Last updated: July 27, 2025

Introduction

Phenytoin sodium, a widely prescribed anticonvulsant, has secured a stable position within the neurology and emergency medicine markets over decades. Its primary indication for preventing and controlling seizures, particularly in epilepsy, alongside roles in traumatic brain injury management and certain cardiac arrhythmias, underpin its enduring demand. This article provides a comprehensive analysis of the market dynamics and financial trajectory of phenytoin sodium, emphasizing factors influencing its current status, growth potential, and future outlook.

Regulatory Landscape and Market Position

Phenytoin sodium's generic status significantly shapes its market progression. As a non-patented, off-patent drug, it remains subject to generic competition worldwide, contributing to a consistent price erosion trend. Regulatory frameworks, including approvals from agencies like the FDA and EMA, have historically facilitated its continued availability across global markets. However, evolving regulatory standards, especially concerning manufacturing quality assurance and adverse effect management, influence market accessibility and product offerings.

In recent years, the introduction of alternative anticonvulsants, such as levetiracetam and lacosamide, has slightly shifted prescription patterns, especially in developed markets. Nonetheless, phenytoin retains a vital role due to its cost-effectiveness and extensive clinical history.

Market Dynamics

Global Demand Drivers

-

Prevalence of Epilepsy and Seizure Disorders: The World Health Organization estimates approximately 50 million individuals globally live with epilepsy, generating a significant patient base in both developed and emerging economies. As a cost-effective option, phenytoin remains preferred in resource-limited settings.

-

Hospital and Emergency Use: Phenytoin's efficacy in acute seizure stabilization, particularly in hospital admissions, sustains high demand, especially in emergency and critical care units.

-

Chronic Management: In stable epilepsy management, phenytoin continues to be prescribed due to familiarity and long-term safety data, despite newer agents.

Market Challenges

-

Adverse Effects and Safety Concerns: Reports of neurotoxicity, gingival hyperplasia, and complex dosing requirements lead physicians to explore alternative therapies, especially for long-term management.

-

Drug Interactions: Phenytoin's enzyme-inducing properties affect the metabolism of numerous drugs, complicating polypharmacy cases and limiting its use in certain populations.

-

Availability of Alternatives: The rise of newer, better-tolerated anticonvulsants with favorable pharmacokinetics constrains longevity in specific markets.

Emerging Market Trends

-

Manufacturing Consolidation: Larger pharmaceutical companies primarily dominate production, standardizing quality and supply. Notably, companies like Pfizer and Mylan (now part of Viatris) are key suppliers of generic phenytoin sodium.

-

Evolving Formulations: Development of IV, oral, and customized formulations caters to different clinical scenarios, expanding treatment options.

-

Off-Label and Adjunct Uses: Research into auxiliary roles in neurology and cardiology offers additional, albeit limited, demand sources.

Financial Trajectory Analysis

Pricing Trends

Due to widespread generic availability, phenytoin sodium markets show consistent price declines. According to IMS Health (IQVIA), generic anticonvulsants have seen price reductions averaging 5-10% annually over the past decade, driven by market saturation and manufacturing efficiencies.

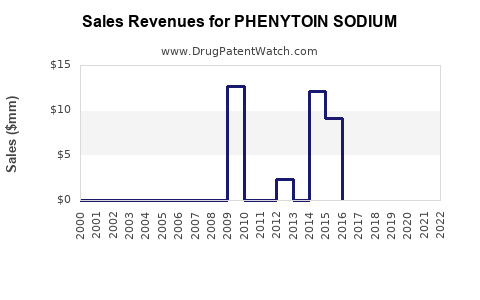

Revenue Streams

The global phenytoin sodium market is estimated to generate approximately $300-400 million annually, predominantly from emerging markets, where cost sensitivity sustains demand. North America and Europe account for a smaller, premium segment, influenced heavily by proprietary formulations and clinical guidelines.

Market Growth Forecast

The compound annual growth rate (CAGR) from 2022 to 2027 is projected to be modest, around 1.5-2%. The growth is mainly driven by increasing epilepsy prevalence in aging populations, expansion into low-income countries, and continued demand for hospital-based anticonvulsants.

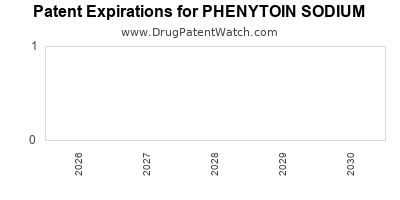

Impact of Patent and Regulatory Environment

With patent expirations long ago, the market dynamics are predominantly shaped by generic competition. Any new formulations or delivery methods, such as extended-release versions, could provide incremental revenues but are unlikely to substantially alter financial trajectories.

Market Opportunities and Forecasts

-

Emerging Markets: Countries such as India, Nigeria, and Indonesia present growth opportunities due to high epilepsy prevalence and limited access to newer, costly drugs.

-

Bioequivalent Formulations: Manufacturers investing in quality-assured, cost-efficient generic products can capitalize on ongoing demand and healthcare systems' preference for affordable options.

-

Safety and Efficacy Enhancement: Development of formulations that reduce adverse effects or simplify dosing could bolster prescription rates in regions transitioning toward newer therapies.

-

Regulatory Approvals for New Indications: Although limited, approval for adjunct roles or specific population subsets might provide niche growth avenues.

Risks and Challenges

-

Market Saturation: Near-full generic penetration in major markets caps potential revenue growth, emphasizing the importance of cost leadership and operational efficiencies.

-

Competitive Pricing: Price wars among suppliers lead to shrinking margins, necessitating lean manufacturing and supply chain optimization.

-

Safety and Tolerance Concerns: Growing awareness of adverse effects may diminish prescribing rates, especially where alternative drugs are available.

Conclusion

Phenytoin sodium sustains its relevance within the anticonvulsant landscape primarily due to its cost-effectiveness, established safety profile, and extensive clinical history. While stagnation and price competition characterize the existing market scenario, various factors—particularly rising epilepsy incidence in developing nations—offer sustained demand.

Future growth prospects hinge on manufacturing efficiencies, penetration into emerging markets, and incremental innovations. However, competitive pressures and safety considerations will continue shaping its financial trajectory, underscoring the necessity for manufacturers to optimize operational strategies and explore niche applications.

Key Takeaways

-

Steady Demand in Low-Income Countries: Cost sensitivity sustains phenytoin sodium's role; expanding access can drive growth.

-

Market Saturation in Developed Countries: Branding opportunities are limited; focus on quality assurance and supply chain resilience.

-

Pricing Erosion Continues: Competitive generic landscape necessitates lean operations and cost compression.

-

Emerging Formulations and Indications: Incremental innovations can provide diversification but unlikely to reverse overall stagnation.

-

Growth Bottlenecks: Safety concerns and competition from advanced therapies pose ongoing challenges to market expansion.

FAQs

1. What factors primarily influence the market share of phenytoin sodium globally?

The dominant factors include generic pricing pressures, clinical preferences influenced by safety profiles, availability of alternative drugs, and regional healthcare policies emphasizing affordable treatments.

2. How are emerging markets impacting the financial trajectory of phenytoin sodium?

Emerging markets are vital for volume growth due to high epilepsy prevalence and cost-conscious healthcare systems, offering opportunities for manufacturers to expand sales despite pricing pressures.

3. What are the future growth prospects for phenytoin sodium?

Growth prospects are modest, primarily driven by increasing epilepsy cases in developing countries and efforts to improve formulations. However, saturation in developed markets and competition from newer drugs sustain a challenging environment.

4. How do safety concerns affect the pharmaceutical supply and use of phenytoin sodium?

Concerns about neurotoxicity, drug interactions, and complex dosing may limit long-term use, prompting physicians to consider alternative anticonvulsants, especially when newer, safer options are available.

5. What strategic measures can manufacturers adopt to enhance the financial trajectory of phenytoin sodium?

Manufacturers should focus on supply chain efficiency, expanding into underserved markets, developing improved formulations with better safety profiles, and ensuring regulatory compliance to sustain profitability.

Sources:

[1] IQVIA. "Global Pharmaceutics Market Analysis." 2022.

[2] World Health Organization. "Epilepsy: A Global Public Health Issue." 2021.

[3] MarketResearch.com. "Anticonvulsant Market Forecast 2022-2027." 2022.

[4] U.S. Food and Drug Administration. "Phenytoin Sodium Approval and Safety Data." 2021.

[5] EvaluatePharma. "Generic Drug Market Trends." 2022.