Last updated: July 30, 2025

Introduction

PAXIL CR (paroxetine controlled-release) is a selective serotonin reuptake inhibitor (SSRI) developed by GlaxoSmithKline (GSK), primarily indicated for depression, anxiety disorders, and other mental health conditions. Since its market launch, PAXIL CR has played a significant role within the pharmaceutical landscape. This analysis explores the drug's evolving market dynamics, competitive positioning, regulatory influences, and financial trajectory, providing insights into its current and future market implications.

Market Dynamics of PAXIL CR

Market Segmentation and Indication Expansion

PAXIL CR's primary market encompasses adult patients diagnosed with major depressive disorder (MDD), generalized anxiety disorder (GAD), obsessive-compulsive disorder (OCD), post-traumatic stress disorder (PTSD), and social anxiety disorder. Over the years, the expanded indications have widened its user base, aligning with broader mental health awareness and reduced stigma.

The shift toward personalized medicine and recognition of mental health in clinical practice has driven demand, especially amid the COVID-19 pandemic, which heightened psychological distress globally[1]. The increasing prevalence of depressive and anxiety disorders, estimated at approximately 264 million globally for depression alone (WHO), supports sustained demand for SSRIs like PAXIL CR[2].

Competitive Landscape and Market Share

PAXIL CR faces stiff competition from other SSRIs and SNRIs, including Prozac (fluoxetine), Zoloft (sertraline), Lexapro (escitalopram), and Paxil’s own immediate-release formulation. Recent entrants, such as generic versions and newer agents like vortioxetine, also influence market share dynamics.

Genericization significantly impacts pricing and revenue streams; following patent expirations, biosimilars and generics have eroded original formulation sales. GSK faced patent cliff effects in the early 2010s, prompting a strategic focus shift toward other pipeline products and emerging markets[3].

Regulatory Environment and Patent Lifecycles

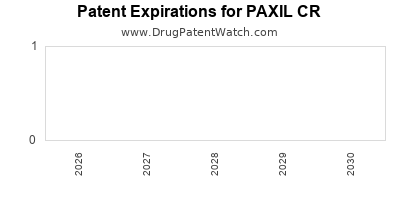

Patent protections for PAXIL CR, which typically extend 20 years from filing, have largely expired in key markets like the US and Europe, enabling the entry of generics. Regulatory authorities like the FDA and EMA continue to enforce strict formulations and manufacturing standards, impacting supply and market controls.

GSK's patent loss led to a marked decrease in exclusivity-driven pricing power post-2014, compelling the company to innovate or diversify to maintain profitability. Regulatory hurdles around biosimilar approval and patent litigations also influence market stability.

Pricing Strategies and Reimbursement Policies

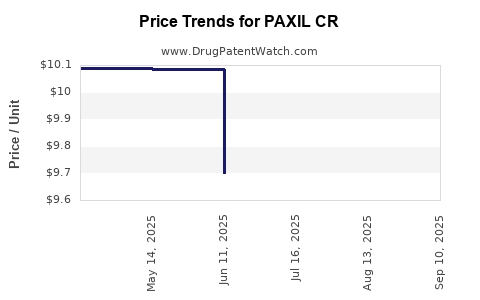

Pricing for PAXIL CR has historically been premium, justified by brand recognition and clinical efficacy. However, reimbursement policies increasingly incentivize generic substitution, pressuring brand pricing.

In major markets, insurance and governmental payers negotiate and set reimbursement limits that impact prescribing patterns, especially when generics are available at a fraction of the cost. This dynamic accelerates the shift toward lower-cost alternatives, notably as health systems globally prioritize cost containment[4].

Prescribing Trends and Physician Preferences

Physicians increasingly prefer prescribing newer SSRIs or SNRIs with better tolerability profiles or fewer drug interactions. The adverse effect profile of PAXIL CR, including sexual dysfunction and withdrawal symptoms, influences its prescribing trends. Newer agents with improved safety profiles often supplant PAXIL CR in treatment algorithms.

Pharmacovigilance data and post-marketing surveillance also shape clinician decisions. The awareness of drug-drug interactions and side effects has compelled GSK to update prescribing information and patient counseling guidelines.

Financial Trajectory of PAXIL CR

Revenue Patterns and Declines

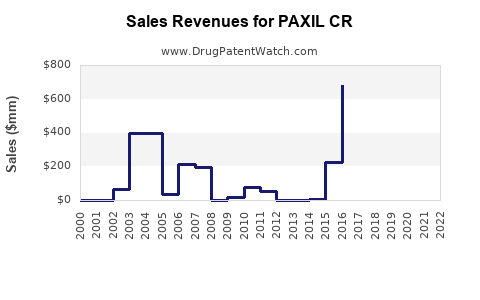

Initially a blockbuster, PAXIL CR contributed substantially to GSK's revenue during its peak. However, patent expirations and market saturation caused a steep decline in sales from 2014 onward[5]. For instance, US sales plummeted as generic versions flooded the market, reducing the brand's revenue by more than 50% within a few years.

Despite this decline, PAXIL CR continues to generate revenue in emerging markets where generics are less dominant, and brand loyalty persists. Global sales are estimated to have stabilized at a lower plateau, with incremental growth driven by niche indications or formulations.

Impact of Patent Litigation and Generics

Patent litigation, a common countermeasure by innovator companies, aimed to extend exclusivity periods or delay generic entry. GSK engaged in legal strategies and settlement agreements to prolong market presence, though these have only limited effect post-patent expiry.

The rapid adoption of generics significantly reduced the drug’s profit margins. GSK attempted to mitigate some revenue losses through cost-cutting, marketing of new formulations, and diversification into other therapeutic areas.

R&D Investment and Pipeline Considerations

GSK has invested heavily in developing next-generation antidepressants and digital health solutions. The shift signifies a strategic pivot away from reliance on older compounds like PAXIL CR towards innovative therapies with patent protection and differentiated efficacy.

The company's pipeline includes novel agents targeting neuroinflammation and circadian rhythm regulation, potentially altering future market dynamics and financial forecasts[6].

Future Financial Outlook

The outlook for PAXIL CR suggests a continued decline in mature markets but potential stabilization in specific regions or through new formulation variants. As healthcare systems globally grapple with mental health crises, the demand for effective, affordable medications remains relevant.

However, the growing preference for newer agents with better safety profiles and the prevalence of generics will likely keep PAXIL CR’s revenue contribution modest in the medium term. Strategic licensing, partnerships, and formulation innovations may serve as revenue stabilizers.

Market Implications and Strategic Opportunities

Pharmaceutical companies can capitalize on evolving market dynamics through several avenues:

-

Formulation Innovation: Developing extended-release, combination, or delivery system enhancements to differentiate formulations.

-

Targeting Emerging Markets: Expanding access and improving branding in regions with less generic penetration and rising mental health awareness.

-

Pipeline Differentiation: Investing in novel therapies with superior safety or efficacy profiles to position future products for premium pricing.

-

Digital Health Integration: Incorporating digital therapeutics and remote monitoring to complement pharmacotherapy, particularly relevant during pandemic-era healthcare adjustments.

Key Takeaways

-

Declining Revenue Post-Patent Expiry: PAXIL CR experienced significant revenue decline following patent expiration and subsequent generic competition, typical within the SSRIs segment.

-

Market Segmentation Drives Sustained Demand: Despite market pressures, demand persists in emerging regions and niches where brand loyalty and lack of generics remain influential.

-

Competitive and Regulatory Factors: Continued patent litigation, regulatory standards, and pharmacovigilance shape market access and profitability.

-

Innovation as a Growth Catalyst: Future profitability hinges on the development of novel compounds and formulation strategies that address safety, tolerability, and patient adherence.

-

Strategic Diversification: GSK and similar firms must diversify beyond fixed-generation products to sustain financial health and competitive advantage.

Conclusion

PAXIL CR’s market trajectory illustrates the typical lifecycle of branded psychiatric medications facing patent expiration and intense generic competition. While it remains relevant in specific contexts, its future financial contribution depends on innovation, strategic market expansion, and evolving prescribing preferences. Stakeholders investing in or competing within the mental health therapeutics landscape must continuously adapt to these dynamic market forces for sustained growth.

FAQs

-

What factors contributed to the decline of PAXIL CR's market share?

The expiration of patents, arrival of generic competitors, shifting physician preferences toward newer SSRIs with better tolerability, and reimbursement policies favoring cost-effective generics primarily drove its declining market share.

-

Are there ongoing efforts to improve or reformulate PAXIL CR?

GSK and other manufacturers explore formulation improvements like extended-release systems or combination therapies; however, no recent reformulation has significantly altered PAXIL CR’s market position.

-

How do regional differences impact PAXIL CR’s market performance?

In emerging markets, brand loyalty and limited access to generics sustain PAXIL CR’s revenues. Conversely, in mature markets like the US, rapid generic penetration has substantially reduced its market share.

-

What is the outlook for PAXIL CR amid the rise of digital mental health solutions?

Digital therapeutics complement pharmacotherapy but are unlikely to replace medications like PAXIL CR entirely. Integration with digital health platforms may enhance adherence and patient outcomes, potentially stabilizing demand.

-

How does the competition from newer antidepressants impact GSK’s strategic focus?

GSK’s investment in pipeline development and emerging therapeutic classes aims to offset declining revenues from older drugs like PAXIL CR, emphasizing innovation to maintain market relevance.

References

[1] World Health Organization. (2022). Depression factsheet.

[2] WHO. (2022). Mental health: Strengthening our response.

[3] GSK Annual Reports. (2014–2022).

[4] IQVIA. (2022). Global prescription drug market analysis.

[5] EvaluatePharma. (2022). Industry Analysis.

[6] GSK Pipeline Portfolio. (2023).