Share This Page

Drug Price Trends for NITRO-BID

✉ Email this page to a colleague

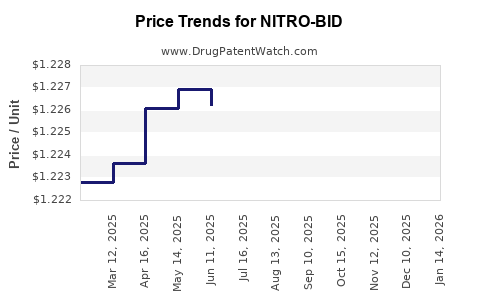

Average Pharmacy Cost for NITRO-BID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NITRO-BID 2% OINTMENT | 00281-0326-60 | 1.22756 | GM | 2025-12-17 |

| NITRO-BID 2% OINTMENT | 00281-0326-08 | 2.39165 | GM | 2025-12-17 |

| NITRO-BID 2% OINTMENT | 00281-0326-30 | 1.23409 | GM | 2025-12-17 |

| NITRO-BID 2% OINTMENT | 00281-0326-60 | 1.22920 | GM | 2025-11-19 |

| NITRO-BID 2% OINTMENT | 00281-0326-08 | 2.38733 | GM | 2025-11-19 |

| NITRO-BID 2% OINTMENT | 00281-0326-30 | 1.23426 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NITRO-BID

Introduction

NITRO-BID, a topical drug primarily used for treating certain skin infections and ulcers, stands as an integral product in the niche antimicrobial field. Known chemically as nitrofurazone, this drug has maintained its relevance through decades, especially in wound care and infection management. As healthcare markets evolve, understanding NITRO-BID’s current positioning and future pricing landscape is essential for stakeholders, including manufacturers, distributors, and healthcare providers.

Market Overview

Historical Context and Usage

NITRO-BID has been marketed globally, especially in regions with limited access to newer antimicrobial agents. Despite its longstanding presence, the drug’s usage has been influenced by evolving antibiotic resistance, safety profile concerns, and the emergence of newer topical agents with improved efficacy and tolerability.

Regulatory Status

Across different jurisdictions, NITRO-BID’s regulatory status varies. In the United States, its marketing hinges on the FDA's prior approval, with some formulations lacking recent regulatory updates, compounding concerns over safety and efficacy. In emerging markets, regulatory oversight may be less stringent, affecting market entry and pricing strategies.

Market Segmentation

The principal segments for NITRO-BID include hospital wound care units, outpatient clinics, emergency care providers, and private dermatology practices. Geographical markets, especially in Asia, Africa, and Latin America, dominate due to higher disease prevalence and limited access to advanced therapeutics.

Market Drivers

- Rising incidence of skin infections, diabetic foot ulcers, and burn injuries.

- Limited access to advanced wound management products in developing regions.

- Cost-effectiveness of NITRO-BID relative to newer agents.

- Prescriber familiarity due to long-standing use.

Market Constraints

- Safety concerns, including potential carcinogenicity reports raised by some studies.

- Competition from newer topical antimicrobials with broader spectra and fewer side effects.

- Regulatory restrictions or discontinuations in key markets.

- Growing antibiotic resistance reducing overall antimicrobial effectiveness.

Competitive Landscape

Major competitors include topical agents like povidone-iodine, silver-based dressings, honey dressings, and newer antibiotics such as mupirocin and retapamulin. These alternatives often boast better safety profiles and wider antimicrobial spectra.

Generic manufacturing has increased, intensifying price competition. Key players include generic providers in India, China, and other manufacturing hubs, emphasizing low-cost production.

Price Trends and Projections

Current Pricing

In mature markets, the retail price of NITRO-BID (usually the topical ointment) ranges from $5 to $15 per tube (30g), depending on formulation and packaging. In developing regions, prices often sit below $2, reflecting lower manufacturing costs and purchasing power.

Pricing Factors Affecting NITRO-BID

- Manufacturing Costs: Generic manufacturers benefit from low-cost production, resulting in competitive pricing.

- Regulatory Environment: Restrictions or bans in certain jurisdictions can sharply influence prices.

- Market Demand: Fluctuations driven by infection rates and clinical adoption impact volume and prices.

- Supply Chain Dynamics: Global supply chain disruptions can cause price volatility, especially in raw materials like nitrofurazone.

Future Price Projections (2023–2028)

Given the current market landscape, the following projections are anticipated:

- Stability or Slight Decline in Price in mature, regulated markets due to generic competition and safety concerns. Prices may hover around $3 to $5 per tube.

- Potential Price Increase in emerging markets driven by demand and supply chain constraints, possibly reaching $4 to $8 per tube, contingent on regulatory acceptance.

- Impact of New Formulations or Alternatives: Introduction of novel antimicrobial dressings could diminish NITRO-BID’s market share, exerting downward pressure on prices, especially in competitive sectors.

Influence of Regulatory and Safety Developments

Recent safety concerns, notably mutagenicity and carcinogenicity reports in animal studies, could prompt regulatory restrictions, leading to market exit or price reductions. Conversely, if safety profiles are reassured through robust clinical data, prices may stabilize or climb modestly.

Opportunities and Risks

Opportunities

- Expanding in Underdeveloped Markets: High disease burden and limited alternatives present growth avenues.

- Product Line Extensions: Developing reformulated or combination products with improved safety can restore demand.

- Strategic Licensing and Partnerships: Collaborations with local manufacturers can expand distribution and reduce costs.

Risks

- Regulatory Bans or Restrictions: Potential removal from markets due to safety concerns.

- Competitive Displacement: Emergence of superior topical agents.

- Generic Market Saturation: Heavy competition driving commoditization and shrinking profit margins.

Regulatory and Patent Considerations

No recent patent protection bolsters the exclusivity of NITRO-BID, mainly as patents for nitrofurazone's formulations have expired. Patent expirations accelerate generic manufacturing but may also erode pricing power.

Regulatory scrutiny concerning safety profiles might lead to restrictions or withdrawals, especially in stringent markets such as the US and Europe. Monitoring regional regulatory updates is essential for accurate market and price forecasts.

Key Takeaways

- NITRO-BID remains relevant in specific segments, especially in low-resource markets with high infection rates.

- Its pricing landscape is influenced heavily by generic competition, safety concerns, and regional regulatory policies.

- Future price stability is contingent upon safety validation and market acceptance; new formulations could modify this outlook.

- Opportunities exist in expanding access in emerging markets, but risks include regulatory actions and competition from advanced antimicrobial agents.

- Industry stakeholders should focus on safety reassessment and strategic partnerships for sustained market presence.

FAQs

1. What are the primary therapeutic uses of NITRO-BID?

NITRO-BID is employed mainly for topical management of skin and wound infections, including burns, ulcers, and infected traumatic wounds.

2. How does NITRO-BID compare price-wise to newer antimicrobials?

NITRO-BID generally offers a lower-cost alternative, especially in generic form, making it attractive for resource-limited settings compared to newer, patented agents.

3. Are there safety concerns impacting NITRO-BID’s market?

Yes. Animal studies have raised mutagenicity and carcinogenicity concerns, which could lead to regulatory restrictions or bans, impacting market presence.

4. What are the key factors influencing future NITRO-BID prices?

Regulatory status, safety profile validation, competition, regional demand, and supply chain stability primarily drive future pricing.

5. Is NITRO-BID likely to see growth in developed markets?

Growth prospects are limited in developed markets due to safety concerns and competition from superior agents; however, niche applications and value-based pricing could sustain current levels.

References

[1] U.S. Food and Drug Administration. (2022). Review of topical antimicrobial agents.

[2] Market Research Future. (2021). Global wound care products market insights.

[3] WHO. (2020). Guidelines on antimicrobial resistance and infection control.

[4] IPCS INCHEM. (2010). Nitrofurazone (Nitrofurazone) chemical safety data.

[5] EvaluatePharma. (2022). Pharmaceutical market trends and projections.

More… ↓