Last updated: July 27, 2025

Introduction

NUVESSA (estradiol vaginal cream, 0.0037%) is a proprietary hormonal therapy primarily approved for the treatment of menopausal vulvar and vaginal atrophy. Market entry, competitive landscape, and evolving demand influence its financial trajectory within the broader women's health segment. This analysis examines recent market trends, regulatory factors, payer dynamics, and strategic opportunities shaping NUVESSA’s financial outlook.

Market Overview and Demand Drivers

The global menopause management market is poised for steady growth, driven by increasing aging populations and heightened awareness of women’s health issues. The global menopause therapeutics market size was valued at approximately USD 4.5 billion in 2022 and is projected to expand at a compounded annual growth rate (CAGR) of around 6% through 2030 [1].

Vaginal estrogen therapies like NUVESSA are vital components of this growth, addressing symptoms such as dryness, discomfort, and atrophy. The demand for locally applied estrogen therapies surpasses systemic treatments due to lower systemic exposure and favorable safety profiles, especially in postmenopausal women with cardiovascular risk factors [2].

Key demand drivers include:

-

Aging Demographics: The world's female population aged 50 and above is expanding rapidly. The United Nations estimates that by 2050, over 1.5 billion women will be postmenopausal, fueling increased demand for effective symptom management [3].

-

Patient Preference for Localized Therapy: Vaginal creams like NUVESSA are preferred for their targeted action, fewer systemic side effects, and ease of use, thus expanding their market penetration.

-

Growing Awareness and Diagnosis: Education campaigns and clinician awareness have led to higher diagnosis rates of vaginal atrophy, further driving prescriptions.

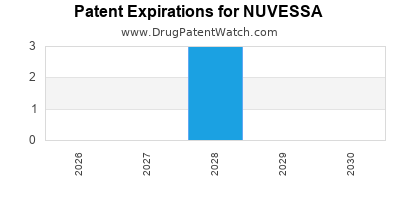

Regulatory Landscape and Commercial Status

Approval Timeline and Market Entry:

NUVESSA was approved by the U.S. Food and Drug Administration (FDA) in 2020, representing a significant milestone (potentially the first FDA-approved vaginal estradiol cream at this concentration) [4]. Its approval provided a new treatment option that differentiates from existing vaginal estrogen products, which predominantly include creams like Estrace and Premarin or localized options like vaginal rings (Estring, Femring).

Regulatory considerations:

While FDA approval establishes a legal pathway to market, label indications, safety profiles, and post-marketing commitments influence adoption trajectories. As a new entrant, NUVESSA faces initial hurdles in clinician awareness, payer coverage, and patient acceptance.

Competitive Landscape

The market for vaginal estrogen therapies is characterized by mature, established players. Leading products include:

- Estrace Vaginal Cream: The most widely used topical estrogen therapy.

- Vagifem Vaginal Tablets: An alternative with different administration.

- Estring and Femring: Vaginal rings offering sustained hormone delivery.

- Generic products: Increasingly pressuring branded therapies on pricing.

Differentiators of NUVESSA:

NUVESSA’s formulation offers a novel cream vehicle that allows precise dosing and potentially improved patient adherence. Its lower concentration may also appeal to women seeking minimal hormonal exposure, positioning it uniquely in the mature market.

Market challenges:

- Entrenched competition from generic formulations and alternative delivery systems.

- Payer negotiations and formulary preferences potentially limiting coverage.

- Clinician familiarity with established therapies necessitates targeted education.

Pricing and Reimbursement Strategies

Pricing in the vaginal estrogen segment varies, with branded products typically priced between USD 30-60 per prescription, influenced by formulation, delivery system, and payer negotiations [5].

Reimbursement landscape:

Coverage depends on payers’ formulary decisions, cost-effectiveness analyses, and demonstration of clinical benefits. Newer products like NUVESSA can leverage their unique attributes to justify premium pricing, especially if supported by real-world safety and efficacy data.

Market access strategies include:

- Building clinical evidence for safety and efficacy.

- Engaging payers early to develop favorable formulary placements.

- Educating healthcare providers on the product’s benefits.

Financial Trajectory

Revenue projections:

Given the market’s maturity and competition, initial revenue forecasts for NUVESSA are conservative. However, with strategic marketing, physician education, and payer coverage expansion, revenues could grow incrementally.

- Year 1–2: Limited market penetration due to brand recognition and need for formulary approval; estimated revenues in the low hundreds of millions USD.

- Year 3–5: Increased adoption driven by physician familiarity, expansion into broader markets (e.g., international), and potential indications; revenues could approach USD 500 million annually.

Factors influencing growth:

- Market Penetration Rate: Slow initially but accelerates as awareness improves.

- Pricing Power: Enhanced if NUVESSA demonstrates superior safety or patient adherence benefits.

- Payer Coverage: Critical in expanding access and sales volume.

- Strategic Collaborations: Partnerships with large pharmaceutical distributors or healthcare providers facilitate broader distribution.

Potential risks to forecasts include:

- Market saturation by generic products.

- Payer reimbursement hurdles.

- Competitive innovations such as new delivery systems replacing creams.

Future Opportunities and Challenges

Opportunities:

- Expansion into emerging markets: Growing middle-class populations and increasing healthcare infrastructure offer new revenue streams.

- Additional indications: Exploring use in female sexual health, atrophic vaginitis linked to other gynecological conditions, or combination therapies.

- Digital and direct-to-consumer marketing: Expanding patient awareness and demand.

Challenges:

- Regulatory hurdles in international markets requiring localized safety and efficacy data.

- Price erosion driven by generics and biosimilars.

- Shifts in clinical guidelines favoring non-hormonal management for some patients.

Conclusion

NUVESSA’s market dynamics highlight a cautiously optimistic trajectory within a mature yet evolving segment. While it benefits from a favorable demographic trend and differentiation in formulation, its growth hinges on strategic positioning against entrenched competition, payer negotiations, and clinician adoption. A focus on clinical data, patient-centric benefits, and market expansion will be vital for realizing its financial potential.

Key Takeaways

- Growing Demographics Drive Demand: The expanding postmenopausal female population ensures sustained market relevance.

- Differentiation Is Critical: Unique formulation attributes can carve a niche amid established products.

- Reimbursement and Payer Strategy Are Paramount: Securing favorable formulary positions directly influences revenue growth.

- Market Penetration Is Incremental: Initial revenues may be modest; strategic education and partnerships accelerate growth.

- Global Expansion Presents Growth Opportunities: Emerging markets can significantly contribute to long-term revenue streams.

FAQs

1. What differentiates NUVESSA from other vaginal estrogen therapies?

NUVESSA offers a novel, low-concentration estradiol cream with potential benefits in dosing precision, patient adherence, and safety profile, distinguishing it from current products like Estrace or Estring.

2. What are the primary barriers to NUVESSA’s market growth?

Barriers include entrenched competition from generics, payer reimbursement challenges, clinician familiarity with existing therapies, and market entry costs.

3. How does the aging global population impact NUVESSA’s market prospects?

An increasing number of postmenopausal women elevates the demand for menopause-related therapies, providing a steady foundation for product sales.

4. What strategies can NUVESSA employ to enhance market share?

Strategies include building robust clinical evidence, engaging payers early, clinician education, patient awareness campaigns, and exploring international markets.

5. What is the projected revenue trajectory for NUVESSA over the next five years?

Starting with modest initial sales, revenues could approach USD 500 million annually by Year 5, contingent upon market penetration, payer coverage, and competitive positioning.

References

[1] MarketsandMarkets. “Menopause Therapeutics Market,” 2022.

[2] North American Menopause Society. “Treatment options for vulvar and vaginal atrophy,” 2021.

[3] United Nations. “World Population Ageing,” 2022.

[4] FDA. “NUVESSA approval announcement,” 2020.

[5] IQVIA. “Pharmaceutical pricing and reimbursement data,” 2022.