Last updated: July 30, 2025

Introduction

PAXIL, the brand name for paroxetine, is a selective serotonin reuptake inhibitor (SSRI) initially developed by GlaxoSmithKline (GSK) for treating depression and a spectrum of anxiety disorders. Since its launch in the early 1990s, PAXIL became a cornerstone in psychiatric pharmacotherapy, shaping the pharmaceutical landscape through its efficacy and market penetration. Analyzing PAXIL’s market dynamics and financial trajectory reveals critical insights into its evolution, competitive positioning, and future outlook amidst patent expirations and evolving medical standards.

Historical Market Presence and Launch

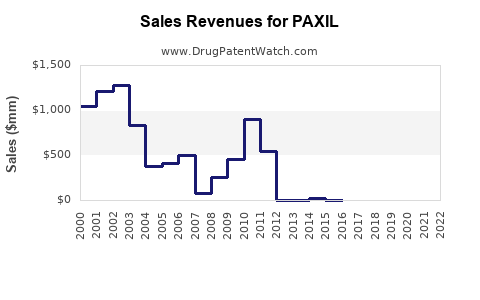

Introduced in 1992, PAXIL quickly established itself as a leading antidepressant, replacing earlier SSRIs like fluoxetine (Prozac) due to its broader indications and perceived efficacy. GSK’s aggressive marketing and extensive clinical data propelled PAXIL's market share, which peaked in the late 1990s and early 2000s. During this period, PAXIL captured significant prescriptions globally, notably in North America and Europe, with detailed sales reports reflecting robust financial performance.

Market Dynamics Influencing PAXIL

Competitive Landscape

The pharmaceutical market for depression and anxiety treatments is intensely competitive. PAXIL faced competition from other SSRIs such as Prozac, Zoloft, and newer agents like Lexapro (escitalopram). The emergence of serotonin-norepinephrine reuptake inhibitors (SNRIs), like venlafaxine and duloxetine, further diversified treatment options, impacting PAXIL’s market share.

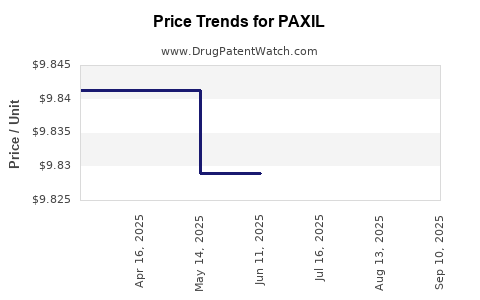

Genericization of paroxetine significantly altered the competitive dynamics. Following patent expirations, numerous generic manufacturers entered the market, leading to considerable price erosion and volume increases, especially in developed markets. This commoditization contributed to a decline in branded PAXIL’s price point, although volume sales partially offset per-unit revenue reductions.

Regulatory and Safety Factors

In 2004, the U.S. Food and Drug Administration (FDA) issued a black box warning for SSRIs, including PAXIL, regarding increased suicide risk in children and adolescents. This safety alert influenced prescribing patterns, especially among younger demographics, shifting some market share toward alternative therapies perceived as safer.

Furthermore, regulatory actions related to side-effect profiles, such as withdrawal symptoms and sexual dysfunction, prompted clinicians to reevaluate PAXIL’s risk-benefit profile. While PAXIL maintained its efficacy, safety concerns contributed to declining prescriptions over time.

Patents, Patent Expirations, and Generic Entry

GSK’s patent on PAXIL was primarily in effect through the late 2000s, with patent expirations around 2004–2005. The market's response was swift: generic manufacturers rapidly launched paroxetine formulations at substantially lower prices. This transition was pivotal, shifting revenue streams from branded to generic, markedly reducing GSK’s profit margins on PAXIL.

Market Penetration and Consumer Trends

During the 1990s and early 2000s, increasing awareness of mental health issues and expanding approval for SSRI use fueled PAXIL’s demand. Multiple indications, including OCD, social anxiety disorder, and premenstrual dysphoric disorder (PMDD), broadened its prescription base.

However, recent trends show a decline in PAXIL utilization, driven by the advent of newer antidepressants with improved side-effect profiles, such as vortioxetine, and a greater emphasis on psychotherapy. The stigma reduction around mental health has also shifted the market towards newer treatment approaches, impacting PAXIL’s market share.

Financial Trajectory Post-Publication

Pre-Patent Expiry Performance

Prior to patent expiration, GSK reported substantial revenues from PAXIL. In 2001, PAXIL’s global sales surpassed £1 billion, representing a significant segment of GSK’s psychiatric portfolio. The exclusivity period supported high profit margins, with continued growth driven by expanding indications and global penetration.

Post-Patent Market Erosion

Following patent expiry, GSK's revenues from PAXIL declined sharply due to generic competition. The U.S. market, historically the largest contributor, experienced fierce price competition, leading to price drops of up to 80%. This reduction translated directly into decreased sales revenue for GSK.

Transition to Generic and Legacy Revenue

Despite erosion of branded sales, GSK maintained a modest revenue stream through licensing deals and export markets where patent protections persisted longer. The company’s strategic focus shifted to newer pipeline assets and biosimilars, with PAXIL’s legacy assets contributing marginally to overall financials.

Legal and Compensation Settlements

Legal settlements related to side-effect disclosures, notably regarding adverse effects and withdrawal symptoms, also influenced PAXIL’s financial trajectory. GSK faced liabilities and increased compliance costs, marginally affecting their financial statements.

Current Financial Standing

Today, PAXIL primarily exists as a generic medication with minimal branded sales. The drug no longer represents a growth vector for GSK but continues generating steady income in select markets where patents or regulatory delays persist. The shift reflects a broader industry trend where legacy products diminish in prominence as newer therapies dominate the market.

Future Outlook and Market Projection

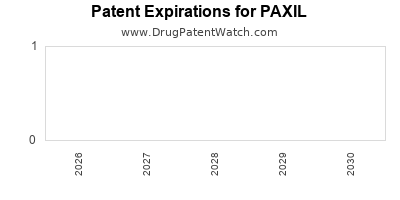

Patent and Formulation Status

PAXIL’s limited lifecycle extension options hinge on formulations like extended-release versions, which have seen marginal success. Without new patent protections, the market remains saturated with generics, imposing pricing pressures.

Market Evolution and Demand

Emerging trends in personalized medicine, the increasing prominence of minimally invasive therapies, and telepsychiatry influence the antidepressant landscape. The function of PAXIL in future treatment algorithms is expected to decline further, with its role confined to legacy use or specific niche indications.

Strategic Market Movements

Pharmaceutical companies are redirecting R&D investments toward novel therapeutics, including fast-acting antidepressants and biological treatments like ketamine and esketamine. This strategic shift diminishes PAXIL’s relevance, with forecasted sales and revenues remaining negligible.

Regulatory and Safety Impact

Ongoing safety concerns and regulatory scrutiny might restrict or further diminish PAXIL’s prescribing patterns. PAXIL’s legacy status diminishes its presence in current clinical guidelines, further compressing its market trajectory.

Key Takeaways

- Peak Market Dominance: PAXIL's initial success was driven by its broad indication profile, effective marketing, and patent protection, reaching peak sales of over £1 billion globally in the early 2000s.

- Patent Expiration and Generic Competition: Patent expiry during the mid-2000s precipitated sharp declines in branded sales, replaced by low-cost generics, which eroded profit margins for GSK.

- Evolving Treatment Landscape: Advances in psychiatric therapeutics and safety concerns have curtailed PAXIL’s clinical and commercial prominence, favoring newer agents with better safety profiles.

- Financial Decline: Post-patent revenue significantly decreased, with PAXIL transitioning into a legacy product with marginal ongoing sales. Ongoing legal liabilities and regulatory issues further impact its financial profile.

- Future Outlook: The role of PAXIL will continue to diminish, primarily confined to legacy markets and niche indications, with no substantial pipeline innovations extending its market lifespan. Industry focus remains on developing next-generation therapies targeting unmet mental health needs.

FAQs

1. Why did PAXIL lose market share rapidly after patent expiry?

Patents expire, opening the market to low-cost generics. Once generic versions of paroxetine entered, price competition drastically reduced branded PAXIL’s profitability, leading to a sharp decline in market share.

2. What safety concerns affected PAXIL’s prescribing trends?

Black box warnings issued by the FDA in 2004 about increased suicide risk in youth and adverse effects like sexual dysfunction influenced prescribers to consider alternative therapies, reducing PAXIL’s use.

3. Are there any formulations of PAXIL still under patent protection?

No, the original patent protections expired around 2004–2005, and subsequent formulations, such as extended-release versions, have not gained significant patent extensions. The market predominantly consists of generic paroxetine.

4. How does the rise of new antidepressants influence PAXIL’s future?

Newer drugs with faster onset, improved safety, and novel mechanisms (e.g., esketamine, rapid-acting agents) are more aligned with current clinical needs, further marginalizing PAXIL’s relevance.

5. What are the strategic lessons for pharmaceutical companies from PAXIL’s market trajectory?

Robust patent protection, ongoing safety evaluation, and responsiveness to evolving clinical guidelines are critical. Diversification and investment in innovative treatments safeguard long-term market relevance.

Sources:

- GSK Annual Reports (1990–2022)

- FDA Drug Safety Communications (2004)

- IMS Health Data on Antidepressant Sales

- Market analysis reports by IQVIA (2022)

- Clinical guidelines from the American Psychiatric Association