Last updated: July 27, 2025

Introduction

Nabumetone, a non-steroidal anti-inflammatory drug (NSAID), is primarily used to treat conditions such as rheumatoid arthritis and osteoarthritis. As a product of Johnson & Johnson's subsidiary, Janssen Pharmaceuticals, nabumetone has carved a niche within the NSAID market. Its unique pharmacological profile and market positioning influence its market trajectory and financial prospects amid evolving healthcare dynamics.

Pharmacological Profile and Market Positioning

Nabumetone distinguishes itself from traditional NSAIDs through its selective COX-2 enzyme inhibition, aiming to reduce gastrointestinal side effects associated with NSAID use. This attribute positions nabumetone favorably among patients with heightened gastrointestinal risk, a significant market segment given the widespread prevalence of arthritis and related conditions.

Despite its advantages, nabumetone's market share remains modest compared to competitors like ibuprofen, naproxen, and celecoxib. Factors influencing its positioning include established prescribing habits, brand loyalty, and the availability of newer therapeutic agents such as biologics.

Market Dynamics

- Prevalence of Arthritis and Chronic Pain

The rising global prevalence of osteoarthritis and rheumatoid arthritis drives demand for NSAIDs. According to the Global Burden of Disease Study, musculoskeletal disorders are among the leading causes of disability worldwide [1]. This epidemiological trend sustains the baseline demand for drugs like nabumetone.

- Shift Toward Safer NSAIDs

Safety profiles significantly influence prescribing behaviors. Nabumetone's lower gastrointestinal toxicity offers competitive advantage over traditional NSAIDs in populations at risk for GI adverse events. However, the emergence of selective COX-2 inhibitors (e.g., celecoxib) has challenged nabumetone's market share due to their targeted safety profile.

- Regulatory Environment

Regulatory scrutiny pertaining to NSAID-associated cardiovascular risks, notably posterior issues linked to some COX-2 inhibitors, influences market dynamics. Companies must navigate stringent safety assessments, impacting product positioning and marketing strategies [2].

- Competitive Landscape

Generic availability and patent expiration timelines impact revenue potential. While nabumetone's patent has long expired, its popularity is restrained by the dominance of other NSAIDs and biologics. Market penetration hinges on differentiating safety and efficacy profiles and price competitiveness.

- Healthcare Cost and Reimbursement Policies

Reimbursement frameworks and healthcare expenditures directly affect sales. Cost-effective NSAID options like nabumetone find favor in cost-sensitive markets, especially in developing regions where patented biologics remain inaccessible.

- Emerging Therapeutics

The advent of biologic disease-modifying antirheumatic drugs (DMARDs) and targeted synthetic DMARDs offers alternatives for severe rheumatoid arthritis, potentially reducing NSAID reliance. This therapeutic evolution constrains nabumetone’s long-term market growth, primarily limited to mild to moderate cases.

Financial Trajectory

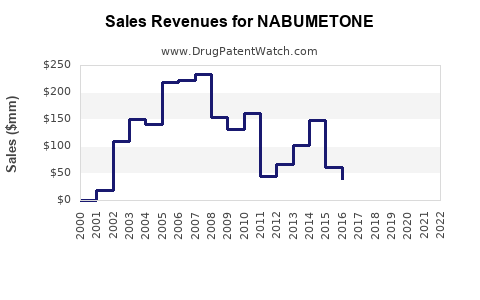

- Historical Performance

As a relatively minor player within Johnson & Johnson’s portfolio, nabumetone historically generated modest revenue, primarily driven by steady prescriptions for arthritis management. Its sales are characterized by stability rather than growth, constrained by market saturation and intense competition.

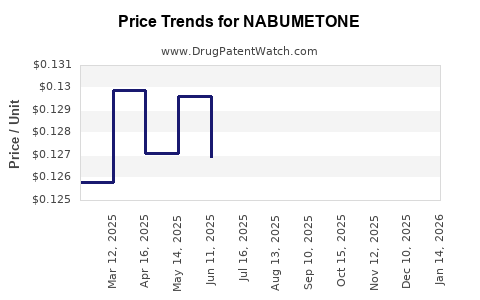

- Current Market Trends

The shift toward personalized medicine and targeted therapies constrains NSAID growth. While nabumetone benefits from its safety profile, overall demand growth is tempered. Johnson & Johnson's strategic focus on innovative and biologic therapies further limits investment in nabumetone-specific R&D, potentially leading to revenue plateau or decline.

- Forecasted Growth

Forecasts project limited growth prospects for nabumetone, with incremental sales driven by aging populations and continued use in less severe cases. However, the expanding availability of safer and more effective alternatives—particularly in developed markets—may inversely impact sales volumes.

- Emerging Markets

In regions with limited access to biologics, nabumetone could experience modest growth due to its favorable safety profile and affordability. Strategic marketing and physician education could unlock additional demand streams.

- Impact of Patent and Patent-Like Exclusivities

Since patent expiration, generic competitors have entered the market, exerting downward pressure on prices and margins. Consequently, revenue trajectories are expected to remain muted unless niche utility or formulations are developed.

Strategic Implications

For stakeholders, understanding nabumetone’s market and financial trajectory reveals several strategic insights:

- Product Differentiation: Emphasizing nabumetone’s safety profile in markets with high GI complication risk sustains its niche status.

- Market Expansion: Focusing on emerging markets where NSAIDs remain first-line treatments could bolster sales.

- Formulation Innovation: Developing novel formulations or combination therapies could create new revenue streams.

- Positioning Amid Competition: Highlighting distinct pharmacokinetic properties and safety benefits could reinforce its market niche against newer competitors.

Conclusion

Nabumetone's market dynamics are characterized by a mature, commoditized environment facing increasing competition from both traditional NSAIDs and novel biologics. Its financial trajectory appears stable but limited, with growth potential primarily in underserved markets or niche applications. Strategic positioning emphasizing safety and cost-effectiveness remains vital for maintaining relevance.

Key Takeaways

- Nabumetone benefits from a safety profile that appeals to specific patient segments, notably those at risk for gastrointestinal complications.

- The global rise in arthritis prevalence sustains baseline demand, but competition from newer therapeutics constrains growth.

- Patent expirations and generic competition have suppressed pricing and profit margins, impacting revenue potential.

- Expansion into emerging markets offers modest growth opportunities due to affordability and limited access to biologics.

- Innovation and targeted market strategies are essential for extending the product’s financial viability amidst evolving healthcare landscapes.

FAQs

1. What distinguishes nabumetone from other NSAIDs?

Nabumetone is a selectively formulated NSAID with reduced gastrointestinal toxicity, making it preferable for patients with GI risk factors—a significant differentiator among NSAIDs.

2. How does the patent lifecycle affect nabumetone’s financial outlook?

Since patent expiration, generic competition has driven prices down, limiting revenue growth and emphasizing the importance of niche positioning and market expansion.

3. What are the main competitive threats to nabumetone?

Traditional NSAIDs, selective COX-2 inhibitors with improved safety profiles, and biologic therapies for severe arthritis pose significant competition, reducing nabumetone’s market share.

4. Can nabumetone expand its market presence?

Yes, particularly in emerging markets and among patients contraindicated for biologics. Strategic marketing emphasizing its safety and affordability can facilitate growth.

5. What future developments could impact nabumetone’s market?

The advent of personalized medicine, new anti-inflammatory agents, and safer biologic therapies could further diminish NSAID relevance, necessitating continued innovation and strategic repositioning.

Sources:

[1] GBD 2017 Disease and Injury Incidence and Prevalence Collaborators. "Global, regional, and national incidence, prevalence, and years lived with disability for 354 diseases and injuries, 1990–2017." The Lancet, 2018.

[2] Silverstein, F.E., et al. "Gastrointestinal toxicity of nonsteroidal anti-inflammatory drugs." New England Journal of Medicine, 1999.