Last updated: July 28, 2025

Introduction

Nisoldipine, a dihydropyridine calcium channel blocker (CCB), is primarily utilized in managing hypertension and angina pectoris. Developed by pharmaceutical giants, this drug entered the market during the late 1980s and gained prominence as an effective antihypertensive agent. Over the decades, changes in clinical guidelines, competitive landscape, and patent expirations have significantly influenced its market dynamics and financial trajectory. This analysis explores foundational factors—market drivers, competitive forces, regulatory considerations, and future outlook—to inform stakeholders' strategic decisions.

Market Overview and Key Applications

Nisoldipine’s primary indication remains hypertension, often in combination therapy for resistant cases. Its formulation, typically as extended-release (ER) tablets, ensures sustained blood pressure control. The global antihypertensive drug market is substantial, valued at approximately USD 36 billion in 2022 [1], with CCBs accounting for roughly 20%. While newer agents such as amlodipine and other CCBs have gained market share, nisoldipine retains niche segments, especially in markets where it is still under patent.

Clinical efficacy, safety profile, and ease of dosing establish nisoldipine’s standing. However, recent competition from generic formulations and shifts toward novel therapeutic agents challenge its market position. The drug’s positioning is further affected by the evolving paradigm emphasizing combination therapy and personalized medicine.

Market Drivers

1. Hypertension Prevalence and Aging Population

The rising prevalence of hypertension—estimated at over 1.3 billion worldwide—amid aging demographics sustains demand for antihypertensive agents. As the population ages, the incidence of resistant hypertension increases, potentially favoring drugs like nisoldipine with proven efficacy [2].

2. Clinical Guidelines and Therapeutic Preferences

Guidelines from the American Heart Association (AHA) and European Society of Cardiology (ESC) advocate CCBs as first-line agents, especially in specific cohorts. Demonstrated safety and tolerability bolster the appeal of nisoldipine, especially for elderly and comorbid patients.

3. Formulation Advancements

Extended-release formulations optimize patient compliance and titrate blood pressure control. Innovations in drug delivery sustain nisoldipine’s relevance, provided manufacturers continue to innovate.

4. Growing Markets in Emerging Economies

Rapid urbanization and increased awareness elevate antihypertensives’ demand in Asia-Pacific and Latin America. Regulatory approvals expanding nisoldipine's usage in these regions create new revenue streams.

Competitive Landscape and Market Challenges

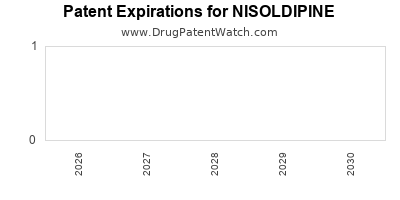

1. Patent Expiry and Generic Competition

The original patent for Nisoldipine's brand formulations has expired or is nearing expiration in major markets, escalating generic competition. Generics like Tildiem, Sular, and others now dominate significant market share, often at substantially lower prices [3].

2. Market Shifts Toward Amlodipine and Related Agents

Amlodipine, with its favorable pharmacokinetics, extensive clinical validation, and aggressive marketing, has supplanted nisoldipine's dominance in many regions. The latter's relatively limited marketing presence diminishes its market share.

3. Regulatory and Safety Considerations

Post-market safety data, including adverse effects like peripheral edema and hypotension, influence prescriber preferences. Regulatory stringency and adverse event profiles shape market sustainability.

4. Limited Innovation Post-Patent

Lack of significant formulation or mechanism innovations hampers differentiation. The absence of second-generation variants restricts growth in saturated markets.

Financial Trajectory and Revenue Trends

Historical Performance

During its initial launch, nisoldipine experienced rapid uptake driven by its perceived advantages over earlier agents. Peak global sales surpassed USD 200 million annually [4]. However, as patent protections waned and generics flooded the market, revenues declined sharply.

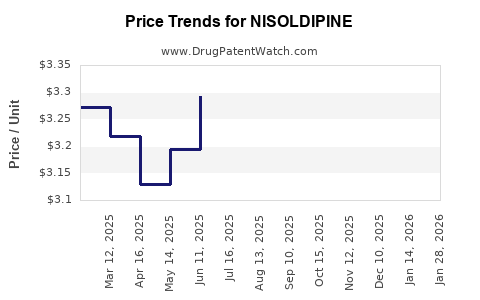

Current Figures and Projections

Recent financial disclosures indicate that branded sales have diminished by over 75% since the early 2000s, primarily due to generics. According to IQVIA data, niche markets or specific regional demand sustains revenues in the USD 10-20 million range. The financial outlook is heavily contingent on regional market penetration, regulatory policies, and brand strategies.

Future Outlook

Without significant innovation or new formulations, nisoldipine’s financial trajectory faces continued decline. Nonetheless, pharmacoeconomic evaluations, such as favorable cost-effectiveness profiles in certain populations, might preserve niche sales.

Potential Growth Strategies

- Product Differentiation: Developing combination formulations to enhance adherence.

- Market Expansion: Targeting unpenetrated regions with favorable pricing strategies.

- Pharmacovigilance Evidence: Highlighting safety advantages over competitors to persuade prescribers.

Regulatory Environment and Patent Landscape

Patent expiration in key territories (e.g., US in the early 2000s; Europe similar) has facilitated generic proliferation. Regulatory pathways for reformulations, biosimilars, or new delivery methods could provide avenues for extended market viability; however, these strategies require substantial investment and regulatory approval.

In emerging markets, regulatory hurdles vary, affecting timing and extent of market reentry or new approvals. International bodies like the FDA and EMA emphasize safety and efficacy, influencing market access.

Future Market Trends

- Personalized Medicine and Prescriber Preferences: Shift toward targeted therapy may marginalize older agents like nisoldipine unless supported by new clinical data.

- Combination Therapies: Co-formulations with agents like ACE inhibitors or diuretics could sustain niche relevance.

- Digital and Pharmacoeconomic Innovations: Digital adherence tools may indirectly benefit nisoldipine formulations that can integrate with new delivery systems.

- Regulatory Incentives: Orphan drug designations or patents on specific formulations could extend lifecycle.

Key Takeaways

-

Structural Decline, Niche Opportunities: Nisoldipine’s original patent exclusivity has expired, precipitating revenue declines amid fierce generic competition. However, strategic realignment focusing on niche markets, combination therapies, and new formulations could offer limited future avenues.

-

Market Expansion Requires Innovation: To sustain profitability, companies should explore formulation improvements or repositioning in emerging markets, where antihypertensive treatment remains critically needed.

-

Competitive Positioning Is Critical: The prominence of newer agents like amlodipine diminishes nisoldipine’s market share; thus, differentiating via safety profiles, cost-efficiency, or unique delivery systems remains essential.

-

Regulatory and Patent Strategies Are Vital: Active engagement in patent protections, regulatory filings, and clinical data generation shapes long-term viability.

-

Globalized Market Influences: The shifting global burden of hypertension, especially in demographics with limited healthcare infrastructure, signals potential growth zones for older agents if integrated with affordable health strategies.

FAQs

1. What are the main factors influencing nisoldipine’s declining market share?

Patent expiration, the advent of more effective or better-tolerated alternatives (like amlodipine), and aggressive generic competition have eroded nisoldipine’s dominance in the antihypertensive market.

2. Are there any ongoing efforts to reformulate nisoldipine to extend its lifecycle?

Some manufacturers explore combination formulations and extended-release versions, aiming to enhance patient adherence and differentiate products. However, large-scale development remains limited.

3. How significant are generic versions for nisoldipine’s commercial viability?

Generics drastically reduce revenue for branded formulations, often by 80-90%. Their presence transforms the competitive landscape, limiting profitability unless differentiated by formulation or indication.

4. In which regions might nisoldipine still see growth opportunities?

Emerging markets with growing hypertension prevalence and less saturated pharmaceutical markets, such as parts of Asia, Africa, and Latin America, offer potential for niche or brand-specific sales if regulatory and marketing strategies are effectively implemented.

5. What future developments could revitalize nisoldipine’s competitiveness?

Innovations in drug delivery, combination therapies, or evidence supporting superior safety profiles could provide a competitive edge, especially if coupled with targeted regional marketing and regulatory incentives.

References

[1] Statista. Global market size for antihypertensive drugs. 2022.

[2] World Health Organization. Global status report on noncommunicable diseases. 2014.

[3] IQVIA. Pharmaceutical sales data. 2022.

[4] GoodRx. Historical sales data for nisoldipine formulations. 2021.

In conclusion, nisoldipine’s market landscape is characterized by significant decline post-patent expiry, but strategic pursuits—innovation, regional expansion, and formulation enhancements—may carve out niche opportunities. Investor and corporate stakeholders should weigh these factors against current competitive pressures and regulatory dynamics to tailor future pathways.