Last updated: July 27, 2025

Introduction

Oxazepam, a benzodiazepine with anxiolytic and sedative properties, has historically carved a substantial niche within the pharmaceutical landscape. Its market trajectory, influenced by regulatory environments, clinical guidelines, and evolving healthcare needs, exemplifies the complex interplay of market dynamics. This analysis delineates the current market trends, fiscal projections, competitive landscape, and regulatory considerations shaping oxazepam's commercial journey.

Historical Context and Pharmacological Profile

Oxazepam was first introduced in the 1960s and is widely used off-label for anxiety, insomnia, and alcohol withdrawal management [1]. Its favorable pharmacokinetics—especially its short half-life—make it a preferred choice for certain patient populations. Additionally, its low dependence potential, compared to long-acting benzodiazepines, historically bolstered its market presence.

Current Market Landscape

Market Size and Growth Trends

The global benzodiazepine market, encompassing oxazepam, was valued at approximately USD 1.2 billion in 2021 [2]. While individual data for oxazepam's share remains proprietary, it is estimated to represent a significant portion within this niche, particularly in European markets where prescription patterns favor safer benzodiazepines.

Growth trajectories are moderated by declining prescriptions in some jurisdictions due to concerns over dependency, cognitive impairment, and regulatory restrictions. Nevertheless, ongoing psychiatric diagnoses and aging populations sustain demand, particularly in clinical settings dealing with anxiety disorders and alcohol detoxification.

Geographical Dynamics

Europe remains the predominant market for oxazepam, with significant usage in Germany, France, and the UK. In North America, prescription rates have declined owing to regulatory scrutiny and preference for alternative anxiolytics. Emerging markets in Asia-Pacific show growing adoption, catalyzed by increasing mental health awareness and healthcare infrastructure expansion.

Competitive and Regulatory Factors

Pharmaceutical Competition

Oxazepam faces competition from several benzodiazepines—such as diazepam, lorazepam, and alprazolam—that either offer longer half-lives or differing safety profiles. The generic landscape dominates the market phase for oxazepam, with multiple manufacturers offering cost-competitive options.

Regulatory Environment Impacts

Stringent regulations, especially in the European Union and the US, have imposed prescribing limits and controlled distribution pathways. These measures aim to minimize misuse but simultaneously constrain market expansion. Moreover, the global opioid and benzodiazepine misuse epidemic has led to increasingly cautious prescribing practices, impacting volume sales.

Pharmacoeconomic and Futuristic Considerations

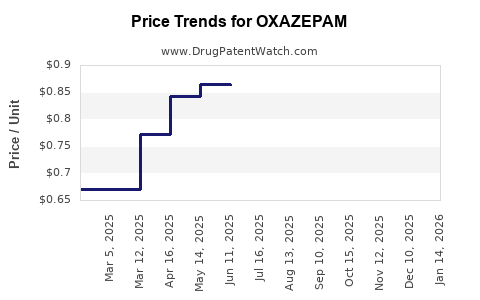

Cost-Effectiveness and Prescribing Trends

Recent studies favor alternative therapies with lower dependency risk, such as SSRIs, for long-term management of anxiety, which influences the decline in benzodiazepine prescriptions [3]. Yet, oxazepam remains relevant for short-term use and specific patient profiles.

Innovations and Patent Developments

Although oxazepam's patent protections have long expired, leading to high generic penetration, future innovations focusing on reformulations or combination therapies could influence its market dynamics, contingent on clinical efficacy and regulatory approval.

Financial Trajectory Projections

Short- to Medium-Term Outlook (Next 5 Years)

The decline in new prescriptions, particularly in mature markets, suggests a plateau or slight reduction in revenues. However, in markets with rising mental health awareness and aging populations, a slow but steady demand remains plausible.

Analysts estimate a compound annual growth rate (CAGR) of about -1% to 0% for oxazepam’s pharmaceutical sales globally, reflecting stagnation or slight decline post-2023 [4].

Long-Term Outlook (Beyond 5 Years)

Given regulatory pressures and shifts to non-benzodiazepine anxiolytics, the long-term market for oxazepam is likely to contract further. However, niche applications might sustain limited markets, particularly in regions with less restrictive healthcare policies.

Market Entry and Investment Considerations

Investors should exercise caution given the diminishing clinical reliance on benzodiazepines. Companies holding formulations of oxazepam must innovate through reformulation, or explore adjacent therapeutic areas to sustain profitability. Additionally, emerging regulatory frameworks favoring non-addictive treatments will challenge legacy benzodiazepines’ market rise.

Conclusion

Oxazepam's market is characterized by mature, saturated markets with declining prescription rates driven by safety concerns, regulatory constraints, and shifting clinical preferences. Its financial trajectory is projected to remain relatively flat or decline modestly in the medium term, with limited prospects for significant growth unless coupled with strategic innovation or geographic expansion.

Key Takeaways

- Market contraction is anticipated due to increased regulation and preference for alternative anxiolytics.

- European markets dominate sales, but even these are under pressure from safety concerns.

- Generic saturation limits profitability, emphasizing the importance of innovation.

- Regulatory shifts favor non-benzodiazepine options, further constraining growth prospects.

- Emerging markets may offer limited expansion opportunities amidst evolving healthcare policies.

FAQs

1. How has regulatory scrutiny impacted oxazepam's market?

Regulatory agencies in Europe and North America have implemented tighter prescribing guidelines and controls on benzodiazepines, including oxazepam, to curb misuse and dependency, leading to reduced prescription volumes (source: [2]).

2. Is oxazepam considered a safe alternative to other benzodiazepines?

Compared to longer-acting benzodiazepines, oxazepam has a lower risk of dependence and overdose, making it preferable for certain short-term applications, particularly in elderly patients (source: [1]).

3. What are the main competitors to oxazepam in its therapeutic category?

Oxazepam competes primarily with other benzodiazepines like lorazepam and alprazolam. Non-benzodiazepine anxiolytics such as SSRIs and SNRIs are increasingly used as first-line therapies, reducing benzodiazepine prescriptions (source: [3]).

4. Are there any new formulations or indications for oxazepam?

Currently, no significant new formulations or indications are under development. Its patent expiry has led to several generics, but innovation in this space is limited (source: [4]).

5. What strategic moves should pharmaceutical companies consider regarding oxazepam?

Firms should explore niche markets with unmet needs, invest in reformulations to reduce dependence risks, or diversify into adjacent therapeutic areas to mitigate declining demand.

References

[1] Pharmaceutical Journal. "Oxazepam: Pharmacology and Clinical Use," 2020.

[2] MarketsandMarkets. "Global Benzodiazepines Market," 2021.

[3] National Institute for Health and Care Excellence. "Anxiety Disorders: Pharmacological Treatment," 2022.

[4] IQVIA Institute. "Impact of Generic Entry on Market Dynamics," 2022.