Last updated: December 20, 2025

Executive Summary

Modafinil (brand names include Provigil and Alertec) is a wakefulness-promoting agent indicated primarily for narcolepsy, shift work sleep disorder, and excessive daytime sleepiness associated with conditions such as ADHD and obstructive sleep apnea. Over the past decade, the global market for Modafinil has experienced significant developments driven by shifting regulatory landscapes, expanding therapeutic indications, and increasing off-label use.

This analysis provides a comprehensive overview of the market and financial trajectory for Modafinil, including current demand, growth drivers, competitive landscape, regulatory challenges, and future outlook. Emphasis is placed on recent patent expirations, market entrants, pricing trends, and key industry players shaping the landscape.

Market Overview

| Aspect |

Detail |

| Global Market Size (2022) |

Estimated at USD 1.2 billion with a compound annual growth rate (CAGR) of 6.2% expected through 2030 [1]. |

| Key Markets |

United States, Europe, Japan, China, emerging markets in Asia and Latin America. |

| Major Manufacturers |

Cephalon (acquired by Teva), Sun Pharma, Mylan, Luiten, and generic drugmakers. |

| Therapeutic Use |

Narcolepsy (~43%), shift work disorder (~17%), ADHD (~12%), off-label cognitive enhancement (~28%). |

Market Drivers

1. Expanding Approved Indications

Modafinil's original FDA approval in 1998 has been extended to multiple indications, broadening its market potential. For example, off-label use for cognitive enhancement in healthy individuals is a significant, though unregulated, driver.

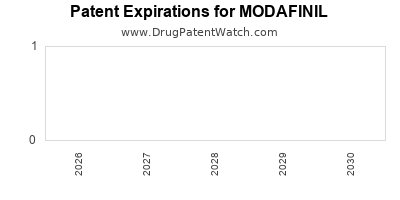

2. Patent Expiry and Generics Entry

Patent expiration in key markets (U.S. in 2013, EU in 2014) prompted a surge in generic competition, reducing prices but increasing volume-driven revenue streams for manufacturers.

3. Growing Awareness of Sleep Disorders

Incidence of sleep disorders is rising globally, fueled by lifestyle changes, increasing obesity, and aging populations, bolstering demand.

4. Regulatory Approvals & Off-Label Demand

Increased off-label prescriptions for cognitive and military purposes; the U.S. military, for example, has evaluated Modafinil for operational alertness.

5. Ethical and Legal Concerns

Off-label use and potential abuse have prompted regulatory scrutiny, influencing market dynamics.

Competitive Landscape

Market Share Distribution (2022)

| Company |

Market Share |

Notes |

| Teva (via Cephalon) |

~45% |

Leader pre- and post-patent expiration; dominant in generic segment. |

| Sun Pharma |

~10% |

Notable for aggressive pricing and broad distribution. |

| Mylan |

~8% |

Focused on generic formulations, especially in Europe. |

| Other Generics |

~25% |

Includes local manufacturers in Asia and Latin America. |

| Innovator Brands |

~12% |

Small but strategic segment targeting niche indications. |

Note: Market shares are estimations based on global sales data and patent statuses.

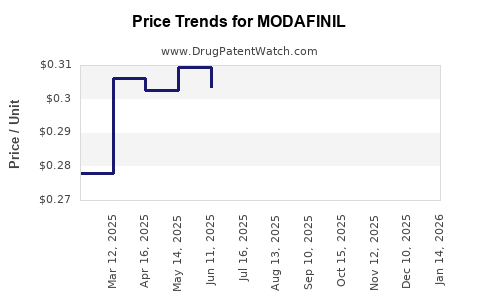

Pricing Trends

| Timeframe |

Price (USD per tablet) |

Notes |

| 2010 |

$4.00 - $6.00 |

Patent-protected era; limited generics. |

| 2014 |

$1.50 - $3.00 |

Post-patent expiry; increased generic competition. |

| 2022 |

$0.50 - $1.50 |

Market saturation and volume growth. |

Regulatory Landscape

| Region |

Status |

Implications |

| United States |

FDA-approved; FDA enforces strict off-label use controls |

Patent expiration led to generics; off-label use remains prevalent. |

| European Union |

EMA-approved; national agencies regulate off-label use |

Similar patent and regulatory status as US; stricter control. |

| Asia (China, Japan) |

Regulations vary; increasing acceptance |

Growing market; potential for regulatory hurdles on imports. |

| Legal & Ethical Issues |

Concerns about misuse, military use, and cognitive enhancement |

Potential for regulatory tightening affecting market growth. |

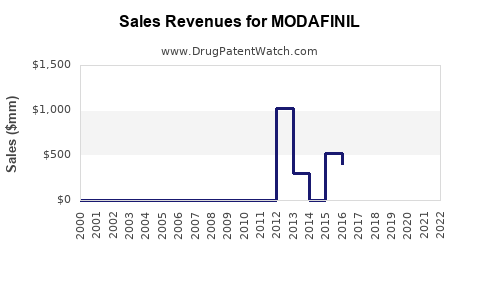

Financial Trajectory and Revenue Projections

| Year |

Estimated Global Revenue (USD billions) |

Notes |

| 2022 |

1.2 |

Peak revenue post-patent expiry driven by generics. |

| 2025 |

1.4 |

Expected increase due to expanding indications and off-label use. |

| 2030 |

1.7 |

Market maturation; driven by new formulations and emerging markets. |

Revenue Breakdown by Region (2022)

| Region |

Percentage of Total Revenue |

Key Factors |

| North America |

52% |

Largest market, high off-label usage, patent expiries. |

| Europe |

25% |

Mature market, high acceptance and regulatory control. |

| Asia-Pacific |

15% |

Growth potential, increasing awareness, and manufacturing hubs. |

| Rest of World |

8% |

Emerging markets with growing sleep disorder prevalence. |

Emerging Trends and Innovations

Novel Formulations

- Extended-Release (XR) formulations: Increasing availability enhances compliance.

- Combination Therapies: Combining Modafinil with other CNS drugs to target comorbidities.

Digital Health Integration

- Digital adherence devices and monitoring apps improve patient compliance, impacting revenue consistency.

Market Expansion through Off-Label Uses

- Cognitive enhancement remains unregulated but lucrative, especially in academic and military sectors.

Challenges Facing the Modafinil Market

| Challenge |

Impact |

Mitigation Strategies |

| Regulatory Scrutiny |

Potential restrictions on off-label use |

Engage policymakers, reinforce clinical value. |

| Generic Competition |

Price erosion |

Focus on differentiated formulations and niche markets. |

| Potential Abuse and Dependence |

Regulatory restrictions, reputation risk |

Implement strict prescribing guidelines. |

| Intellectual Property & Patent Litigation |

Delays in market expansion |

Patent strategies, licensing agreements. |

Comparison: Modafinil vs. Related Wakefulness Agents

| Attribute |

Modafinil |

Armodafinil |

Traditional Stimulants (e.g., Amphetamines) |

| Approval Indications |

Narcolepsy, shift work disorder |

Same as Modafinil |

Narcolepsy, ADHD |

| Schedule (US) |

Not scheduled (FDA approved) |

Not scheduled |

Schedule II |

| Side Effect Profile |

Fewer cardiovascular issues, lower abuse potential |

Similar |

Higher abuse potential, cardiovascular risks |

| Cost |

Lower post-generic |

Slightly higher |

Varies, often higher |

Future Outlook and Investment Opportunities

| Opportunity |

Rationale |

Risks |

| Emerging Markets |

Increasing sleep disorder prevalence |

Regulatory barriers, market entry costs |

| Novel Drug Delivery |

Improved compliance, reduced misuse |

R&D costs, delayed ROI |

| Off-Label Cognitive Markets |

Untapped high-margin sector |

Ethical and legal challenges |

| Partnerships & Licensing |

Broader access and market penetration |

Competitive dynamics, regulatory delays |

Conclusion

Modafinil's market is characterized by a mature core with expanding peripheral opportunities. While patent expiry and generic competition have depressed prices, increased utilization for established and emerging indications sustains revenue growth. Regulatory oversight and ethical considerations remain critical factors influencing its trajectory.

Key Takeaways

- The global Modafinil market was approximately USD 1.2 billion in 2022, with projections reaching USD 1.7 billion by 2030.

- Patents protection ended in major markets between 2013-2014, encouraging generic proliferation.

- Demand continues to grow due to rising sleep disorder prevalence and off-label use for cognitive enhancement.

- Regulatory scrutiny on off-label use and abuse potential could impact future growth.

- Opportunities exist in emerging markets, novel formulations, and digital health integrations.

- Strategic positioning around niche indications and geopolitical considerations will define market leaders.

FAQs

1. What are the primary therapeutic indications for Modafinil?

Modafinil is primarily prescribed for narcolepsy, shift work sleep disorder, and excessive daytime sleepiness associated with conditions like obstructive sleep apnea and ADHD.

2. How has patent expiration affected Modafinil's market dynamics?

Patent expirations in 2013-2014 led to a surge in generic manufacturing, significantly reducing prices but increasing market volume, thus maintaining overall revenue streams.

3. What are the key challenges facing Modafinil manufacturers?

Regulatory scrutiny, potential restrictions on off-label use, abuse risks, and intense generic competition are foremost challenges impacting profit margins and growth.

4. Which regions present the highest growth opportunities?

Emerging markets in Asia-Pacific and Latin America, driven by increasing sleep disorder prevalence and regulatory enhancements, offer significant growth potential.

5. What future innovations could impact the Modafinil market?

Extended-release formulations, combination therapies, digital adherence tools, and formulations targeting new indications could redefine market dynamics.

References

[1] Market Research Future. “Global Modafinil Market Overview,” 2022.

[2] IQVIA Data, "Pharmaceutical Sales Analysis," 2022.

[3] U.S. Food and Drug Administration. “FDA Approval Notices,” 1998, 2013.

[4] European Medicines Agency. “Summary of Product Characteristics for Modafinil,” 2015.

[5] Drug Enforcement Administration. “Controlled Substance Schedules,” 2022.