Share This Page

Drug Sales Trends for NITRO-BID

✉ Email this page to a colleague

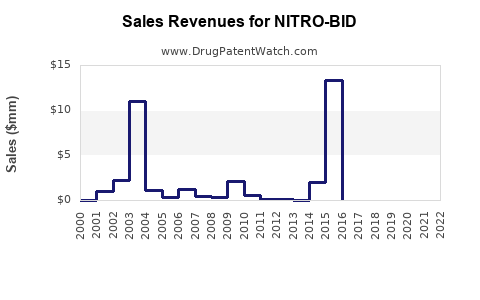

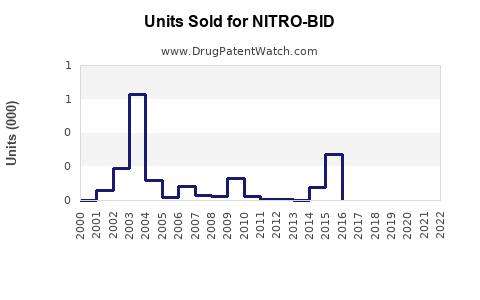

Annual Sales Revenues and Units Sold for NITRO-BID

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NITRO-BID | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NITRO-BID | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NITRO-BID | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NITRO-BID | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NITRO-BID | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| NITRO-BID | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NITRO-BID

Introduction

NITRO-BID, an established topical antimicrobial agent containing nitrofurazone, remains a vital component in wound management within healthcare settings. Historically used for infected skin and postoperative wounds, NITRO-BID's market presence is influenced by evolving wound care standards, regulatory shifts, and the competitive landscape. This report offers a comprehensive analysis of NITRO-BID's current market position, competitive environment, and projected sales trajectory over the next five years, informed by recent industry trends and healthcare demand patterns.

Product Overview

NITRO-BID (nitrofurazone topical ointment) is an antimicrobial dressing used primarily to prevent and treat bacterial infections in chronic and acute wounds, such as burns, ulcers, surgical incisions, and traumatic injuries. Its broad-spectrum activity facilitates bacterial control while supporting wound healing processes. Despite its longstanding use, NITRO-BID faces challenges from alternative therapies, including modern antimicrobial dressings and systemic antibiotics.

Market Landscape

Current Market Size and Demand Drivers

Globally, the wound care market was valued at approximately USD 23 billion in 2022, with an expected compound annual growth rate (CAGR) of around 6.2% through 2028 (Research and Markets, 2022). NITRO-BID represents a niche segment within topical antimicrobials, traditionally favored in hospital settings, long-term care facilities, and wound clinics.

Demand for topical antimicrobials remains robust due to rising prevalence of chronic wounds, such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers, fueled by aging populations and increasing diabetes incidence. According to the International Diabetes Federation, global diabetes prevalence is projected to reach 700 million by 2045, inherently increasing wound management needs.

Regional Market Dynamics

- North America: Dominates the market due to advanced healthcare infrastructure, high prevalence of chronic wounds, and widespread hospital use. U.S. government and private insurers cover wound care products extensively.

- Europe: Significant demand driven by aging populations and comprehensive healthcare policies, with notable adoption in the UK, Germany, and France.

- Asia-Pacific: Fastest-growing segment owing to increasing healthcare access, rising chronic disease burdens, and expanding wound care facilities in China, India, and Southeast Asia.

Regulatory Environment

NITRO-BID’s regulatory status varies by region. In the U.S., it has been available through the FDA's over-the-counter and prescription pathways, although recent concerns regarding toxicity have led to increased scrutiny. In Europe, similar molecules face evolving regulatory requirements emphasizing safety and efficacy, potentially impacting product availability.

Competitive Analysis

Key Competitors

NITRO-BID contends with multiple topical antimicrobial agents, including:

- Silver-based dressings: e.g., Silver sulfadiazine, commonly used in burn care.

- Mupirocin creams: for skin infections.

- Polymer-based antimicrobial dressings: Wound dressings infused with iodine, honey, or other agents.

Market Differentiators

NITRO-BID’s main advantages include proven efficacy, availability, and cost-effectiveness. However, competitors leverage better safety profiles, ease of use, or higher antimicrobial activity, which influences clinician preference.

Patent and Regulatory Challenges

Initial patents on nitrofurazone expired decades ago, leading to generic manufacturing proliferation. Regulatory concerns about potential carcinogenicity and toxicity have caused some markets to restrict use, which could hinder growth prospects.

Sales Projections and Growth Forecasts

Historical Sales Performance

Historically, NITRO-BID experienced steady sales driven by hospital procurement and wound clinics, with periodic fluctuations tied to safety alert issuance. The product’s annual sales in North America are estimated at USD 50-75 million, reflecting its niche status.

Projection Methodology

Our projections consider:

- Rising demand from increasing wound care needs.

- Competitive pressures and safety concerns reducing market share.

- Potential regulatory restrictions and clinical guidelines shifts.

- The impact of emerging alternatives and innovative therapies.

Forecast Overview (2023-2028)

| Year | Estimated Global Sales (USD Million) | Growth Rate | Key Drivers |

|---|---|---|---|

| 2023 | 60 | — | Steady demand, ongoing clinician use |

| 2024 | 63 | +5% | Increased chronic wound prevalence |

| 2025 | 66 | +5% | Broader adoption in emerging markets |

| 2026 | 64 | +0.5% | Regulatory restrictions in some regions, market stabilization |

| 2027 | 63 | -1.5% | Competitive shifts, safety concerns |

| 2028 | 62 | -1.5% | Market saturation, safer alternatives gaining ground |

Key Factors Influencing Outcomes

- Regulatory Risk: Stringent safety standards may restrict use, contributing to a plateau or decline.

- Market Penetration of Alternatives: Advanced antimicrobial dressings with improved safety profiles could erode NITRO-BID’s market share.

- Emerging Markets Opportunity: Increasing healthcare infrastructure in Asia-Pacific presents growth potential, offsetting mature markets' stagnation.

Strategic Opportunities and Challenges

Opportunities

- Reformulation and Safety Profiling: Developing safer formulations or new delivery mechanisms could revitalize product use.

- Expanding Use Cases: Targeting niche indications such as specific burn care protocols or outpatient wound management.

- Partnerships: Collaborating with hospitals and wound care providers can strengthen market presence.

Challenges

- Regulatory Restrictions: Safety concerns about nitrofurazone have limited use in certain regions.

- Market Competition: The rise of topical agents with better safety profiles.

- Longevity of Demand: The product’s relevance diminishes as newer therapies emerge.

Conclusion

NITRO-BID’s market remains primarily stable within specific institutional healthcare settings, but its long-term growth prospects face notable headwinds due to regulatory scrutiny and product competition. While global demand driven by increasing wound care needs sustains current sales levels, the product will likely experience gradual decline absent significant reformulation or strategic repositioning.

Key Takeaways

- The global wound care market is expanding, supporting NITRO-BID’s ongoing relevance, especially in high-need regions.

- Safety concerns and regulatory shifts limit future growth, emphasizing the need for reformulation or niche targeting.

- Strong demand exists in emerging markets, presenting an avenue for moderate sales expansion if regulatory hurdles are addressed.

- Competition from advanced antimicrobial dressings and systemic therapies further constrains NITRO-BID’s market share.

- Strategic innovation and partnerships are essential for sustained relevance in an evolving wound management landscape.

FAQs

1. What factors influence NITRO-BID’s sales performance?

Sales are primarily influenced by chronic wound prevalence, regulatory safety standards, clinician preferences, and competition from newer antimicrobial agents.

2. How do regulatory concerns impact NITRO-BID’s market?

Increased safety scrutiny can lead to restrictions or withdrawal in certain markets, limiting sales and adoption.

3. Are there ongoing developments to improve NITRO-BID?

Currently, no major reformulations are announced, but future development may focus on enhancing safety and efficacy tailored to market needs.

4. What regions show the highest growth potential for NITRO-BID?

Emerging markets in Asia-Pacific are poised for growth due to expanding healthcare infrastructure and increasing chronic wound care demand.

5. How does NITRO-BID compare to newer wound healing products?

While cost-effective and with proven efficacy, NITRO-BID lacks the safety profile and ease of use of modern antimicrobial dressings, limiting its competitive edge.

References

[1] Research and Markets. (2022). Wound Care Market – Growth, Trends, and Forecast (2022-2028).

More… ↓