Share This Page

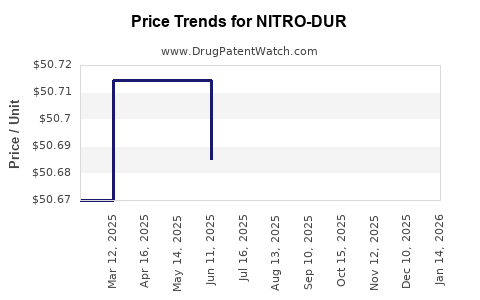

Drug Price Trends for NITRO-DUR

✉ Email this page to a colleague

Average Pharmacy Cost for NITRO-DUR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NITRO-DUR 0.3 MG/HR PATCH | 50742-0515-01 | 50.52014 | EACH | 2025-12-17 |

| NITRO-DUR 0.3 MG/HR PATCH | 50742-0515-30 | 50.52014 | EACH | 2025-12-17 |

| NITRO-DUR 0.3 MG/HR PATCH | 50742-0515-01 | 50.48610 | EACH | 2025-11-19 |

| NITRO-DUR 0.3 MG/HR PATCH | 50742-0515-30 | 50.48610 | EACH | 2025-11-19 |

| NITRO-DUR 0.3 MG/HR PATCH | 50742-0515-01 | 50.56467 | EACH | 2025-10-22 |

| NITRO-DUR 0.3 MG/HR PATCH | 50742-0515-30 | 50.56467 | EACH | 2025-10-22 |

| NITRO-DUR 0.3 MG/HR PATCH | 50742-0515-01 | 50.50646 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NITRO-DUR (Nitroglycerin Transdermal Patches)

Introduction

NITRO-DUR, a transdermal nitroglycerin patch, remains an essential medication for managing angina pectoris—a treatment cornerstone for chronic chest pain linked to coronary artery disease (CAD). Its unique delivery system offers steady-state plasma concentrations, improving symptom control and patient adherence. Given its established therapeutic role and aging global populations with increasing cardiovascular disease prevalence, understanding NITRO-DUR's market dynamics and projecting future pricing trajectories is crucial for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Market Landscape Overview

Global Cardiovascular Disease and NITRO-DUR's Demand

The global burden of cardiovascular disease (CVD) continues to escalate, with the World Health Organization (WHO) estimating approximately 17.9 million deaths annually attributed to CVD [1]. Angina management remains vital, especially in developed nations with aging demographics. NITRO-DUR, as a first-line therapy for stable angina, benefits from this persistent demand.

Market Penetration and Key Players

NITRO-DUR's patent protections have largely expired, leading to increased generic competition. Key manufacturers include leading generic pharmaceutical firms such as Mylan, Teva, and Sandoz, which manufacture and distribute nitroglycerin patches worldwide. The transition from branded to generic formulations has significantly impacted market share and pricing strategies.

Regulatory Considerations

The approval landscape is well-established, with regulatory agencies like the FDA (U.S.) and EMA (Europe) supporting the continued use of nitroglycerin patches, emphasizing safety, efficacy, and bioequivalence for generics [2]. Regulatory pathways for biosimilars or new formulations remain limited, constraining innovation-driven market growth.

Market Dynamics Driving Growth

Key Market Drivers

- Prevalence of CAD: Increasing prevalence, notably among aging populations, sustains steady demand.

- Chronic angina management: Long-term therapy needs favor transdermal delivery over oral forms, reducing first-pass metabolism risks.

- Patient adherence: Enhanced compliance compared to oral nitrates, owing to consistent delivery and fewer dosing schedules.

- Healthcare system preferences: Hospitals and clinics favor patches over injectable or oral medications for outpatient management.

Market Challenges

- Generic competition: Low-cost generics exert pricing pressure, constraining revenue growth.

- Side-effect profiles: Headaches and hypotension may limit use, potentially shifting prescribing patterns.

- Patent cliff: Loss of exclusivity has precipitated pricing declines, impacting profit margins.

Market Size and Revenue Projections

Current Market Size (2023)

Estimations suggest the global nitroglycerin transdermal patch market, with NITRO-DUR as a significant contributor, is valued approximately at $400 million, reflecting widespread use across North America, Europe, and Asia-Pacific regions.

Future Growth Trends

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3-4% over the next five years, driven predominantly by increasing CVD incidence and continued reliance on transdermal nitrate therapy [3].

Regional Breakdown

- North America: Dominates with a 45% market share; growth driven by aging demographics and high healthcare expenditure.

- Europe: Accounts for 30%, with steady adoption across EU nations.

- Asia-Pacific: Rapid growth expected, with a CAGR of ~6%, propelled by expanding healthcare access and rising CAD prevalence.

Price Projections

Historical Pricing Trends

Since patent expiration in the early 2000s, NITRO-DUR's unit price has declined sharply, with current average retail prices around $8–$12 per patch in the U.S., depending on dosage and manufacturer [4].

Current Market Pricing

Generic dominance has stabilised prices at a low baseline, with competition driving costs down. Consequently, profit margins for manufacturers have shrunk, pressuring them to seek cost efficiencies and alternative formulations.

Projected Future Pricing

Given increasing generic saturation, prices are expected to plateau around $5–$8 per patch by 2028. Slight price decreases may continue due to intensified competition, with some premium brands maintaining a higher price point (up to $10–$12), targeting niche segments or offering differentiated formulations.

Innovative Formulation Impact

Emerging formulations—such as sustained-release patches with improved adhesion or reduced side effects—could command premium pricing. However, the market penetration of such innovations remains limited, and their impact on overall pricing remains speculative.

Market Entry and Competition

Future Entrants and Innovations

- Biosimilar or alternative nitrate delivery systems: Currently limited, but future entrants may introduce novel transdermal patches or combination therapies.

- Digital health integration: Smart patches with dose monitoring could fetch higher prices but require significant R&D investments.

Implications for Price Trajectory

Market entry of innovative, differentiated products could temporarily sustain higher prices, but generic price erosion is likely to dominate in the long term.

Regulatory and Policy Impact on Price and Market

Healthcare policies emphasizing cost containment—particularly in public healthcare systems—may further depress prices. Additionally, reimbursement policies and formulary placements influence market accessibility and pricing strategies.

Key Opportunities and Risks

| Opportunities | Risks |

|---|---|

| Growing geriatric population with CVD burden | Price war among generics |

| Technological advancements in patch formulations | Regulatory hurdles for new formulations |

| Strategic expansion into emerging markets | Market saturation and declining reimbursement levels |

Key Takeaways

- The NITRO-DUR market remains vital for angina management, with steady demand driven by aging populations and chronic disease prevalence.

- Generic competition has lowered prices substantially, projecting stability or slight declines over the next five years.

- Pricing is anticipated to hover between $5–$8 per patch globally, with premium formulations possibly commanding higher prices.

- Innovation, such as sustained-release or digital-integrated patches, may temporarily elevate prices but face significant regulatory and market entry barriers.

- Healthcare policy frameworks aimed at cost savings will continue to influence pricing strategies and market access.

FAQs

1. How has generic competition affected NITRO-DUR pricing?

Generic manufacturers have driven prices downward by offering bioequivalent alternatives, leading to a stable, low-cost market with prices averaging $5–$8 per patch globally.

2. What are the key growth regions for NITRO-DUR?

North America and Europe currently dominate the market, but Asia-Pacific is emerging rapidly, with projections of higher growth rates due to increasing CVD burden and expanding healthcare infrastructure.

3. Are there innovative formulations of NITRO-DUR in development?

While research exists for new delivery systems, such as sustained-release or smart patches, widespread commercial availability remains limited, and these innovations may command higher prices temporarily.

4. How does healthcare policy influence NITRO-DUR pricing?

Cost containment strategies and reimbursement policies in various countries influence market pricing, often favoring low-cost generics to reduce healthcare expenditures.

5. What is the outlook for NITRO-DUR over the next decade?

The market will experience modest growth, with prices likely stabilizing or decreasing slightly due to competition. Technological advances and regional expansion offer future opportunities, but sustained profitability depends on innovation and regulatory navigation.

References

- World Health Organization. CVD Fact Sheet. 2021.

- U.S. Food and Drug Administration. Bioequivalence Guidelines. 2020.

- MarketResearch.com. Global Transdermal Nitrate Market Outlook, 2022-2027.

- GoodRx. NITRO-DUR price comparisons and trends. 2023.

More… ↓