Last updated: July 28, 2025

Introduction

The pharmaceutical landscape governing MYMETHAZINE FORTIS, a methylphenidate-based medication, is characterized by evolving market demands, regulatory considerations, and competitive forces. As a stimulant primarily indicated for attention deficit hyperactivity disorder (ADHD) and narcolepsy, MYMETHAZINE FORTIS's commercial success hinges on intricate market dynamics and its capacity to carve out a significant share within a saturated therapeutic segment.

This analysis delineates the factors shaping MYMETHAZINE FORTIS’s market trajectory, from current trends and regulatory environment to competitive pressures and investor outlook, to aid stakeholders in strategic decision-making.

Market Overview

The global ADHD medication market is projected to reach approximately USD 15 billion by 2027, fueled by increasing diagnosis rates, heightened awareness, and expanding treatment horizons [1]. Methylphenidate compounds, including formulations such as MYMETHAZINE FORTIS, comprise a substantial portion of this market, owing to their well-established efficacy and clinician familiarity.

The development of extended-release formulations, including MYMETHAZINE FORTIS, aligns with consumer preferences for convenience and consistent symptom control. Its potential to meet unmet needs in pediatric and adult populations underpins its commercial promise.

Market Drivers

-

Rising Prevalence of ADHD and Sleep Disorders

Epidemiological studies indicate a rising global prevalence of ADHD, affecting approximately 5-10% of children and 2-5% of adults [2]. Similarly, narcolepsy incidence, although rarer, presents a niche for targeted therapeutics. MYMETHAZINE FORTIS’s efficacy in these indications positions it favorably to capitalize on these trends.

-

Expanded Indications and Off-Label Use

Emerging research and off-label applications, such as cognitive enhancement and treatment of refractory depression, can augment market opportunities. Careful clinical validation remains critical to expanding indications legally and ethically.

-

Regulatory Approvals and Market Access

The regulatory landscape remains pivotal. Recent approvals by authorities such as the FDA and EMA bolster confidence among prescribers and patients. Patent protections, exclusivity periods, and pricing negotiations also influence revenue trajectories.

-

Advancements in Formulation Technology

MYMETHAZINE FORTIS’s extended-release profile offers competitive advantages over immediate-release variants. Improved pharmacokinetics enhance adherence, efficacy, and patient satisfaction, thereby supporting sustained market share.

Market Challenges

-

Intense Competition

The stimulant market faces intense competition from both branded and generic methylphenidate products. Established players such as Medikinet, Concerta, and Ritalin enforce price competition and market saturation, underscoring the need for distinct clinical and formulary positioning.

-

Generic Entrants and Price Pressures

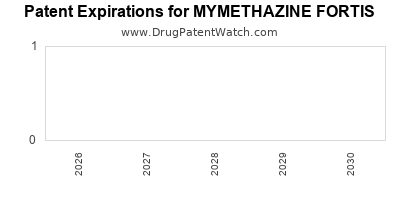

Patent expirations threaten exclusivity. Generics undercut pricing, compelling drug developers to pursue novel delivery systems and formulations to maintain profitability.

-

Regulatory and Public Health Scrutiny

The heightened scrutiny of stimulant abuse potential and regulatory restrictions on prescribing practices pose challenges. Careful positioning and compliance are necessary to mitigate market access barriers.

-

Market Penetration in Emerging Economies

While mature markets offer stable revenue streams, emerging economies present growth opportunities tempered by infrastructure challenges, regulatory hurdles, and cost sensitivity.

Financial Trajectory

Revenue Projections

Initial launch phases typically involve heavy marketing and educational campaigns. Based on analogous drugs, MYMETHAZINE FORTIS could expect an initial market penetration of 10-15%, with revenues scaling as awareness increases and prescriber confidence solidifies. If the drug captures 15% of the USD 15 billion global ADHD market by 2027, annual revenues could approximate USD 2.25 billion, assuming competitive pricing strategies [1].

Cost Structure and Profitability

Development costs encompass R&D, regulatory approval processes, manufacturing scale-up, and marketing expenses. Post-launch, recurring costs relate to production, distribution, pharmacovigilance, and reimbursement negotiations. As patent protection endures, profit margins are expected to stabilize, with potential for significant returns if market penetration exceeds projections.

Investment and Funding Outlook

Pharmaceutical firms investing in MYMETHAZINE FORTIS can expect an attractive long-term outlook contingent on successful clinical demonstration, regulatory approval, and market acceptance. Strategic partnerships and licensing agreements can enhance financial stability and accelerate market access.

Regulatory and Policy Impact on Financial Trajectory

Global regulatory trends toward stricter controls on stimulant prescriptions—due to concerns over misuse and dependence—may influence demand. Conversely, innovative formulations and abuse-deterrent technologies could mitigate these concerns, fostering a more favorable financial outlook.

Emerging Trends Shaping Future Financial Outlook

- Personalized Medicine: Tailoring treatments to genetic profiles may refine patient selection and optimize outcomes, enhancing drug valuation.

- Digital Health Integration: Incorporating digital adherence tools can improve treatment continuity and data collection, adding value.

- Market Diversification: Expanding indications and geographies can buffer market risks and diversify revenue streams.

Conclusion

MYMETHAZINE FORTIS’s market dynamic stems from its position within a burgeoning stimulant market driven by increasing ADHD prevalence and demand for extended-release formulations. Financially, the drug’s trajectory depends heavily on regulatory success, competitive positioning, and innovation in formulation technology. While challenges persist, strategic execution—particularly in expanding indications and navigating regulatory landscapes—can position MYMETHAZINE FORTIS as a lucrative asset in the long-term pharmaceutical portfolio.

Key Takeaways

- Growing Market Potential: The global ADHD medication market is expanding, favoring formulations like MYMETHAZINE FORTIS, especially with its extended-release profile aligning with patient preferences.

- Competitive Landscape: The presence of multiple generic methylphenidate products necessitates differentiation via formulation innovation, clinical validation, and market access strategies.

- Regulatory and Policy Considerations: Navigating global regulatory environments and addressing abuse liability concerns are critical to maximizing market penetration.

- Revenue Opportunities: With strategic positioning, MYMETHAZINE FORTIS could achieve substantial revenue, contingent on successful clinical and regulatory milestones.

- Diversification and Innovation: Embracing personalized medicine, digital integration, and expanding indications will be instrumental in sustaining financial growth.

FAQs

-

What are the primary clinical advantages of MYMETHAZINE FORTIS over existing methylphenidate formulations?

MYMETHAZINE FORTIS’s extended-release mechanism offers sustained symptom control, improved adherence, and reduced dosing frequency, providing a competitive edge over immediate-release variants.

-

How does regulatory approval impact MYMETHAZINE FORTIS's financial chances?

Regulatory approval validates safety and efficacy, enabling market entry, price setting, and reimbursement. Delay or denial can significantly hinder revenue prospects.

-

What strategies can maximize MYMETHAZINE FORTIS's market penetration?

Incorporating clinical education, early access programs, strategic alliances, and geographic expansion can effectively increase adoption rates.

-

How will competition from generics influence MYMETHAZINE FORTIS's profitability?

Generics exert downward pressure on prices, necessitating differentiation through formulation, branding, or added value services to maintain margins.

-

What future innovations could enhance MYMETHAZINE FORTIS’s market position?

Development of abuse-deterrent formulations, digital adherence tools, and expanding therapeutic indications can strengthen its market presence and financial trajectory.

References

[1] Grand View Research. “ADHD Drugs Market Size, Share & Trends Analysis Report.” 2021.

[2] Polanczyk G, et al. “The worldwide magnitude of ADHD: a systematic review and meta-regression analysis.” The Canadian Journal of Psychiatry, 2015.