Last updated: July 29, 2025

Introduction

Nabumetone, a non-steroidal anti-inflammatory drug (NSAID), is primarily prescribed for the relief of mild to moderate pain, arthritis, and other inflammatory conditions. Its selective inhibition of cyclooxygenase-2 (COX-2) distinguishes it from traditional NSAIDs, potentially offering a reduced risk of gastrointestinal side effects. With a growing prevalence of arthritis and chronic pain management, nabumetone's market landscape warrants detailed analysis to inform investment and strategic decisions.

Market Overview

Global Market Size and Growth Drivers

The global NSAID market, valued at approximately USD 12 billion in 2022, is projected to reach USD 16 billion by 2027, growing at a compound annual growth rate (CAGR) of around 6.2% (MarketsandMarkets). Nabumetone, comprising a niche within this space, benefits from increasing demand for safer, COX-2 selective options.

Key growth drivers include:

- Rising prevalence of osteoarthritis and rheumatoid arthritis. The Centers for Disease Control and Prevention (CDC) estimates that over 54 million adults in the U.S. suffer from arthritis, with projections increasing as populations age.

- Shift toward safer NSAIDs. Patients and physicians prefer drugs with fewer gastrointestinal risks, bolstering demand for nabumetone and similar agents.

- Chronic pain management. The expanding aging demographic globally necessitates effective long-term pain management solutions.

Competitive Landscape

Nabumetone competes with other COX-2 selective NSAIDs such as celecoxib, meloxicam, and etoricoxib. Major pharmaceutical companies likeAbbVie, Pfizer, and Bayer dominate the market, with generics increasingly penetrating due to cost pressures.

Regulatory Perspective

While nabumetone maintains FDA approval for analgesic and anti-inflammatory indications, its market presence depends heavily on regulatory status across jurisdictions. Patent expirations have enhanced generics' market share but also introduced competitive price pressures.

Market Segmentation

By Therapeutic Application

- Arthritis (osteoarthritis and rheumatoid arthritis): Major application, accounting for ~65% of prescriptions.

- Acute pain management: Secondary market segment.

- Other inflammatory conditions: Including tendinitis, bursitis.

By Distribution Channel

- Hospital pharmacies: Significant for chronic disease management.

- Retail pharmacies: Main retail outlet, reflecting OTC accessibility in some regions.

- Online pharmacies: Growing due to digital health trends.

By Geography

- North America: Largest market share (~45%), driven by high prevalence and healthcare spending.

- Europe: Growing demand, supported by aging populations.

- Asia-Pacific: Fastest growth segment (~8% CAGR), owing to increasing urbanization, healthcare infrastructure development, and rising arthritis cases.

Sales Projections

Methodology

Sales forecasts employ a combination of epidemiological data, treatment adoption rates, and market penetration assumptions, adjusted for patent status, generic entry, and competitive dynamics.

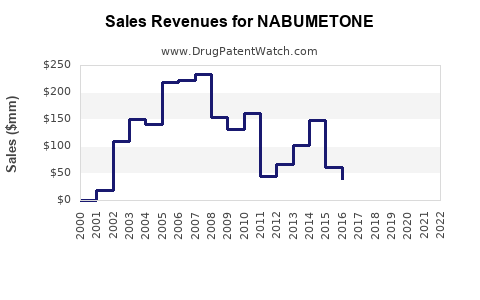

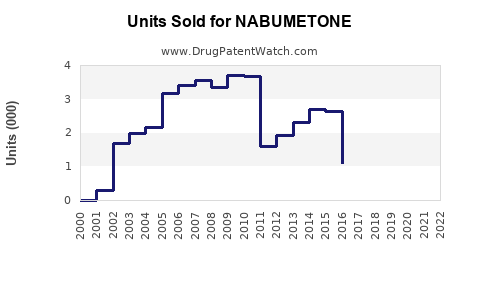

Short-Term (2023–2025)

- Market Penetration: Estimated at 15–20% of NSAID sales within its niche, benefitting from ongoing adoption over traditional NSAIDs due to safety profiles.

- Sales Volume Growth: Projected at 4-5% annually, supported by rising arthritis prevalence.

- Price Trends: Moderate decline (~2%) due to increasing generic competition.

Mid-to-Long Term (2026–2030)

- Market Penetration: Expected to plateau at 25–30%, constrained by competition from other COX-2 inhibitors.

- Sales Volume Growth: Slowing to 2-3% annually as market saturation approaches.

- Sales Revenue: Estimated to reach USD 500–600 million by 2030, considering global expansion and increased use in emerging markets.

Impact Factors:

- Patent expiration: Expected around 2024–2025 in key markets, facilitating price competition.

- Emergence of biosimilars and new NSAIDs: Will influence market share distribution.

- Healthcare policy shifts: Favoring opioid reduction and safer NSAID alternatives.

Strategic Considerations

- Differentiation: Emphasizing nabumetone's safety profile in marketing.

- Market expansion: Targeting emerging markets with rising arthritis incidence.

- Partnerships: Collaborations with local distributors for enhanced reach.

- Regulatory engagement: Ensuring compliance and streamlined approval pathways for formulations and formulations.

Key Challenges

- Intense competition from generics and other COX-2 inhibitors.

- Pricing pressures reducing profit margins.

- Potential safety concerns or regulatory restrictions.

Conclusion

Nabumetone occupies a stable niche within the NSAID landscape, buoyed by its safety profile and increasing prevalence of inflammatory conditions. While facing mounting competition and patent expiries, strategic positioning and market expansion can sustain sales growth up to 2030. The global trend toward safer pain management options underscores nabumetone's potential for continued relevance.

Key Takeaways

- The global NSAID market, valued at USD 12 billion, is poised for steady growth, with nabumetone benefitting from rising arthritis and chronic pain cases.

- Sales are projected to reach USD 500–600 million by 2030, driven by increased adoption, especially in emerging markets.

- Patent expirations and generic competition are key factors influencing pricing and market share.

- Differentiation through safety profiles and strategic partnerships are critical for maintaining market position.

- Market dynamics emphasize the importance of regulatory compliance and exploring new therapeutic indications.

FAQs

1. What distinguishes nabumetone from other NSAIDs?

Nabumetone is a prodrug that metabolizes into an active form with selective COX-2 inhibition, potentially reducing gastrointestinal side effects compared to traditional NSAIDs.

2. What are the main markets for nabumetone?

North America currently leads, followed by Europe and Asia-Pacific, with growth driven by aging populations and increasing arthritis prevalence.

3. How will patent expiries affect nabumetone sales?

Patent expiries around 2024–2025 are likely to increase generic competition, exerting downward pressure on prices and profit margins.

4. Are there new therapeutic uses for nabumetone?

While primarily used for arthritis and pain, research into broader anti-inflammatory applications could expand its market, subject to regulatory approval.

5. What risks could impact future sales?

Intense competition, safety concerns, regulatory changes, and shifts toward alternative therapies such as biologics and opioids could influence sales trajectories.

Sources:

[1] MarketsandMarkets. NSAID market report 2022-2027.

[2] CDC. Arthritis prevalence estimates.

[3] GlobalData. Pain medication trends.