Last updated: July 27, 2025

Introduction

Paroxetine mesylate, a selective serotonin reuptake inhibitor (SSRI), gained prominence in treating various mental health disorders, including depression, anxiety, obsessive-compulsive disorder (OCD), and post-traumatic stress disorder (PTSD). Since its FDA approval in 1992, paroxetine mesylate has become a mainstay in psychopharmacology, with significant implications for pharmaceutical market dynamics and investment strategies. This report analyzes the evolving market landscape, regulatory trends, patent lifecycle, competitive forces, and financial prospects associated with paroxetine mesylate.

Market Landscape and Therapeutic Demand

Global Prevalence of Indications

The demand for SSRIs like paroxetine mesylate is driven by the rising prevalence of depression and anxiety disorders worldwide. According to the World Health Organization (WHO), over 264 million people suffer from depression globally [1], fueling sustained demand for effective antidepressants. In developed markets such as North America and Europe, mental health awareness has increased, leading to higher prescription rates for SSRIs.

Market Penetration and Prescription Trends

Paroxetine has retained a significant market share within the SSRI segment, although growth has been tempered by market saturation and the emergence of newer agents. Prescription data indicates a steady decline in paroxetine prescriptions in some regions due to the rise of newer antidepressants with improved side-effect profiles, such as vortioxetine and vilazodone [2]. Nonetheless, paroxetine's long-term safety profile ensures its continued utilization, particularly in specific patient subsets.

Regional Market Variations

The North American market remains the largest for paroxetine mesylate, supported by high healthcare expenditure and mental health awareness. Europe exhibits similar trends, with generic availability reducing brand inflation. In emerging markets, increasing mental health diagnoses and improving healthcare infrastructure suggest potential growth, albeit constrained by regulatory hurdles and pricing pressures.

Regulatory and Patent Dynamics

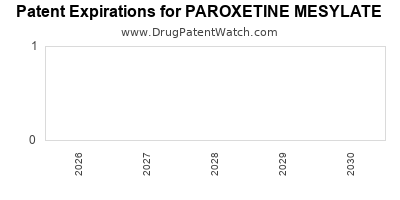

Patent Life and Generic Competition

Paroxetine mesylate's initial patent expiration occurred in the early 2000s, leading to widespread generic manufacturing. Patent expirations substantially reduce drug prices and narrow profit margins, compelling pharmaceutical companies to innovate or diversify their portfolios [3].

Regulatory Environment

Regulatory agencies, including the FDA and EMA, continue to scrutinize SSRIs for safety concerns, particularly neuropsychiatric side effects and withdrawal phenomena. These regulatory considerations influence labeling, prescribing practices, and risk management plans, indirectly impacting product demand and market stability.

Reformulation and Labeling Changes

Recent regulatory actions have prompted updates to paroxetine’s labeling, including warnings about increased risk of suicidal ideation in young adults and discontinuation syndrome. Such modifications can affect physician prescribing behaviors, with potential financial implications for manufacturers.

Competitive Landscape

Market Competition

While paroxetine mesylate faces competition from newer antidepressants with favorable side-effect profiles, it remains a cost-effective choice, especially as a generic. Key competitors include other SSRIs such as sertraline, fluoxetine, and escitalopram, each with distinct clinical profiles and market strengths.

Emerging Therapeutic Alternatives

The advent of novel therapeutic classes, including serotonin-norepinephrine reuptake inhibitors (SNRIs) and atypical antipsychotics, diversifies treatment options and influences market share. Additionally, the rise of personalized medicine aims to optimize treatment efficacy, possibly reducing reliance on broad-spectrum SSRIs like paroxetine.

Off-Label and Specialized Uses

Off-label indications for paroxetine include vasomotor symptoms associated with menopause and certain smoking cessation protocols, expanding its application beyond primary indications and influencing sales trajectories.

Financial Trajectory and Market Opportunities

Revenue Trends

Following patent expiry, paroxetine mesylate's revenue faced significant decline; however, strategic focus on generics has stabilized essential revenue streams, especially in markets with limited access to newer agents. Companies with manufacturing rights for authorized generics benefit from lower R&D costs and robust margins.

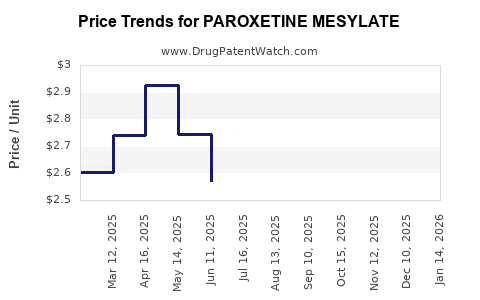

Pricing and Market Penetration Strategies

Post-patent expiration, pricing pressures intensify due to generic competition. Manufacturers often adopt market penetration strategies, including volume-based sales and partnerships with pharmacy chains, to sustain revenues.

Pipeline and Diversification

Pharmaceutical firms venture into combination therapies or develop derivative formulations (e.g., extended-release versions) to differentiate product offerings and extend lifecycle. Investment in biosimilars and new indications could redefine paroxetine’s financial relevance.

Impact of Biosimilars and Cost-Containment

Although biosimilars are less relevant for small-molecule drugs like paroxetine, health systems increasingly emphasize cost-efficiency, favoring generics over branded formulations. Price erosion risks and reimbursement policies influence the drug’s financial outlook.

Market Challenges and Opportunities

Safety Profile and Post-Market Surveillance

Safety concerns regarding SSRIs, including withdrawal and suicidality risks, necessitate ongoing pharmacovigilance. Negative safety perceptions could hamper demand, despite the drug’s proven efficacy.

Digital Therapeutics and Alternative Treatments

Emerging digital therapeutics and psychotherapeutic interventions offer adjunct or alternative options, potentially reducing reliance on pharmacotherapy and impacting future sales.

Regulatory Incentives and Market Expansion

Incentives for mental health treatment and expanded regulatory approvals for new indications can open markets. For example, approvals for pediatric use or for specific comorbid conditions could sustain demand.

Conclusion: Strategic Outlook for Paroxetine Mesylate

The financial trajectory of paroxetine mesylate is characterized by an initial revenue decline post-patent expiration, stabilized by generic competition and cost-driven prescribing. While the global mental health burden ensures ongoing demand, the drug faces competitive pressures from newer agents and evolving regulatory landscapes. Firms that innovate through formulation advancements, expand indications, or leverage cost-effective manufacturing are positioned to optimize revenue streams. The overall outlook remains cautiously optimistic, contingent upon regulatory developments, safety considerations, and emerging therapeutic paradigms.

Key Takeaways

- Market saturation and generic competition have significantly reduced paroxetine mesylate’s revenue, emphasizing the importance of lifecycle management strategies.

- Regional disparities influence demand, with mature markets favoring cost-effective generics and emerging markets showing growth potential.

- Regulatory challenges, including safety warnings and labeling updates, affect prescribing patterns and market stability.

- Diversification efforts, such as new formulations or expanded indications, provide avenues to extend the financial relevance of paroxetine mesylate.

- Technological advances and alternative treatments could reshape the mental health treatment landscape, impacting the long-term market dynamics for paroxetine mesylate.

FAQs

-

What factors primarily influence the market share of paroxetine mesylate?

The emergence of newer antidepressants, patent expirations, safety profile perceptions, regional prescribing habits, and pricing strategies significantly impact its market share.

-

How does patent expiration affect the financial outlook of paroxetine mesylate?

Patent expiration allows for generic manufacturing, leading to price erosion and reduced profits for brand-name producers but offers opportunities in volume-based sales for generic manufacturers.

-

What are the main safety concerns associated with paroxetine mesylate?

Risks include withdrawal symptoms, increased suicidal ideation in young adults, and potential drug interactions, necessitating careful monitoring and regulatory updates.

-

Can new formulations or indications help sustain the drug’s market presence?

Yes, reformulations like extended-release versions and expanded indications can bolster sales and prolong market relevance.

-

What emerging treatments threaten the long-term dominance of paroxetine mesylate?

Novel antidepressants with improved tolerability, digital therapeutics, and psychotherapeutic innovations may reduce dependence on traditional SSRIs like paroxetine.

References

[1] World Health Organization. (2021). “Depression.” WHO.

[2] IQVIA. (2022). “Prescription Trends for SSRIs in North America and Europe.”

[3] U.S. Food & Drug Administration. (2020). “Drug Patent and Exclusivity Data.”