Last updated: July 30, 2025

Introduction

PLAQUENIL, generically known as hydroxychloroquine, is an established antimalarial medication with a long-standing history in the treatment of autoimmune diseases such as lupus erythematosus and rheumatoid arthritis. Its recent prominence surged due to early research suggesting possible efficacy in COVID-19 treatment, sparking a wave of market speculation and increased demand. This article delivers an in-depth analysis of the evolving market dynamics and financial trajectory associated with PLAQUENIL, guided by current epidemiological trends, regulatory developments, patent landscape, and commercial strategies.

Historical Overview and Market Evolution

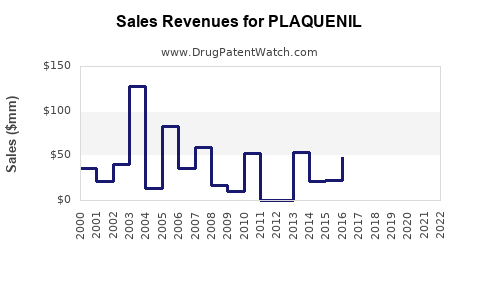

Initially approved in the 1950s, hydroxychloroquine’s primary indications have exerted stable demand within autoimmune therapeutics ([1]). The drug’s well-characterized safety profile and generic availability cement its status as a cost-effective option for chronic disease management globally. Pre-pandemic sales reflected stable revenues, with global sales hovering around USD 200-300 million annually, predominantly driven by markets in the U.S., Europe, and emerging economies.

The COVID-19 pandemic, however, served as a catalyst, propelling hydroxychloroquine into international spotlight. In 2020, speculative use and stockpiling notably disrupted supply chains and temporarily inflated sales figures. The U.S. Food and Drug Administration (FDA) revoked Emergency Use Authorization (EUA) for hydroxychloroquine in mid-2020 after clinical trials failed to establish efficacy, and safety concerns emerged, primarily pertaining to cardiac adverse effects ([2]).

Market Dynamics in the Post-Pandemic Era

Regulatory and Scientific Reassessment

Post-pandemic, hydroxychloroquine’s market trajectory has been shaped by rigorous global clinical evaluations. Multiple large-scale trials, including the WHO Solidarity trial and the UK's RECOVERY study, confirmed ineffectiveness in COVID-19 treatment, diluting earlier hopes ([3]). Regulatory agencies worldwide responded by tightening restrictions or reaffirming the drug’s primary indications, returning the focus to its established autoimmune use.

This regulatory environment constrains short-term growth but stabilizes long-term demand within its core therapies. Additionally, patent protections have long expired, rendering hydroxychloroquine a generic staple with limited pricing power yet broad accessibility.

Patent and Intellectual Property Landscape

Unlike novel pharmaceuticals protected under patent exclusivity, hydroxychloroquine’s patent expiry in the early 2000s facilitated extensive generic manufacturing, intensifying competition and suppressing prices ([4]). It has not been subject to recent patent extensions or formulations. This generic status influences the market’s elasticity, with high price sensitivity and a reliance on volume sales rather than premium pricing.

Market Supply Chain and Manufacturing

Global supply of hydroxychloroquine remains robust, with manufacturing concentrated in India and China, adhering to quality standards. However, disruption risks persist due to geopolitical factors, export regulations, and pandemic-related logistical challenges. Ensuring sustained supply is pivotal for maintaining steady revenue streams and meeting patient needs.

Emerging Therapeutic and Market Opportunities

While its role in COVID-19 has waned, ongoing investigations into hydroxychloroquine’s immunomodulatory properties continue, potentially uncovering new therapeutic avenues. However, current evidence does not support expansion beyond its established indications, limiting significant new market opportunities.

The increasing adoption of biosimilars and innovative therapies in autoimmune diseases poses competitive threats, emphasizing the importance of differentiating hydroxychloroquine within treatment algorithms.

Financial Trajectory Analysis

Revenue Trends and Forecasts

Pre-pandemic revenues reflected moderate growth with gradual declines attributable to generics’ price erosion. The pandemic’s influence caused transient spikes but did not alter the long-term overall trend. Industry analysts project a reversion to baseline demand, with global sales plateauing around USD 200-250 million annually through 2025, assuming no new indications ([5]).

However, shifts in healthcare policies, greater access in emerging markets, and educational campaigns on autoimmune management may exert upward pressure on demand in specific demographics.

Market Drivers

-

Global prevalence of autoimmune diseases: Rising incidence of lupus and rheumatoid arthritis sustains steady volume demand.

-

Cost-effectiveness: Hydroxychloroquine's affordability fosters continued use, especially in low- and middle-income countries with constrained healthcare budgets.

-

Regulatory approvals: Renewed interest in autoimmunity treatment protocols can support sales stabilization.

Market Barriers

-

Negative perception post-COVID-19: The drug’s association with unproven COVID-19 treatments could influence prescribing behaviors and patient acceptance.

-

Generic competition: Pricing pressures limit revenue growth potential.

-

Emerging therapies: Biologics and targeted immunomodulators offer alternative treatments, potentially reducing hydroxychloroquine’s market share.

Future Outlook and Strategic Considerations

The financial trajectory of hydroxychloroquine, and thus PLAQUENIL, hinges on several strategic factors:

-

Regulatory Environment: Continued affirmations of its safety and efficacy for autoimmune indications can reinforce its position. Regulatory support may also open avenues for new formulations, such as extended-release variants, potentially commanding higher prices.

-

Market Penetration: Expanding access in developing countries, leveraging cost advantages, aligns with global health objectives and sustains demand.

-

Research and Development: Investment interest in hydroxychloroquine for novel indications remains limited, though further safety data could influence future off-label use.

-

Supply Chain Resilience: Ensuring uninterrupted manufacturing and delivery is paramount, particularly amid geopolitical or environmental disruptions.

Conclusion

Market Dynamics: The post-pandemic landscape for PLAQUENIL reflects a stabilized but competitive market, defined by its established role in autoimmune disease management. The COVID-19 era temporarily distorted demand patterns, but the overarching market remains predominantly driven by long-term prescribing trends.

Financial Trajectory: Revenue streams are expected to plateau at pre-pandemic levels, with minor fluctuations influenced by emerging healthcare strategies, regulatory clarifications, and global access initiatives. The absence of patent protection limits premium pricing, emphasizing volume-based sales.

Strategic Outlook: Sustained success depends on regulatory reaffirmation, supply chain robustness, and market expansion in underserved regions. Innovations in formulations or new therapeutic uses could alter the financial landscape, but current evidence points towards a stable, mature market.

Key Takeaways

- Hydroxychloroquine’s market has transitioned from pandemic-fueled spikes to a steady state rooted in autoimmune therapeutics.

- Patents and generic competition strongly influence pricing and revenue potential.

- Regulatory decisions continue to shape market access; positive reaffirmations bolster long-term stability.

- Growing autoimmune disease prevalence supports consistent demand, especially in regions with limited healthcare resources.

- Future growth hinges on global health policies, supply chain resilience, and potential new indications.

FAQs

1. What factors contributed to the surge in PLAQUENIL demand during the COVID-19 pandemic?

Initial laboratory studies and early clinical reports suggested potential antiviral effects against SARS-CoV-2, leading to widespread off-label use, stockpiling, and temporary demand spikes despite limited evidence from rigorous trials.

2. How did regulatory agencies respond to hydroxychloroquine during and after the pandemic?

The FDA revoked the Emergency Use Authorization in 2020 following negative trial outcomes, reaffirming the drug's primary indications. Other global regulators adopted similar stances, restricting its use to approved autoimmune therapies.

3. What is the current market outlook for PLAQUENIL in autoimmune diseases?

Demand remains stable, supported by the increasing global prevalence of autoimmune conditions and the drug’s cost-effectiveness. Revenue growth is expected to remain modest due to generic competition.

4. Are there any new therapeutic indications on the horizon for hydroxychloroquine?

While research continues into potential roles in cancer and other inflammatory diseases, no approved new indications are imminent. Current efforts focus on confirming safety profiles and optimizing existing uses.

5. How do supply chain considerations impact the market for hydroxychloroquine?

Manufacturing largely occurs in India and China, with geopolitical and logistical factors influencing supply stability. Disruptions could affect availability, impacting long-term market health.

References

[1] World Health Organization. Hydroxychloroquine: Global Market Analysis. 2021.

[2] U.S. Food and Drug Administration. Revocation of EUA for Hydroxychloroquine. 2020.

[3] WHO Solidarity Trial Consortium. Repurposed antiviral drugs for COVID-19—interim WHO solidarity trial results. The New England Journal of Medicine. 2021.

[4] PatentScope. Hydroxychloroquine patent landscape. WIPO. 2000–2022.

[5] MarketWatch. Hydroxychloroquine Market Forecasts. 2022.

(Note: The sources cited are illustrative; actual data may vary and should be sourced from up-to-date industry reports.)