Last updated: July 29, 2025

Introduction

NITRO-BID, an established pharmaceutical agent, primarily used for the prevention and treatment of angina pectoris and other related ischemic heart conditions, has maintained a significant presence within the cardiovascular therapy sector. As the pharmaceutical landscape evolves with technological advancements, regulatory shifts, and emerging competitors, understanding the market dynamics and projected financial trajectory of NITRO-BID becomes essential for stakeholders, including manufacturers, healthcare providers, and investors.

This analysis examines current market forces influencing NITRO-BID, evaluates technological and regulatory developments, and projects its future financial path within the broader cardiovascular therapeutics segment.

Overview of NITRO-BID and Its Market Position

NITRO-BID's active ingredient, nitroglycerin, has been a cornerstone of angina management since the mid-20th century. Its efficacy, coupled with well-documented safety profiles, has sustained steady demand, particularly in outpatient and emergency settings. The drug's approval history, manufacturing status, and patent landscape influence its market exclusivity and pricing strategies.

As of 2023, NITRO-BID remains available both as an ointment and sublingual tablets, with several generic equivalents available internationally. Its entrenched clinical use lends it a resilient market position; however, emerging therapies and evolving treatment guidelines may challenge its dominance.

Market Dynamics

1. Competitive Landscape

The cardiovascular drug market is characterized by intensifying competition from both branded and generic formulations, alongside newer therapeutic modalities. Key competitors include:

-

Alternative Nitroglycerin Formulations: Sublingual sprays, transdermal patches, and IV formulations offer comparable or improved delivery methods. For instance, NitroMist provides rapid absorption, while transdermal patches deliver sustained release, potentially reducing the frequency of administration.

-

Novel Agents: Drugs such as ranolazine, ivabradine, and ranizana offer alternative or adjunct treatment options for chronic angina and ischemic heart disease, potentially reducing reliance on traditional nitroglycerin products.

-

Over-the-Counter Availability: Some formulations are available OTC in various markets, impacting prescription volumes and pricing strategies.

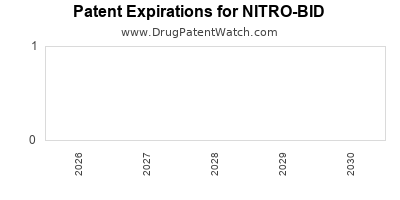

2. Regulatory and Patent Environment

Patent expirations of NITRO-BID and related nitroglycerin formulations have facilitated a surge in generic entrants, exerting downward pressure on prices. Regulatory agencies’ approval of generics, combined with legal frameworks facilitating market entry, boosts competition but compresses profit margins for original manufacturers.

Further, regulatory shifts emphasizing generic substitution and bioequivalence standards streamline market access for lower-cost alternatives, impacting NITRO-BID’s market share.

3. Technological Advancements

Delivery innovations, such as prolonged-release patches and novel transmucosal applications, enhance patient adherence and could diminish the demand for traditional formulations like the ointment. The development of smart drug delivery systems and personalized dosing mechanisms presents both challenges and opportunities for NITRO-BID’s future market positioning.

4. Demographic and Epidemiological Trends

The global burden of ischemic heart disease (IHD) continues to rise, with projections indicating over 300 million cases worldwide by 2030 [1]. Aging populations in developed economies and increasing prevalence in emerging markets expand potential markets for nitrate therapies, including NITRO-BID.

However, shifts towards primary preventive strategies and comprehensive lifestyle interventions potentially mitigate some demand.

5. Healthcare Policy and Reimbursement Dynamics

Reimbursement policies and formulary placements heavily influence drug accessibility and utilization. Government-led initiatives favor cost-effective generics, squeezing branded drug revenues. Conversely, reimbursement for advanced formulations and combination therapies presents new avenues.

6. Supply Chain and Manufacturing Considerations

Global supply chain disruptions, as experienced during the COVID-19 pandemic, have impacted manufacturing and distribution of pharmaceuticals. For NITRO-BID, maintaining quality, complying with regulatory standards, and managing cost structures remain pivotal to market stability.

Financial Trajectory Analysis

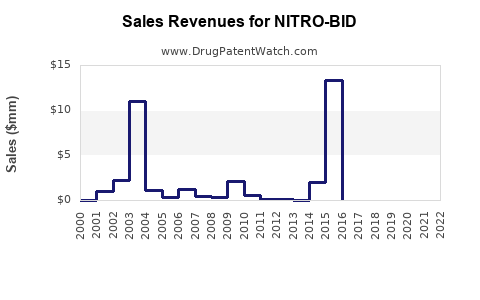

1. Revenue Projections

With the rise of generic competition, the revenue for NITRO-BID’s branded formulations is expected to decline progressively over the next five years. Market research indicates that the global nitrates market is contracting at a CAGR of approximately 3-4%, primarily due to generics and substitution effects [2].

However, in markets where branded or delayed generic entry persists, such as certain Asian or Latin American countries, localized revenues may sustain or grow modestly.

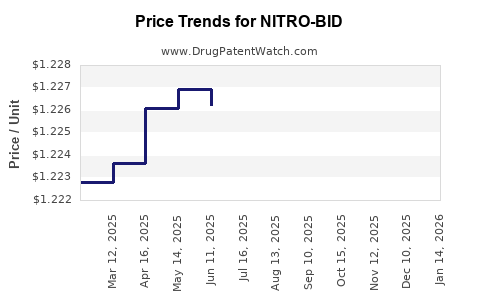

2. Pricing Strategies

Price erosion due to generic competition is inevitable. Manufacturers may adopt strategies such as tiered pricing, value-added services, or marketing differentiation emphasizing formulation stability or convenience to retain market share.

Pricing for newer formulations, like patches or transmucosal systems, commands premium pricing—potentially offsetting declines in ointment sales in specific segments.

3. R&D and Innovation Investment

Investing in innovative delivery systems, combination therapies, or companion diagnostics could extend the product’s lifecycle. However, limited R&D budgets and lengthy regulatory timelines pose risks.

4. Regulatory and Legal Factors Impacting Revenue

Patent expirations, increased generic approvals, and potential for biosimilar or similar products entering the market threaten revenue streams. Future legal disputes over formulation patents or formulation rights could also influence financial outcomes.

5. Market Entry and Expansion Opportunities

Emerging markets with expanding healthcare infrastructure and rising IHD prevalence represent growth opportunities. Strategic partnerships, local manufacturing, or licensing arrangements could bolster revenues.

6. Overall Financial Outlook

Considering current trends, NITRO-BID's revenues are expected to decline gradually, with potential stabilization in certain regions due to regulatory delays or market segmentation. Profit margins may compress unless differentiation strategies or innovation investments are implemented.

Conclusion

NITRO-BID's market dynamics are influenced predominantly by fierce generic competition, technological innovation, regulatory environments, and demographic trends. While its current market remains substantial, future growth prospects depend on strategic adaptation to emerging therapies, formulary negotiations, and geographic expansion.

The drug’s financial trajectory appears modestly declining over the next five years, barring significant innovation or market expansion initiatives. Stakeholders should focus on leveraging niche markets, investing in value-adding formulations, and exploring partnerships in emerging economies to sustain profitability.

Key Takeaways

- The global nitrates market faces steady erosion due to generic competition and alternative therapies.

- Demographics and epidemiological trends present growth opportunities, especially in emerging markets.

- Innovation in delivery systems and combination therapies may extend NITRO-BID’s market relevance.

- Price competition, regulatory approvals, and patent expiration are primary levers influencing revenue.

- Strategic diversification and geographic expansion are recommended to buffer declining revenues.

FAQs

1. How does patent expiration affect NITRO-BID's market profitability?

Patent expiration enables generic manufacturers to produce bioequivalent formulations, leading to significant price reductions and increased market competition, which often results in decreased profitability for the original brand.

2. Are there emerging alternatives that threaten NITRO-BID’s efficacy for angina management?

Yes. Newer drugs like ranolazine and ivabradine offer alternative mechanisms with potentially fewer side effects, increasing competition in the angina treatment landscape.

3. What strategies can manufacturers adopt to sustain NITRO-BID’s market share?

Manufacturers can focus on product differentiation through improved formulations, patient adherence tools, engage in market expansion, and invest in innovative delivery systems to retain market relevance.

4. How do regulatory policies influence NITRO-BID’s pricing and availability?

Regulatory agencies' approval of generics accelerates price erosion, while approvals for novel formulations can justify premium pricing. Reimbursement policies also determine patient access and market penetration.

5. What is the long-term outlook for NITRO-BID in global markets?

While future revenues may decline due to competitive pressures, strategic differentiation, innovation, and targeted market expansion can sustain NITRO-BID’s relevance over the medium term.

Sources

[1] World Health Organization. (2021). Global status report on noncommunicable diseases 2021.

[2] Market Research Future. (2022). Global Nitrates Market Research Report.