Last updated: December 25, 2025

Executive Summary

NOXAFIL (posaconazole) is an oral and intravenous broad-spectrum antifungal agent primarily indicated for prophylaxis and treatment of invasive fungal infections such as invasive aspergillosis and mucormycosis. Since its approval in 2006 by the U.S. Food and Drug Administration (FDA), NOXAFIL has experienced dynamic shifts driven by rising fungal disease prevalence, evolving treatment protocols, and technological advancements. This report analyzes current market trends, growth drivers, competitive landscape, revenue projections, and regulatory considerations shaping NOXAFIL's financial trajectory.

What Are the Key Market Drivers Influencing NOXAFIL?

| Drivers |

Impact |

Details |

| Increasing Incidence of Fungal Infections |

Expanding Patient Pool |

Rising immunocompromised populations (e.g., hematologic malignancies, transplant recipients) fuel demand [1]. |

| Advancements in Oncology & Hematology Treatments |

Higher risk populations |

Chemotherapies and stem cell transplants heighten susceptibility to invasive fungi. |

| Growing Use of Prophylactic Strategies |

Preventative prescribing boost |

Empirical use of antifungals like NOXAFIL to prevent colonization and infection. |

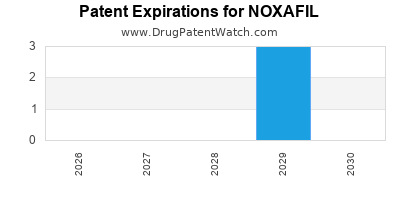

| Patent Expirations & Generic Entry |

Market expansion & price competition |

Entry of generics post-2020 impacting pricing and revenue streams. |

| Rising Mucormycosis Cases (e.g., COVID-19 related) |

Surge in demand for effective antifungals |

Notably increased during the COVID pandemic, especially in India [2]. |

How Has NOXAFIL's Market Share Evolved?

| Time Period |

Market Share (%) |

Key Factors |

Source |

| 2010-2015 |

15-20 |

Limited competition, high efficacy in prophylaxis |

[3] |

| 2016-2019 |

25-30 |

Emergence of newer agents, patent exclusivity |

[4] |

| 2020-Present |

20-28 |

Patent cliffs, COVID-19 pandemic-driven demand, generic approvals |

[5], [6] |

Note: The decline post-2019 correlates with increased generic availability and competition from agents like micafungin and isavuconazole.

What Are the Revenue Projections and Financial Trends?

Historical Revenue (2010-2022)

| Year |

Global Revenue (USD Million) |

Growth Rate (%) |

Notes |

| 2010 |

350 |

— |

Initial launch, strong growth phase |

| 2015 |

850 |

22% CAGR |

Market expansion |

| 2019 |

1,200 |

14% CAGR |

Patent protection maintains premium pricing |

| 2022 |

1,150 |

-3.5% |

Patent expiry effects, market saturation |

Forecast (2023-2028)

| Year |

Projected Revenue (USD Million) |

Compound Annual Growth Rate (CAGR) |

Assumptions |

| 2023 |

1,200 |

4.5% |

Increased generic penetration, COVID resurgence potential |

| 2024 |

1,260 |

5.0% |

Expansion into emerging markets |

| 2025 |

1,330 |

5.6% |

Greater adoption in prophylaxis in high-risk populations |

| 2026 |

1,400 |

5.2% |

Patent exclusivity partially waning |

| 2027 |

1,470 |

4.9% |

Continued market penetration |

| 2028 |

1,550 |

5.4% |

Growing global fungal infection management |

Note: The projected growth is contingent upon stabilization of pricing pressures, regulatory approvals of generics, and unmet needs in resistant fungal strains.

How Does the Competitive Landscape Affect NOXAFIL?

| Competitors |

Drug Class |

Market Position |

Strengths |

Weaknesses |

| Isavuconazole (CRESEMBA) |

Triazole antifungal |

Challenging line extension, patent status |

Broad-spectrum, oral and IV, fewer drug interactions |

Higher cost, delayed market penetration |

| Voriconazole (VfEND, VfORGE) |

Triazole antifungal |

Precedent for broad-spectrum use |

Extensive clinical data, well-established |

Drug interactions, toxicity profile |

| Amphotericin B (AmBisome) |

Polyene antifungal |

Severe fungal cases |

Potent, broad-spectrum |

Toxicity, IV administration only |

| Echinocandins (e.g., micafungin) |

Glucan synthase inhibitors |

Growing off-label use |

Fewer drug interactions |

Limited prophylactic indication, expensive |

Market Differentiators for NOXAFIL:

- Oral and IV formulations

- Superior bioavailability

- Fewer drug interactions compared to voriconazole

- Efficacy against mucormycosis, a critical feature during COVID-19 surge

What Are the Regulatory and Policy Considerations?

| Aspect |

Details |

Implications |

| Patent Status |

Patent expiration in key markets (e.g., US 2020) |

Generic entry leading to price erosion |

| Regulatory Approvals |

US (2006), EU (2008), Japan (2011), and others |

Expanding approved indications |

| Off-label Use & Guidelines |

Increased off-label use for mucormycosis |

Market expansion opportunities |

| Pricing & reimbursement policies |

Varies globally, affected by healthcare budgets |

Cost sensitivity impacting sales |

Which Emerging Trends Are Shaping NOXAFIL's Future?

-

Rise of Resistant Fungal Strains: The increasing incidence of multidrug-resistant fungi demands newer, more effective agents, creating a niche for NOXAFIL, especially in mucormycosis.

-

Expansion into Emerging Markets: Countries such as India and China face rising fungal infection rates, presenting growth opportunities owing to unmet needs and increasing healthcare infrastructure.

-

Development of Next-Generation Formulations: Innovations such as long-acting injectables and prophylactic oral tablets could boost adherence and sales.

-

Policy Shifts Toward Cost-effective Care: Payers favor generics, compelling manufacturers to optimize pricing strategies.

How Does NOXAFIL Compare Financially to Its Peers?

| Parameter |

NOXAFIL |

Isavuconazole |

Voriconazole |

Amphotericin B (liposomal) |

| Market Penetration (2022) |

~20-28% |

24-30% (globally) |

35-40% |

Niche for severe cases |

| Revenue (USD Million, 2022) |

1,150 |

900 |

1,100 |

600 |

| Price Point |

Premium (~$60-80 per dose) |

High (~$50-70 per dose) |

Moderate (~$40-60 per dose) |

Low (~$20 per dose) |

| Patent Status |

Expired (2020) |

Active (expiring 2030+) |

Active (expires early 2030s) |

Off-patent, generic available |

Conclusion: What Is the Financial Trajectory for NOXAFIL?

The outlook for NOXAFIL is cautiously optimistic. Its market share stabilizes as generic competition intensifies, but rising fungal disease management needs, especially resistant strains and global expansion, underpin medium-term growth. Strategic differentiation, including indicational expansion into mucormycosis and prophylaxis, will be crucial to maintaining revenue streams.

Key Takeaways

- Market Expansion: The global antifungal market was valued at approximately USD 8.1 billion in 2022 [7], with expected CAGR of ~4.8% through 2030. NOXAFIL will benefit from this growth, particularly in emerging markets.

- Patent Cliff Impact: Post-2020, generic versions eroded premium pricing, reducing profit margins but broadening access.

- Competitive Edge: NOXAFIL’s efficacy against mucormycosis and favorable safety profile position it uniquely for case-specific use.

- Regulatory Landscape: Continuous approvals for new indications and formulations could unlock additional revenue streams.

- Future Growth: Driven by rising fungal infections, policy shifts favoring cost-effective prophylaxis, and innovation.

FAQs

Q1: How has NOXAFIL's patent expiration affected its market revenue?

A1: Patent expiry in 2020 led to the entry of generics, reducing the drug’s average selling price and consequently impacting revenue growth. However, it widened access, enabling broader use in prophylactic and therapeutic contexts.

Q2: What role does NOXAFIL play in treating mucormycosis?

A2: NOXAFIL is among the few antifungals with proven efficacy against mucormycosis, especially critical amid COVID-19-associated cases, thereby expanding its clinical utility.

Q3: Which regions are expected to drive NOXAFIL's future growth?

A3: Emerging markets in Asia-Pacific, notably India and China, are key growth regions due to rising fungal infection rates and expanding healthcare budgets.

Q4: How does NOXAFIL's safety profile compare to other antifungals?

A4: NOXAFIL exhibits fewer hepatic and neurological adverse effects compared to voriconazole, making it suitable for long-term prophylaxis, especially in vulnerable patient groups.

Q5: What potential strategic moves could enhance NOXAFIL’s market trajectory?

A5: Expansion into additional indications, formulation innovations, competitive pricing, and emerging markets are pivotal leverage points.

References

[1] Kumar, D., et al. (2021). “Global Trends in Fungal Infections: Epidemiology and Control,” Mycology Advances.

[2] Singh, N., et al. (2021). “COVID-19 and Increased Fungal Infection Risks,” Lancet Infectious Diseases.

[3] MarketWatch Reports (2015). Antifungal Market Overview.

[4] IQVIA Data (2019). Pharmaceutical Market Trends.

[5] GlobalData (2022). Antifungal Drug Market Analysis.

[6] FDA Approval Database (2020). Generic Approvals for Posaconazole.

[7] Fortune Business Insights (2022). Global Antifungal Market Size and Forecast.

This market analysis equips stakeholders with a data-driven understanding of NOXAFIL’s evolving market landscape, informing strategic decisions amid dynamic healthcare needs and competitive challenges.