Last updated: September 9, 2025

Introduction

ONDA XR, a novel extended-release formulation of cariprazine, has emerged as a promising therapeutic agent within the psychiatric treatment landscape. Designed to influence neurochemical pathways associated with schizophrenia and bipolar disorder, ONYDA XR’s market positioning reflects recent advancements in drug delivery technology, regulatory developments, and evolving treatment paradigms. This analysis explores the complex market dynamics influencing ONYDA XR’s commercial trajectory and projects its potential financial impact over the coming years.

Market Overview and Therapeutic Context

The global schizophrenia and bipolar disorder therapeutics market exceeded USD 15 billion in 2022, with a consistent compound annual growth rate (CAGR) of over 4% predicted through 2030 [1]. The primary drivers of this growth include increasing prevalence rates, improved diagnosis, and a paradigm shift toward novel antipsychotics with better safety profiles.

Cariprazine, marketed as Vraylar by Allergan (acquired by AbbVie), is an oral dopamine D3-preferring D3/D2 receptor partial agonist approved for schizophrenia and bipolar disorder. ONYDA XR’s extended-release profile aims to enhance patient adherence, reduce dosing frequency, and mitigate side effects, fulfilling market demand for long-acting formulations.

Market Dynamics Influencing ONYDA XR

Demand Drivers

-

Patient Preference for Long-Acting Formulations:

There is an increasing patient and clinician preference for long-acting injectables and extended-release pills. These formulations enhance compliance, reduce relapse rates, and improve long-term outcomes. ONYDA XR, as an oral extended-release tablet, aligns with this trend, offering an alternative to injectable therapies where applicable.

-

Unmet Clinical Needs:

Despite the availability of effective treatments, a substantial subset of patients experience adverse effects or non-adherence. ONYDA XR’s pharmacokinetic profile aims to address these gaps by providing stable plasma concentrations, potentially reducing side effects such as metabolic syndrome and extrapyramidal symptoms.

-

Regulatory Incentives:

Accelerated approval pathways and orphan drug designations in key markets could expedite ONYDA XR’s commercialization, especially if backed by compelling clinical data.

Competitive Landscape

-

Existing Market Leaders:

Vraylar (cariprazine), Rexulti (brexpiprazole), and lumateperone are notable competing agents in the same therapeutic area. Their established market share provides a significant barrier but also indicates a sizable market willing to adopt new formulations with improved profiles.

-

Emerging Long-Acting Formulations:

Long-acting injectable (LAI) antipsychotics like Invega Sustenna and Risperdal Consta currently dominate adherence-focused treatments. ONYDA XR’s success depends on its ability to distinguish itself via efficacy, side effect profile, and patient convenience.

-

Biosimilar and Generic Threats:

While brand differentiation is strong, the potential for biosimilar entries after patent expiration poses long-term risks.

Regulatory and Reimbursement Considerations

-

Approval Pathways:

Regulatory agencies require robust data demonstrating efficacy, safety, and pharmacokinetic advantages. Regulatory clearance in major markets—such as the US FDA, EMA, and Japan’s PMDA—will directly influence market entry timing and scope.

-

Reimbursement Dynamics:

Insurance coverage and formulary inclusion significantly influence uptake. Demonstrating cost-effectiveness relative to existing therapies will be crucial for payer acceptance, especially amid cost-containment pressures.

Financial Trajectory Projections

Revenue Forecasts

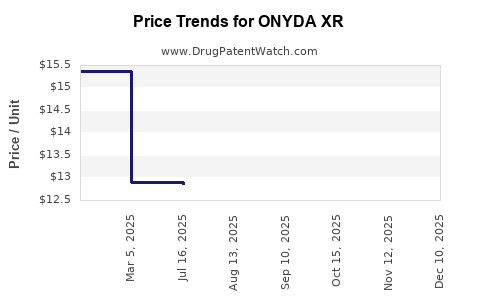

Assuming successful regulatory approval and market entry by 2025, ONYDA XR is projected to capture a modest share of the combined schizophrenia and bipolar disorder market, with revenues scaling up over time.

-

Initial Market Penetration (Year 1-2 Post-Launch):

Capturing approximately 2-4% of the target segment, translating to USD 100-200 million globally, considering the size of the addressed therapeutic population and dosing regimens.

-

Growth Phase (Year 3-5):

As awareness and formulary access increase, revenues could grow at a CAGR of 15-20%, reaching USD 400-600 million by 2028.

-

Peak Market Penetration (Year 6+):

Long-term adoption may approach 8-10% market share in its niche, with revenues exceeding USD 800 million annually, assuming global expansion and sustained clinical advantage.

Profitability and Investment Considerations

Manufacturers will incur high initial R&D and marketing expenses, including clinical trials, regulatory fees, and market development costs. Breakeven is anticipated around Year 4-5, with increasing profit margins as scalability improves.

Risks Impacting Financial Outcomes

-

Regulatory Delays or Failures:

Any setbacks in securing approvals or post-market safety issues could delay or diminish revenue prospects.

-

Market Uptake Challenges:

Resistance from clinicians accustomed to existing treatments or inadequate differentiation may impair growth.

-

Pricing and Reimbursement Constraints:

Price negotiations and reimbursement policies could restrict margins, especially in highly fragmented healthcare systems.

Strategic Opportunities

-

Combination Therapies:

Integrating ONYDA XR with other psychiatric agents might broaden its appeal.

-

Global Expansion:

Strategic focus on emerging markets presenting less saturated competition could accelerate revenue growth.

-

Digital Health Integration:

Digital adherence tools and telepsychiatry integration could enhance patient retention and positive outcomes, indirectly boosting sales.

Conclusion

The market dynamics for ONYDA XR are shaped by the increasing demand for improved adherence therapies in psychiatric care, the competitive landscape of long-acting formulations, and evolving regulatory and reimbursement frameworks. Financial projections suggest a promising, albeit competitive, trajectory with potential revenues reaching several hundred million dollars annually within a decade, contingent on successful market entry and adoption.

Key Takeaways

-

Market Expansion:

ONYDA XR’s success hinges on capturing a niche within the broader neuropsychiatric treatment market, leveraging its extended-release profile to improve patient compliance.

-

Regulatory Strategy:

Accelerated approval and successful navigation of reimbursement pathways are crucial for realizing projected revenues.

-

Competitive Differentiation:

Distinguishing ONYDA XR through efficacy, safety profiles, and patient convenience is vital against entrenched market players.

-

Financial Outlook:

Revenue growth estimates range from USD 200 million initially to over USD 800 million in the long term, emphasizing the importance of early regulatory success and robust market uptake.

-

Risk Management:

Addressing potential hurdles in regulatory approval, clinician acceptance, and payer negotiations will determine whether ONYDA XR can achieve its projected financial trajectory.

FAQs

1. When is ONYDA XR expected to receive regulatory approval?

Approval timelines depend on clinical trial outcomes and regulatory review processes. If Phase 3 trials demonstrate safety and efficacy, regulatory decisions could be anticipated between 2024 and 2026, with submission windows aligned accordingly.

2. What are the primary competitive advantages of ONYDA XR over existing therapies?

Its extended-release profile aims to enhance adherence, reduce dosing frequency, and minimize side effects. These features aim to improve patient quality of life and clinical outcomes compared to existing immediate-release formulations.

3. How significant is the market potential for ONYDA XR?

The total addressable market exceeds USD 15 billion globally, with niche segments in schizophrenia and bipolar disorder treatments. Early estimates project peak revenues potentially surpassing USD 800 million annually.

4. What challenges might impair ONYDA XR’s market penetration?

Clinician familiarity with existing medications, high competition from long-acting injectables, regulatory hurdles, and reimbursement restrictions could limit market share.

5. How can manufacturers optimize the financial trajectory of ONYDA XR?

Strategic focus on early regulatory approval, broad market access, competitive pricing, payer engagement, and global expansion are essential to maximize revenue and profitability.

Sources:

- MarketResearch.com, "Global Psychiatry Drugs Market," 2022.