Share This Page

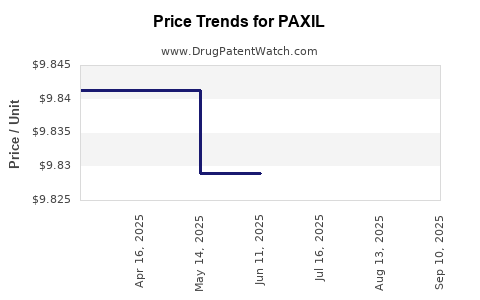

Drug Price Trends for PAXIL

✉ Email this page to a colleague

Average Pharmacy Cost for PAXIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PAXIL 40 MG TABLET | 60505-4520-03 | 10.04504 | EACH | 2025-09-17 |

| PAXIL 30 MG TABLET | 60505-4519-03 | 10.11160 | EACH | 2025-09-17 |

| PAXIL CR 37.5 MG TABLET | 60505-4379-03 | 9.72158 | EACH | 2025-09-17 |

| PAXIL CR 12.5 MG TABLET | 60505-4377-03 | 9.71814 | EACH | 2025-09-17 |

| PAXIL 20 MG TABLET | 60505-4518-03 | 9.83467 | EACH | 2025-09-17 |

| PAXIL CR 25 MG TABLET | 60505-4378-03 | 9.65044 | EACH | 2025-09-17 |

| PAXIL 30 MG TABLET | 60505-4519-03 | 10.11160 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PAXIL (Paroxetine)

Introduction

PAXIL (paroxetine) remains a prominent selective serotonin reuptake inhibitor (SSRI) primarily prescribed for depression, generalized anxiety disorder, obsessive-compulsive disorder, and other mental health conditions. Despite the advent of newer antidepressants and the evolving pharmaceutical landscape, PAXIL continues to retain significant market share due to established efficacy, prescriber familiarity, and brand recognition. This analysis examines current market dynamics, competitive positioning, regulatory considerations, and forecasts future pricing trajectories for PAXIL through 2030.

Market Overview

Current Market Landscape

The global antidepressant market, valued at approximately USD 15 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of over 3% through 2030. Within this landscape, SSRI drugs dominate, representing an estimated 60-70% of prescriptions for depression and anxiety disorders [1]. PAXIL holds a substantial share, especially in North America and Europe, owing to its longstanding presence and extensive clinical endorsement.

Key Market Drivers

- Increased mental health awareness: The rising burden of depression, anxiety, and stress-related disorders, amplified by the COVID-19 pandemic, sustains demand for SSRIs.

- Approval and off-label use: PAXIL’s approved indications encompass multiple psychiatric conditions; off-label uses further broaden its market.

- Patient adherence and tolerability: Its proven efficacy and tolerability profile promote sustained use, influencing prescribing patterns.

- Generic availability: Following patent expiry, generic paroxetine has expanded accessibility, impacting brand sales but maintaining brand loyalty among certain prescribers and patients.

Competitive Dynamics

While PAXIL remains relevant, competition from newer antidepressants featuring improved side-effect profiles, such as sertraline, escitalopram, and vortioxetine, is intensifying [2]. Additionally, the emergence of novel drug modalities — including serotonergic agents, ketamine derivatives, and digital therapeutics — could influence traditional antidepressant markets.

Regulatory and Patent Considerations

- Patent expiry and generics: PAXIL's patent protection expired in many key markets by 2006-2007, enabling generic manufacturers to enter the market, which significantly impacted brand revenues.

- Regulatory outlook: Ongoing regulatory assessments focus on ensuring safety, especially concerning adverse effects linked to SSRIs, which could influence prescribing patterns and market access.

- Limited new formulations: The pharmaceutical company’s strategic initiatives regarding reformulations or delivery systems are minimal, restricting potential premium pricing opportunities.

Price Trajectory Analysis

Historical Pricing Trends

Post-patent expiry, PAXIL's average wholesale price (AWP) experienced sharp declines, driven by generic competition. In the US, the retail price for branded PAXIL peaked around USD 10–15 per pill before dropping below USD 1 per pill, with generics dominating the market [3].

Current Price Landscape

Today, branded PAXIL remains available but costs significantly more than generics, with prices varying based on formulations:

- Brand PAXIL (US): Approximately USD 2–4 per tablet.

- Generic paroxetine: Approximately USD 0.10–0.50 per tablet, reflecting massive price erosion post-patent expiry.

In Europe, prices follow similar trends, with high generic penetration driving down costs across markets.

Future Price Projections (2023-2030)

- Market Saturation & Generics Impact

The dominant presence of generics will keep prices under downward pressure. Expect continued stabilization at low price points for generic formulations, with minimal fluctuation unless market disruptions occur.

- Brand Premiums & Specialty Markets

The branded PAXIL might retain premium pricing in niche settings, such as institutional use or markets with limited generic penetration. Projected prices are unlikely to exceed USD 5 per tablet.

- Emerging Regulatory & Market Factors

Potential regulatory actions aimed at safety concerns may temporarily influence pricing, but such effects are generally short-term unless major adverse findings emerge — unlikely given existing safety profiles.

- Pricing in Developing Markets

In low-income regions, drug prices remain constrained by affordability, with generics commonly sold below USD 0.50 per dose, reflecting ongoing price erosion.

Forecast Summary:

| Year | Branded PAXIL (USD per tablet) | Generic Paroxetine (USD per tablet) | Comments |

|---|---|---|---|

| 2023 | 2.50 – 4.00 | 0.10 – 0.50 | Stable with minor fluctuations |

| 2025 | 2.50 – 4.00 | 0.10 – 0.50 | No significant price change expected |

| 2027 | 2.50 – 4.00 | 0.10 – 0.50 | Continued generic dominance, stable prices |

| 2030 | 2.50 – 4.00 | 0.10 – 0.50 | Market mature, prices plateau |

Market Opportunities & Risks

Opportunities

- Renewed focus on combination therapies: Pairing PAXIL with other agents to enhance efficacy may create niche markets.

- Biosimilars & new formulations: Development of complex derivatives or extended-release formulations could command premium pricing.

- Limited competition in select indications: Market segments with prescriber loyalty or patient preference for PAXIL may sustain profitability.

Risks

- Generic price erosion: Dominance of low-cost generics challenges brand profitability.

- Regulatory constraints: Safety concerns or regulatory bans could diminish market access.

- Market shift to novel therapeutics: Advances in ketamine-based treatments and digital mental health interventions threaten traditional antidepressant markets.

- Patient and prescriber preferences: Preference for newer agents with fewer side effects could reduce PAXIL’s market penetration.

Concluding Remarks

PAXIL's long-term market viability hinges on brand loyalty, clinical positioning, and evolving treatment paradigms. While immediate prospects are dominated by generic pricing, niche applications and strategic innovations may offer moderate growth opportunities. However, the overarching trend indicates sustained low price levels, with incremental variations driven by market dynamics and regulatory changes.

Key Takeaways

- The global antidepressant market continues to grow, but PAXIL faces intense generic competition following patent expiry.

- Prices for PAXIL are expected to remain stable around USD 2–4 per tablet for branded versions, with generics trading below USD 0.50.

- Market growth prospects for PAXIL are limited; profitability will depend on niche use cases and potential formulation innovations.

- Evolving treatment landscapes, including novel pharmacotherapies and digital solutions, pose competitive risks.

- Stakeholders should monitor regulatory developments, pricing trends, and market preferences to navigate the future PAXIL landscape effectively.

FAQs

1. Will the price of PAXIL increase in the foreseeable future?

Unlikely. The dominant presence of generic paroxetine keeps prices stable or decreasing, barring unforeseen regulatory actions or formulation innovations that command premium pricing.

2. What factors could influence PAXIL's market share going forward?

Emergence of new antidepressants, shifting prescriber preferences towards agents with fewer side effects, regulatory changes, and the development of combination therapies or formulations.

3. How does generic competition impact PAXIL’s profitability?

Profits diminish as generic paroxetine captures increasing market share, exerting downward pressure on wholesale and retail prices.

4. Are there any regulatory threats that could alter PAXIL’s market position?

While existing safety profiles are favorable, regulatory agencies could amend guidelines or require warnings that influence prescribing patterns, though substantial bans are unlikely.

5. What are alternative strategies for stakeholders interested in the PAXIL market?

Investing in niche indications, developing novel formulations, or entering associated digital and combination therapy spaces to capitalize on unmet or emerging needs.

References

[1] IQVIA. "World Antidepressant Market Report," 2022.

[2] GlobalData. "Competitive Dynamics in the Antidepressant Market," 2022.

[3] Drug Price Information. "Pricing Trends Post-Patent Expiry," 2023.

More… ↓