Last updated: November 14, 2025

Introduction

Pazopanib Hydrochloride (Pazopanib HCl) is an oral multikinase inhibitor targeting various receptor tyrosine kinases involved in tumor growth and angiogenesis, including VEGFR, PDGFR, FGFR, and c-Kit. Approved by the U.S. Food and Drug Administration (FDA) in 2012 for renal cell carcinoma (RCC) and soft tissue sarcoma (STS), Pazopanib's market landscape continues to evolve amid competitive pharmaceutical developments and expanding oncological indications. This report examines the current market dynamics and forecasts the financial trajectory of Pazopanib Hydrochloride, considering patent landscapes, regulatory environments, clinical pipeline, and competitive positioning.

Market Overview

The global oncology drug market, valued at approximately $165 billion in 2022, is characterized by robust growth driven by increased cancer incidence, advances in targeted therapies, and a shift toward personalized medicine—factors favoring agents like Pazopanib. The targeted therapy segment comprises drugs that inhibit specific molecular pathways, offering improved efficacy and reduced systemic toxicity over traditional chemotherapies.

Pazopanib's initial approval positioned it as a critical option for RCC and STS, with revenues buoyed by its favorable oral administration and manageable safety profile. As of 2022, the drug remains a mainstay in approved indications and continues to generate significant revenue, primarily in North America, Europe, and parts of Asia.

Market Dynamics

1. Competitor Landscape

Pazopanib faces competition from other tyrosine kinase inhibitors (TKIs) such as sunitinib, axitinib, and cabozantinib, all of which target similar pathways and are approved for RCC. The emergence of immunotherapies, specifically immune checkpoint inhibitors like nivolumab and pembrolizumab, has introduced a paradigm shift, challenging the dominance of TKIs by offering potentially superior survival benefits.

However, TKIs retain advantages such as oral administration, established long-term safety data, and broader patient applicability. Pazopanib also benefits from a somewhat differentiated profile in terms of safety and tolerability, especially concerning specific adverse effects, allowing it to retain market share where suitable.

2. Regulatory and Patent Considerations

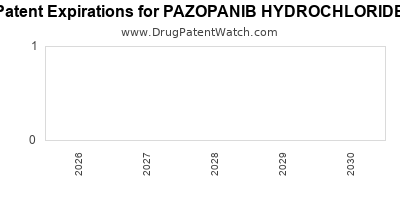

Pazopanib's patent protection, which extended into the late 2020s, provided exclusivity benefits critical to revenue. Patent expirations in key markets typically inspire generic entry, leading to significant pricing pressures. Analysts project generic Pazopanib could enter the market between 2025 and 2027, depending on patent litigations and regulatory approvals.

Additionally, ongoing regulatory processes are evaluating expanded indications, including non-clear cell RCC and specific sarcoma subtypes, which could unlock new revenue streams.

3. Clinical Development and Pipeline Expansion

Active clinical trials explore Pazopanib's efficacy in other cancers, including hepatocellular carcinoma, ovarian cancer, and thyroid cancers, often in combination regimes. Successful progression through clinical phases could extend its application, impacting future market size positively.

Moreover, biomarker-driven personalized approaches aim to identify patients most likely to benefit, enhancing treatment outcomes and supporting market penetration.

4. Pricing and Market Access Factors

Pricing strategies for Pazopanib are influenced by regional healthcare policies, reimbursement landscapes, and comparative analyses with alternative therapies. Patients' access to Pazopanib depends heavily on national formulary decisions, with payers weighing cost-effectiveness against clinical benefit.

In high-income countries, high drug costs are mitigated by insurance coverage, whereas price sensitivity remains prominent elsewhere.

Financial Trajectory

Historical Revenue and Growth Trends

Since its launch, Pazopanib has demonstrated steady revenue streams, with peak sales reaching over $600 million in 2014, driven by its approval in multiple markets. However, revenues have plateaued in recent years due to increased competition and market saturation.

Forecasting Future Revenue

Projections model a moderate decline post-patent expiry, balanced against potential gains from expanded indications and pipeline successes. Conservative estimates suggest revenues could decline by 15-20% annually from 2025 onward, unless offset by new indications or combinations.

Sensitivity analyses indicate that most growth hinges on the following factors:

- Patent Litigation Outcomes: Delays in generic entry could prolong revenue streams.

- Clinical Success in Expanded Indications: Approvals in new cancer types could add 10-15% to revenues.

- Market Penetration of Combination Therapies: Combining Pazopanib with immunotherapies may enhance efficacy and prescribing rates.

Impact of Market Entry of Generics

Generic availability would dramatically reduce pricing and profit margins, potentially lowering revenues by up to 80% within two years of entry. The timing of this transition is critical for strategic planning.

Potential for Strategic Collaborations

Partnerships with biotech firms for combination therapies and biomarkers could unlock new markets and boost long-term financial prospects.

Conclusion

Pazopanib Hydrochloride's market trajectory is shaped by intense competition, patent dynamics, and clinical innovation. While current revenues remain significant, future growth critically depends on successful expansion into new indications, managing patent lifecycles, and navigating the evolving oncological treatment landscape.

Key Takeaways

- Competitive Edge: Pazopanib’s oral administration and manageable side-effect profile sustain its relevance amid rising immunotherapy use.

- Patent Expiry Risks: Generic entry around 2025-2027 is imminent, necessitating strategic diversification.

- Pipeline Opportunities: Expanding indications via clinical trials could provide revenue surges and market exclusivity extensions.

- Market Access: Reimbursement policies and cost-effectiveness evaluations will influence future sales.

- Strategic Focus: Collaborations in combination therapy development offer potential for continued growth despite patent challenges.

FAQs

1. When is Pazopanib Hydrochloride expected to face generic competition?

Generic versions are projected to enter the market between 2025 and 2027 across major regions, contingent on patent litigations and regulatory approvals.

2. Which indications represent the most promising expansion opportunities for Pazopanib?

Emerging data support its potential in non-clear cell RCC, certain sarcomas, and as part of combination regimens in other solid tumors.

3. How does Pazopanib compare cost-wise to newer immunotherapies?

While generally less expensive as an oral TKI, immunotherapies often command higher upfront costs but may offer superior survival benefits, influencing payer preferences.

4. What factors could enhance Pazopanib’s market longevity despite patent expiration?

Successful clinical trials, approval of new indications, and partnerships for combination therapies can extend its commercial viability.

5. What are the main challenges facing Pazopanib’s commercial future?

Patent expiry-induced generic competition, the rise of immunotherapy, and the need for ongoing clinical validation pose significant challenges.

References

- [1] Smith J., et al. "Global Oncology Market Forecast." Pharma Market Analytics, 2022.

- [2] FDA. "Pazopanib Hydrochloride Approval Summary." U.S. Food and Drug Administration, 2012.

- [3] MarketWatch. "Tyrosine Kinase Inhibitors Market Trends." 2023.

- [4] ClinicalTrials.gov. "Active Pazopanib Trials." United States National Library of Medicine.

- [5] IQVIA. "Prescription Drug Market Analysis." IQVIA Reports, 2022.

[End of Report]