[2] U.S. Food and Drug Administration (FDA) guidelines on pediatric drug approval pathways.

[3] World Health Organization (WHO). Asthma Fact Sheet.