Share This Page

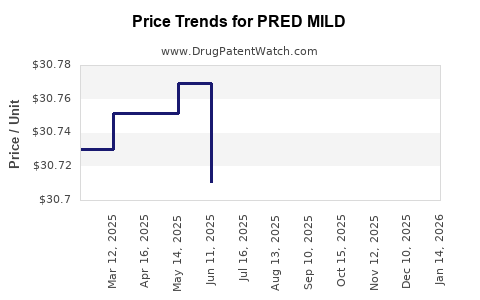

Drug Price Trends for PRED MILD

✉ Email this page to a colleague

Average Pharmacy Cost for PRED MILD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PRED MILD 0.12% EYE DROPS | 11980-0174-10 | 30.66490 | ML | 2025-12-17 |

| PRED MILD 0.12% EYE DROPS | 11980-0174-05 | 30.74443 | ML | 2025-12-17 |

| PRED MILD 0.12% EYE DROPS | 11980-0174-10 | 30.67692 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PRED MILD

Introduction

PRED MILD is a corticosteroid-based topical medication primarily used to treat dermatological conditions such as eczema, psoriasis, and dermatitis. Its formulation, efficacy, and safety profile have made it a common choice among clinicians and patients. As the pharmaceutical landscape continues to evolve with increasing demand for effective dermatological treatments, understanding the market dynamics and price projections for PRED MILD becomes crucial for stakeholders, including manufacturers, investors, and healthcare providers.

This comprehensive analysis explores the current market scenario, competitive landscape, regulatory environment, and future price projections for PRED MILD over the next five years. It offers strategic insights for decision-making, emphasizing emerging trends, market drivers, challenges, and growth opportunities.

Market Overview

Product Profile

PRED MILD is a low-potency corticosteroid formulation, often prescribed for sensitive skin areas or mild to moderate inflammatory skin conditions. Its formulation typically includes prednicarbate or similar corticosteroid agents, combined with soothing excipients to reduce irritation.

Current Market Penetration

The drug enjoys significant penetration in markets such as the United States, Europe, and parts of Asia-Pacific, where dermatology is a prominent specialty. The rising prevalence of dermatological disorders—driven by lifestyle changes, environmental factors, and increased awareness—has bolstered demand for topical corticosteroids.

Market Size and Growth

According to recent industry reports [1], the global dermatological therapeutics market is projected to reach approximately USD 25 billion by 2025, with corticosteroids accounting for a substantial share. The topical corticosteroids segment, including products like PRED MILD, registers an estimated compound annual growth rate (CAGR) of 4-6%. This growth is fueled by advanced formulations and expanding indications.

Market Drivers

Rising Prevalence of Skin Conditions

Increasing incidences of eczema, psoriasis, and allergic dermatitis, particularly in urbanized and aging populations, directly boost demand for corticosteroid treatments such as PRED MILD.

Patient Preference for Topical Therapy

A shift toward topical therapies owing to their localized action, minimal systemic side effects, and ease of use encourages prescription rates.

Development of Safer Formulations

Innovations focusing on reducing side effects have resulted in the development of mild corticosteroids like PRED MILD, expanding its application range for sensitive patient groups.

Growing Awareness and Access

Enhanced public awareness campaigns and improved healthcare infrastructure facilitate greater access to dermatological products, positively impacting sales.

Market Challenges

Regulatory Constraints

Stringent regulations relating to corticosteroid use, especially regarding potency limits and labeling, can restrict market entry and formulation flexibility in certain jurisdictions.

Safety and Side Effect Concerns

Potential adverse effects from long-term corticosteroid use, such as skin thinning and systemic absorption, necessitate careful prescribing, which may limit broader utilization.

Pricing and Reimbursement Policies

Payer policies and drug pricing regulations influence market accessibility and revenue potential, especially in cost-sensitive markets.

Competitive Landscape

PRED MILD faces competition from both branded and generic topical corticosteroids, such as hydrocortisone, betamethasone, and triamcinolone formulations. Patent expirations and the proliferation of generics have increased market competition, exerting downward pressure on prices.

Key players include multinational pharmaceutical companies like GlaxoSmithKline, Novartis, and generic manufacturers focusing on dermatological products. Differentiation factors include formulation stability, safety profile, and brand recognition.

Regulatory Environment

Regulatory agencies such as the U.S. FDA, EMA, and other regional authorities enforce potency guidelines, labeling standards, and manufacturing practices for corticosteroids. Regulatory approval margins influence product positioning and pricing strategies, requiring compliance for market access. Increased emphasis on safety and efficacy through post-marketing surveillance also impacts formulation use and pricing.

Price Trends and Projections

Current Pricing Overview

In established markets, PRED MILD’s retail price ranges from USD 8 to USD 15 per tube (15g), contingent on formulations, branding, and region. Generics often undercut branded versions by 20-50%, intensifying competitive pricing pressure [2].

Projected Price Trajectory (2023-2028)

Considering current market trends and competitive pressures, the following projections are outlined:

-

Stability in Developed Markets: Moderate price stability is expected in regions like North America and Europe due to brand loyalty and regulatory standards. Prices are projected to hover around USD 8-10 per tube over five years, with some inflation adjustments.

-

Gradual Decline in Cost-Driven Markets: In markets with significant generic penetration, prices may decline by approximately 10-20% over five years, driven by competitive dynamics.

-

Premiumization Opportunities: Innovative formulations or combination products incorporating PRED MILD with other active agents could command premium pricing, potentially increasing prices by up to 15% in select segments.

-

Impact of Regulatory and Safety Considerations: Stricter regulatory controls could restrict high-potency corticosteroid markets, potentially elevating demand and prices for milder formulations like PRED MILD.

Influencing Factors on Price Projections

-

Patent and Exclusivity Periods: While formulations like PRED MILD may face patent expiries, exclusivity periods linked to innovative delivery systems or formulations can sustain premium prices.

-

Market Entry of Generics: Increased generic competition is likely to exert downward pressure, especially in price-sensitive markets.

-

Manufacturing and Distribution Costs: Advances in scalable production and supply chain efficiencies may stabilize or reduce costs, influencing retail prices.

-

Healthcare Policy and Reimbursement: Payer discount mandates and formulary placements affect net pricing, with government payers demanding lower prices.

Opportunities and Future Outlook

The growing emphasis on personalized medicine and safety profiles presents opportunities for differentiation through advanced formulations. Developing combination products or topical vehicles offering enhanced efficacy or reduced side effects could command higher prices.

Emerging markets, experiencing increasing dermatology disease burdens and expanding healthcare access, offer significant growth potential. Tailored pricing strategies, alignment with local regulations, and investment in local manufacturing could optimize market penetration.

Key Takeaways

-

The global dermatology market is robust, with corticosteroids like PRED MILD serving a key role, particularly due to rising skin condition prevalence and patient preference for topical treatments.

-

Price stability in developed regions will likely persist, while markets with intense generic competition may see price reductions over time.

-

Innovation in formulation, safety, and combination therapies can provide avenues for premium pricing and market differentiation.

-

Regulatory and reimbursement considerations significantly influence pricing strategies, requiring proactive compliance and stakeholder engagement.

-

Strategic entry into emerging markets, coupled with localized manufacturing, can yield substantial growth opportunities amid decreasing prices elsewhere.

FAQs

1. How does regulatory environment influence PRED MILD’s pricing?

Stringent regulations regarding corticosteroid potency, labeling, and safety standards limit formulation flexibility and market access, keeping prices stable if compliance is met. Conversely, regulatory restrictions can reduce market size, influencing pricing strategies.

2. What is the impact of generic competition on PRED MILD prices?

The proliferation of generic counterparts typically results in significant price reductions—up to 50% or more—especially in cost-sensitive markets. Brand premium is challenged, necessitating differentiation through formulation or brand loyalty.

3. Are there prospects for premium pricing of PRED MILD?

Yes. Innovative formulations, combination therapies, or enhanced safety profiles can justify higher prices. Such premiumization is more viable in developed markets with well-established healthcare frameworks.

4. How will emerging markets shape PRED MILD’s future pricing?

Growing dermatological disease burden and expanding healthcare infrastructure in emerging markets offer volume opportunities. Competitive pricing, local manufacturing, and tailored market strategies are essential for profitable entry.

5. What factors could lead to increased prices for PRED MILD?

Regulatory restrictions limiting higher-potency corticosteroids, increased safety concerns, or patent protections on new formulations could sustain or elevate prices, especially if demand shifts towards milder corticosteroids due to safety profiles.

Sources

[1] Grand View Research. "Dermatological Therapeutics Market Size, Share & Trends Analysis." 2022.

[2] IQVIA. "Global Dermatology Market Dynamics." 2022.

More… ↓