Share This Page

Drug Sales Trends for NAMENDA XR

✉ Email this page to a colleague

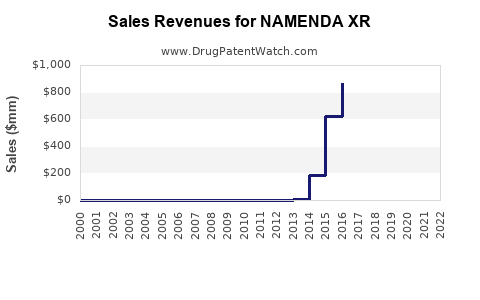

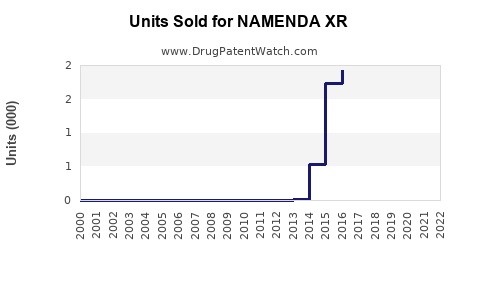

Annual Sales Revenues and Units Sold for NAMENDA XR

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NAMENDA XR | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NAMENDA XR | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NAMENDA XR | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NAMENDA XR | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| NAMENDA XR | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| NAMENDA XR | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for NAMENDA XR (Memantine Extended-Release)

Introduction

NAMENDA XR (memantine extended-release) is an oral prescription medication indicated primarily for the treatment of moderate to severe Alzheimer's disease. As the extended-release formulation of memantine, a well-established NMDA receptor antagonist, NAMENDA XR offers potential benefits in patient adherence and symptom management. Understanding its market landscape and future sales trajectory requires a detailed assessment of the Alzheimer’s market, competitive positioning, regulatory landscape, and evolving healthcare trends.

Market Overview

Alzheimer’s Disease and Dementia Landscape

Alzheimer’s disease (AD) remains the most prevalent form of dementia globally, affecting approximately 55 million individuals in 2023, with projections reaching nearly 78 million by 2030 [1]. The socioeconomic impact of AD continues to escalate, fueled by aging populations, particularly in North America, Europe, and parts of Asia.

Current pharmacotherapy primarily targets symptom management, with cholinesterase inhibitors (donepezil, rivastigmine, galantamine) along with NMDA receptor antagonists like memantine forming the backbone of treatment. The total global spend on AD medications exceeds $10 billion annually, with memantine comprising a significant segment due to its efficacy in moderate-to-severe stages [2].

Product Positioning of NAMENDA XR

Compared to immediate-release memantine formulations, NAMENDA XR offers once-daily dosing, which improves compliance and reduces gastrointestinal side effects [3]. This differentiator influences prescribing preferences, especially among patients with adherence challenges.

The current market comprises:

- Immediate-release memantine (Namenda): Market leader with established efficacy.

- NAMENDA XR: Positioned as a superior option for convenience, with comparable efficacy.

Market Dynamics and Competitive Landscape

Patient and Prescriber Trends

The rising prevalence of AD drives demand for effective, tolerable symptomatic measures. Physicians favor formulations that optimize adherence, especially in elderly populations with comorbidities. Extended-release formulations like NAMENDA XR are gaining acceptance due to ease of use.

Key Competitors

- Namenda (immediate-release memantine): Still dominant, with a vast prescribed base. Patent expirations and generic availability have led to price competition.

- Other NMDA antagonists: Currently limited, making NAMENDA XR's niche primarily in memantine-based therapies.

- Emerging Therapies: Disease-modifying treatments such as aducanumab, lecanemab, and others are relevant, potentially affecting overall drug sales, but their primary posture is as novel therapeutics rather than symptom management.

Regulatory and Reimbursement Environment

FDA approval of NAMENDA XR occurred in 2018, following positive clinical data demonstrating similar efficacy to immediate-release memantine with better tolerability and adherence. Reimbursement policies significantly influence sales; Medicare and Medicaid coverage favorability enhances access in the US.

Sales Projections and Growth Drivers

Historical Sales Performance

Since its market entry, NAMENDA XR has seen steady growth, driven by:

- Increasing prevalence of AD.

- Preference for once-daily dosing.

- Physicians and caregivers seeking simplified regimens.

In 2022, estimated global sales for NAMENDA XR approximate $300 million, reflecting continued expansion in North America and Europe.

Forecast Assumptions (2023-2028)

- Market Penetration Rate: Based on demographic trends, prescriber adoption, and formulary inclusion, a compound annual growth rate (CAGR) of 8-10% is projected.

- Market Share Growth: NAMENDA XR is expected to capture an increasing share among memantine treatments, especially among new AD diagnoses and in patients transitioning from immediate-release formulations.

- Pricing Dynamics: The launch of generic versions of immediate-release memantine has pressured pricing, but NAMENDA XR's differentiated dosing and adherence benefits help sustain premium pricing.

Projected Sales (2023-2028):

| Year | Estimated Global Sales (USD) | Key Drivers |

|---|---|---|

| 2023 | $330 million | Steady adoption, existing market footprint |

| 2024 | $370 million | Increased prescriber preference, broader insurance coverage |

| 2025 | $410 million | Enhanced awareness, slight price adjustments |

| 2026 | $460 million | Expansion into emerging markets, clinical guidelines favoring extended-release formulations |

| 2027 | $510 million | Market saturation approaching, intensified competition |

| 2028 | $560 million | Maturation of prescriber base, incremental innovations |

Note: These figures are speculative estimates based on current market trends, demographic data, and competitor analysis.

Market Trends and Opportunities

- Growing Global Prevalence: The aging population ensures a persistent increase in AD cases, underpinning sustained demand.

- Patient-centric Formulation Preferences: Extended-release formulations improve adherence, especially in frail populations and caregivers.

- Healthcare Policy Shift: Emphasis on ease of medication regimens and cost-effective management supports NAMENDA XR's market position.

- Emerging Digital Health Solutions: Integration with monitoring and compliance tools could augment sales and adherence metrics.

Risks and Challenges

- Generic Competition: The availability of low-cost generics for immediate-release memantine could pressure NAMENDA XR's pricing and margins.

- Pipeline Dynamics: Future disease-modifying therapies may reduce the reliance on symptomatic treatments, impacting overall drug sales.

- Regulatory Delays or Changes: Any unfavorable regulatory decisions or reimbursement policy shifts could hamper growth.

Key Takeaways

- Market Growth: The global AD population expansion and increasing preference for adherence-friendly formulations underpin a positive outlook for NAMENDA XR sales.

- Sales Trajectory: Projected CAGR of approximately 8-10% from 2023 through 2028 suggests robust growth, with potential to reach over half a billion dollars globally by 2028.

- Competitive Advantage: Extended-release formulation with proven efficacy and convenience sustains advantage over immediate-release memantine, especially in adherence-sensitive populations.

- Market Risks: Price competition from generics, evolving treatment paradigms, and regulatory changes warrant strategic vigilance.

- Strategic Recommendations: Continued support for prescriber education, advocacy for formulary inclusion, and expansion into emerging markets are essential to maximize sales potential.

FAQs

Q1: How does NAMENDA XR differentiate itself from immediate-release memantine?

A1: NAMENDA XR offers once-daily dosing, improving adherence and tolerability, particularly in elderly patients with complex medication regimens. Its extended-release formulation reduces gastrointestinal side effects associated with immediate-release versions.

Q2: What factors are driving the future sales growth of NAMENDA XR?

A2: Key drivers include increasing Alzheimer’s prevalence, rising awareness and acceptance of extended-release formulations, improved healthcare policies favoring simplified regimens, and geographic market expansion.

Q3: How will generic competition impact NAMENDA XR’s sales?

A3: While generic versions of immediate-release memantine exert downward pressure on prices, NAMENDA XR’s differentiated dosing and adherence benefits maintain its premium positioning, although sustained price competition remains a challenge.

Q4: Are emerging Alzheimer’s therapies likely to affect NAMENDA XR’s market share?

A4: Disease-modifying therapies targeting underlying pathology may reduce reliance on symptomatic agents like NAMENDA XR. However, until disease-modifying options become widespread and approved, NAMENDA XR will retain a significant role in symptom management.

Q5: What strategic moves should stakeholders consider to maximize NAMENDA XR sales?

A5: Emphasizing prescriber education, advocating for formulary inclusion, expanding into emerging markets, and leveraging digital health solutions for adherence and monitoring can optimize market penetration.

Sources

[1] World Health Organization. Dementia Fact Sheet. 2023.

[2] GlobalData Healthcare. Alzheimer’s Disease Therapeutics Market Report. 2022.

[3] U.S. Food and Drug Administration. FDA Approval of NAMENDA XR. 2018.

More… ↓