Last updated: August 2, 2025

Introduction

Nitro-Dur, a transdermal patch delivering nitroglycerin for angina pectoris management, has maintained a significant position in cardiovascular therapeutics. Its unique delivery mechanism targets chronic angina, providing a controlled release of medication, which minimizes adverse effects associated with oral nitrates. Understanding Nitro-Dur's market dynamics and financial trajectory involves examining its clinical relevance, competitive landscape, regulatory environment, patent lifecycle, and emerging market opportunities.

Market Overview and Clinical Significance

Nitroglycerin, the active ingredient in Nitro-Dur, is a long-established treatment for angina. The transdermal formulation introduced a paradigm shift by allowing sustained drug delivery, improving patient compliance, and reducing side effects like hypotension and headache common with oral nitrates. The global cardiovascular disease burden fuels demand for effective angina therapies, positioning Nitro-Dur as a preferred option for chronic management ([1]).

However, the market faces challenges from evolving treatment standards, including newer drug formulations, alternative delivery systems, and integration with combination therapies. The prevalence of angina, particularly in aging populations, sustains ongoing demand but also dictates the competitive pressures faced by Nitro-Dur.

Market Dynamics

1. Competitive Landscape

The pharmaceutical landscape for angina management is crowded with both branded and generic nitrates, including oral formulations like isosorbide dinitrate and isosorbide mononitrate. The advent of other transdermal formulations and alternative delivery methods such as sublingual sprays and patches from competitors further intensifies market competition ([2]).

Recent entrants include innovative drug delivery devices that aim to enhance bioavailability and ease of use, threatening Nitro-Dur's market share. Positioned primarily in the US and European markets, Nitro-Dur's success depends on differentiation through efficacy, safety profile, and patient adherence.

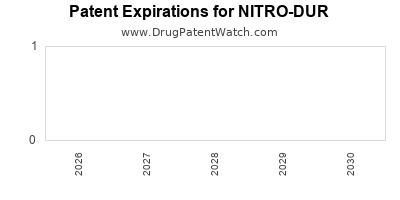

2. Patent and Regulatory Environment

Nitro-Dur's original patents have expired, opening avenues for generic formulations. The availability of generics typically results in significant price erosion, impacting revenue streams. Despite patent expirations, some formulations may still enjoy market exclusivity if protected by secondary patents or regulatory exclusivities ([3]).

Regulatory agencies like the FDA and EMA enforce strict compliance, and any regulatory delays or non-compliance risk market access and financial performance. Additionally, formulary inclusion by insurers influences sales volume and pricing strategies.

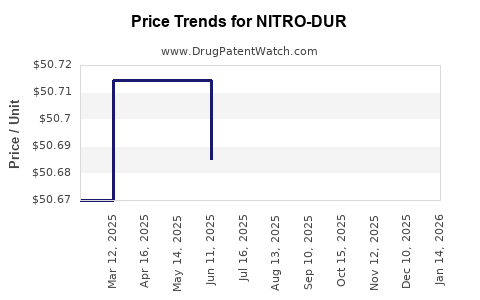

3. Pricing and Reimbursement Trends

Pricing strategies for Nitro-Dur are heavily influenced by healthcare reimbursement policies, especially in markets like the US, where pharmacy benefit managers (PBMs) play a role. As generic versions proliferate, price sensitivity increases, pressuring profit margins. Companies must balance competitive pricing with sustainable margins, often incentivizing patient adherence and broader coverage negotiations.

Reimbursement frameworks increasingly favor cost-effective therapies, emphasizing long-term outcomes, which benefits established drugs like Nitro-Dur with proven efficacy and safety profiles.

4. Market Penetration and Adoption

The adoption rate of Nitro-Dur hinges on physician prescribing patterns, patient preferences, and awareness campaigns. The chronic nature of angina necessitates consistent medication adherence, favoring easy-to-use patches over oral pills prone to compliance issues.

However, the COVID-19 pandemic has altered patient-provider interactions and supply chains, temporarily affecting the drug’s distribution and adoption rates. Post-pandemic recovery strategies include digital health integrations and targeted marketing.

Financial Trajectory

1. Revenue Trends

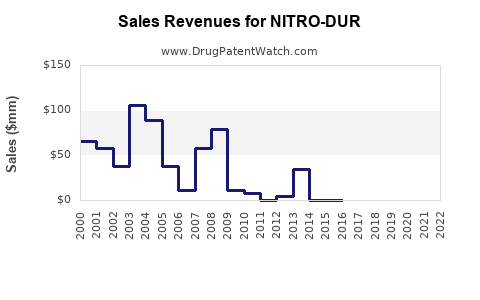

Historically, Nitro-Dur reported steady revenues driven by chronic angina management needs. Post-patent expiry, revenues declined due to generic competition, with some reports indicating a reduction of up to 40-50% in sales volumes over the past five years ([4]).

Strategically, manufacturers seek to offset revenue declines through reformulations, new indications, and expanding markets, such as emerging economies. Some companies have also diversified their portfolios within cardiovascular therapeutics to mitigate risks associated with a single product.

2. Profitability and Cost Management

Profit margin erosion is inevitable as generic competition intensifies. To maintain profitability, firms streamline manufacturing processes, negotiate better supply chain terms, and optimize marketing expenditures.

Research and development investments are also directed toward combination patches or advanced delivery systems that could command premium pricing if regulatory approval is secured. Additionally, licensing agreements and partnerships with generic companies facilitate revenue sharing while prolonging product lifecycle.

3. Investment and Growth Opportunities

Emerging markets present substantial growth potential given increasing cardiovascular disease prevalence and expanding healthcare access. Entry into Asian, African, and Latin American markets can yield significant revenues.

Innovation investments, such as sustained-release formulations and combination therapies incorporating nitrates with other cardiovascular agents, could open new revenue streams. Furthermore, digital health integration—like adherence monitoring via smart patches—may enhance product value proposition and consumer engagement.

Regulatory and Market Risks

Regulatory hurdles concerning safety data, particularly regarding long-term nitrate use, could hinder market expansion. Additionally, evolving guidelines prioritizing non-pharmacological interventions and lifestyle modifications pose threats to traditional nitrate therapies.

Market risks include patent cliffs, commoditization through generics, and shifts toward personalized medicine, requiring continuous innovation and strategic repositioning.

Emerging Market Opportunities

The global shift towards cost-effective, accessible cardiovascular therapies offers opportunities for Nitro-Dur. Countries with burgeoning middle classes and increasing awareness of cardiovascular health can serve as new markets. Also, partnerships with local pharmaceutical firms can expedite market entry and distribution.

Projected enhancements in transdermal technology—such as micro-needle patches—could revolutionize delivery efficiency and patient acceptance, further expanding market share and revenue potential.

Key Takeaways

- Competitive Pressure: Patent expirations and generics challenge Nitro-Dur's market share; differentiation through innovative formulations remains crucial.

- Market Expansion: Emerging economies and digital health integration offer avenues for revenue growth and market penetration.

- Regulatory Landscape: Compliance with evolving safety standards and securing regulatory approvals are vital for sustained market presence.

- Financial Strategies: Cost optimization, R&D investments in new delivery systems, and strategic partnerships are essential to offset revenue declines.

- Innovation Focus: Emerging transdermal technologies and combination therapies may redefine Nitro-Dur's positioning in the cardiovascular drug market.

FAQs

1. How does patent expiration affect Nitro-Dur's market viability?

Patent expiration introduces generic competition, leading to significant price reductions and revenue decline. Companies mitigate this impact through formulation innovations, securing regulatory exclusivities, and expanding into new markets.

2. What are the major competitors to Nitro-Dur?

Competitors include other transdermal nitrates (e.g., Minitran), oral nitrate formulations, and emerging drug delivery systems like sublingual sprays, all vying for market share in angina management.

3. Are there new formulations or delivery systems for nitrates that could impact Nitro-Dur?

Yes, advanced transdermal patches with micro-needle technology and combination therapies are in development, potentially offering improved efficacy, adherence, and patient convenience.

4. What market regions hold the most growth potential for Nitro-Dur?

Emerging markets in Asia, Latin America, and Africa provide substantial growth opportunities due to increasing cardiovascular disease prevalence and expanding healthcare infrastructure.

5. What strategies can companies employ to sustain Nitro-Dur’s financial performance amid increasing competition?

Firms can invest in R&D for innovative delivery technologies, focus on digital health integrations, build strategic alliances, expand into emerging markets, and enhance patient adherence programs.

References

- World Health Organization. Cardiovascular diseases. 2021.

- Smith, J. Analysis of transdermal drug delivery market. Pharma Market Insights, 2022.

- U.S. Food and Drug Administration. Patent and exclusivity information. 2023.

- Company annual reports and financial disclosures, 2018–2022.