Last updated: July 27, 2025

Introduction

Nadolol, a non-selective beta-adrenergic blocker, has established its clinical relevance since its FDA approval in 1979 for conditions including hypertension, angina pectoris, and certain arrhythmias. Despite its age, nadolol continues to maintain a niche in cardiovascular therapeutics, with evolving market dynamics influenced by competitive landscape, patent status, clinical guidelines, and emerging treatment algorithms.

Market Overview

Nadolol's global market remains relatively stable but faces significant competitive pressures from newer beta-blockers and alternative antihypertensives. Its low cost and established safety profile cement its utility in specific patient populations, particularly where generic availability is widespread. As of 2023, the drug's revenues are largely driven by generic sales in developed markets and rising demand in emerging economies where affordability remains crucial.

The drug's use has declined modestly in some regions due to the advent of cardioselective beta-blockers like atenolol and metoprolol, which often exhibit fewer side effects. However, nadolol's unique pharmacokinetic profile—long half-life allowing once-daily dosing—continues to sustain its clinical relevance.

Market Drivers

-

Clinical Guidelines and Evidence-Based Practice: Current hypertension and arrhythmia management guidelines, including those from the American College of Cardiology (ACC) and the European Society of Cardiology (ESC), still endorse beta-blockers like nadolol in specific scenarios, notably in patients with concomitant ischemic heart disease.

-

Cost-Effectiveness and Generics: The absence of patent restrictions enables widespread generic manufacturing, making nadolol a cost-effective choice for both healthcare providers and payers. This affordability sustains volume sales, especially in resource-constrained settings.

-

Emerging Markets Expansion: Increased healthcare access and urbanization drive demand in regions such as Asia-Pacific, Latin America, and Africa, where affordability makes nadolol preferable over newer, more expensive therapies.

-

Treatment of Off-label Indications: Evidence supports nadolol's off-label use for conditions such as portal hypertension and certain forms of tremor, expanding its application.

Market Challenges

-

Competitive Pressure from Selective Beta-Blockers: Cardioselective agents with improved side effect profiles diminish nadolol's dominance in some indications.

-

Safety Concerns and Side Effects: Compared to newer agents, nadolol may have less favorable side effect profiles in certain patient populations, reducing its preference.

-

Lack of Patent Incentives: Being off-patent limits innovation and restricts marketing-driven growth opportunities, constraining revenue growth.

-

Regulatory Changes: Stringent regulations, surveillance, and quality standards—especially in emerging markets—may pose barriers to manufacturing and distribution.

Financial Trajectory Analysis

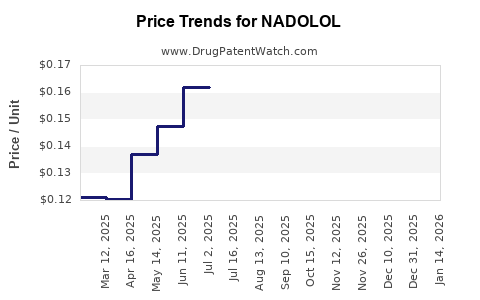

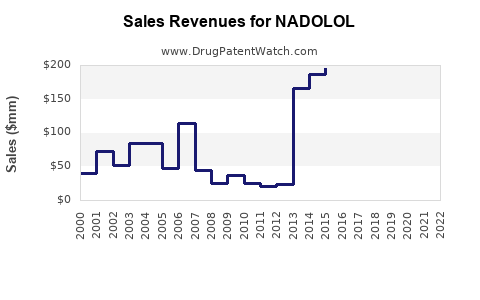

Historical Revenue Trends:

Nadolol's revenues have remained relatively stable, primarily due to its generic status and widespread clinical use. In 2022, estimated global sales ranged between $20–25 million, with a slight decline in mature markets due to competitive substitution by other agents.

Forecasted Growth and Revenue Potential:

Projected compound annual growth rate (CAGR) remains modest, estimated at 1–2% over the next five years, driven by increased demand in emerging markets. Factors such as population growth, better diagnosis rates, and improved healthcare infrastructure contribute positively.

Revenue Drivers:

- Generic Market Expansion: As patents have long expired, increased generic manufacturing reduces prices but maintains volume sales.

- New Indications Exploration: Investigational studies on nadolol for prophylactic migraine have not progressed significantly, limiting potential new revenue streams.

- Partnerships and Licensing: Limited licensing and strategic partnerships could unlock niche markets or drive innovation, possibly elevating revenue.

Risks and Opportunities:

- Market Penetration: Expanding into underrepresented regions could slightly elevate revenues.

- Formulation Innovation: Developing sustained-release formulations might improve compliance, presenting a minor revenue boost.

- Regulatory Approvals: Approval for additional indications could open new markets, although evidence remains scarce.

Regulatory and Patent Landscape

Nadolol's patent has long expired, classifying it as a mature, off-patent generic drug. This status constrains exclusivity-driven revenue growth but fosters price competition and accessibility.

Regulatory authorities continue to monitor safety and efficacy, with post-marketing surveillance maintaining drug quality standards. Future approvals for off-label uses demand rigorous clinical validation.

Competitive Landscape

The market for beta-blockers is crowded, with several generic and branded options. Key competitors include:

- Atenolol and Metoprolol: More cardioselective agents with established safety profiles.

- Propranolol: A non-selective beta-blocker with broader indications.

- Carvedilol and Bisoprolol: Drugs with additional properties offering alternative benefits.

The competitive edge of nadolol lies in its pharmacokinetics—particularly its long half-life (~20–24 hours)—allowing once-daily dosing, which enhances adherence.

Strategic Outlook

The company's focus should be on maintaining market share through:

- Cost Leadership: Ensuring competitive pricing in all markets.

- Geographic Expansion: Target emerging economies with growing cardiovascular disease burdens.

- Formulation Enhancements: Developing novel formulations to improve patient compliance.

- Clinical Data Generation: Supporting studies for off-label indications to enhance utility, especially in ancillary markets like migraine prophylaxis.

Key Takeaways

- Stable but Mature Market: Nadolol remains a cost-effective, clinically relevant beta-blocker primarily driven by generic sales.

- Limited Growth Potential: Revenue growth is constrained by generic competition, aging patent status, and substitution by newer agents.

- Emerging Market Opportunities: Growth prospects hinge on expanding access and utilization in developing regions.

- Innovation and Differentiation: Minor formulation improvements and validation for additional indications could offer modest revenue lifts.

- Strategic Positioning: Maintaining competitive pricing, expanding geographic reach, and supporting clinical research are vital for sustained trajectory.

FAQs

Q1: How does nadolol compare to other beta-blockers in clinical safety?

A1: Nadolol's non-selective profile and long half-life favor compliance but may lead to more side effects like fatigue or bronchospasm compared to cardioselective agents, particularly in patients with respiratory conditions.

Q2: Can nadolol be used for migraine prophylaxis?

A2: While off-label, some studies suggest efficacy in migraine prevention; however, regulatory approval and more robust data are necessary for mainstream recommendation.

Q3: What factors influence nadolol’s market share in developed countries?

A3: Prescriber preferences, clinical guidelines, patient tolerability, and formulary inclusions primarily determine market share, with newer beta-blockers often favored for specific indications.

Q4: Will patent laws affect nadolol's future sales?

A4: Since its patent has expired, future sales are mainly influenced by generic competition, pricing strategies, and clinical utility rather than exclusivity.

Q5: What are the key growth strategies for nadolol manufacturers?

A5: Focus on expanding into emerging markets, developing new formulations, supporting clinical research for additional indications, and maintaining cost competitiveness.

Sources

- U.S. Food and Drug Administration. Nadolol [Prescribing Information]. 1979.

- MarketWatch. Beta-Blockers Market Report 2022-2032.

- European Society of Cardiology. Guidelines on Prevention of Cardiovascular Disease. 2021.

- IMS Health. Global Pharmaceutical Market Data. 2022.

- World Health Organization. Cardiovascular Disease Data & Trends. 2021.