Last updated: July 27, 2025

Introduction

Modafinil, a wakefulness-promoting agent primarily prescribed for narcolepsy, shift work sleep disorder, and excessive daytime sleepiness associated with conditions such as sleep apnea, has gained considerable attention beyond its initial indications. Its off-label use as a cognitive enhancer and its increasing global demand have propelled its presence within pharmaceutical markets. This report offers a comprehensive market analysis of modafinil, including current trends, competitive landscape, regulatory environment, and future price projections.

Market Overview

Global Market Size and Growth

The global market for modafinil was valued at approximately USD 873 million in 2022 and is projected to reach USD 1.2 billion by 2028, growing at a compound annual growth rate (CAGR) of around 6% (2023–2028) [1]. Key drivers include rising awareness of sleep disorders, increasing off-label use for cognitive enhancement, and expanding approval for additional indications in emerging markets.

Regional Market Dynamics

-

North America: Dominates the market, accounting for over 45% of sales due to high prescription rates and established healthcare infrastructure. The U.S. remains the largest individual market, driven by widespread off-label use and strong marketing from pharmaceutical companies.

-

Europe: Represents approximately 25%, with a steady growth trajectory, justified by evolving prescribing practices and expanding awareness.

-

Asia-Pacific: Projected to witness the fastest growth (CAGR ~8%), fueled by increasing sleep disorders, rising healthcare expenditure, and regulatory loosening in countries such as China and India.

-

Latin America & Middle East & Africa: Developing markets with moderate growth prospects, hindered by regulatory hurdles and limited healthcare access.

Market Segmentation

-

By Drug Type: Prescribed pharmaceutical modafinil (brand names such as Provigil) and generics.

-

By Application: Medical use (narcolepsy, shift work disorder, sleep apnea), cognitive enhancement, and military applications.

-

By End-User: Hospitals, clinics, wellness centers, individual consumers (via online channels).

Competitive Landscape

Major Players

-

Cephalon Inc. (Teva Pharmaceuticals): Original patent holder; dominant in branded modafinil formulations before patent expiry.

-

Generics Manufacturers: Numerous manufacturers in India (e.g., Sun Pharma, Cipla) and China producing cost-effective generic versions, significantly impacting prices.

-

Emerging Biosimilar and OTC Players: Increasing entry in various markets, especially for off-label use.

Patent and Regulatory Impact

The expiration of the original patents for Provigil (modafinil) in key jurisdictions has opened doors for generics, intensifying price competition and expanding access.

Pricing Strategies

Brand-name formulations currently retail between USD 20–40 per tablet in the U.S. and Europe, whereas generics sell for USD 2–10 per tablet, reflecting substantial price erosion.

Regulatory Environment

United States

The FDA approved modafinil for narcolepsy, shift work disorder, and excessive sleepiness. The Controlled Substances Act classifies it as a Schedule IV drug, limiting misuse but allowing prescription.

Europe

EMA approval aligns with U.S. indications; however, off-label use is prevalent, with regulatory scrutiny increasing over non-medical use.

Asia & Emerging Markets

Regulatory approval varies; in some regions, policies are evolving to permit wider access, including over-the-counter sales in certain contexts, impacting market dynamics.

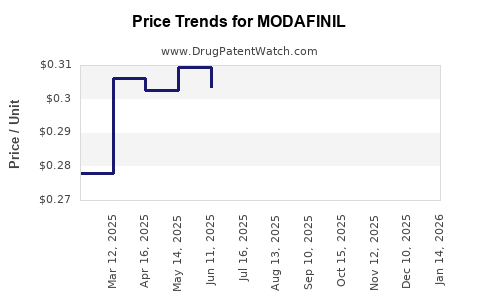

Price Trends and Future Projections

Current Price Dynamics

The advent of generic formulations in 2012—post-patent expiry—has resulted in dramatic price declines. For instance, in the U.S., a branded 100 mg Provigil tablet historically retailed at approximately USD 30, whereas generics now offer similar dosages at less than USD 5 [2].

Projected Price Movements (2023–2028)

-

Stable to Slight Decrease: Prices are predicted to stabilize in mature markets, with slight reductions due to increased competition.

-

Emerging Markets: Prices may decline further as regulatory barriers decrease and manufacturing costs improve.

-

Potential Premium Trends: For branded or specialty formulations targeting niche markets, premiums could persist but are likely to diminish with market saturation.

Influencing Factors

-

Regulatory Changes: Loosening restrictions or approving over-the-counter options could lower prices.

-

Patent Litigation and Market Entry: Continued patent disputes or new entrants can influence pricing strategies.

-

Supply Chain Dynamics: Raw material costs and manufacturing innovations impact pricing.

-

Off-Label and Non-Regulated Use: Growing misuse and non-prescribed access, especially via online channels, could pressure prices and control measures.

Market Challenges & Opportunities

Challenges

-

Regulatory restrictions in certain jurisdictions impede market expansion.

-

Potential for abuse and misuse complicates regulatory oversight and may impact legal supply chains.

-

Competition from emerging generics reduces profitability for branded manufacturers.

Opportunities

-

Expanding indications, such as for ADHD or depression, may create new revenue streams.

-

Development of modified-release formulations could command premium prices.

-

Growing interest in cognitive enhancement among healthy individuals presents off-label market expansion opportunities.

Conclusion: Strategic Outlook

The modafinil market is approaching maturation in developed regions but remains ripe for growth in emerging markets, driven by expanding indications and increasing acceptance. Price pressures from generics are expected to persist, yet niche applications and formulation innovations could sustain premium pricing. Importantly, regulatory developments and public health policies will profoundly influence market dynamics through 2028.

Key Takeaways

-

Market Growth: Expected CAGR of ~6% from 2023–2028, predominantly fueled by emerging markets and off-label use.

-

Pricing Trends: Significant reduction post-patent expiry, with generic prices declining to USD 2–10 per tablet; stable or slightly lower prices anticipated.

-

Regulatory Factors: Evolving policies in Asia-Pacific and policy responses to misuse will shape future market access and pricing.

-

Competitive Landscape: Intense generic competition continues, with potential for niche premium formulations.

-

Market Risks & Opportunities: Regulatory hurdles, misuse concerns, and litigation pose risks, while indication expansion and formulation innovation offer growth avenues.

FAQs

1. What factors primarily influence modafinil's pricing trajectory over the next five years?

Pricing will be driven by generic competition post-patent expiration, regulatory policies, manufacturing costs, and potential for market expansion into new indications. Market saturation and regulatory restrictions could stabilize or lower prices, while innovation or niche applications may sustain premiums.

2. How does the regulatory environment impact modafinil's market growth?

Regulatory approvals facilitate market access, while restrictions over misuse or off-label use can limit demand. Loosening policies—such as allowing over-the-counter sales—may increase accessibility and decrease prices, whereas stricter controls could constrain growth.

3. Which regions offer the most promising growth opportunities for modafinil?

Emerging markets in Asia-Pacific and Latin America present significant growth potential due to expanding healthcare access, increasing sleep disorder diagnoses, and loosening regulations. Mature markets like North America and Europe will contribute stable revenue streams but with subdued price growth.

4. What future innovations may influence modafinil's market positioning?

Modified-release formulations, combination therapies, and expanded approved indications (e.g., for ADHD or depression) could create premium segments. Additionally, developing abuse-deterrent formulations may influence regulatory acceptance and pricing.

5. Are there concerns regarding off-label use impacting the market?

Yes. Off-label cognitive enhancement and misuse can lead to regulatory crackdowns, affecting supply and pricing. Market participants must balance consumer demand with regulatory compliance to mitigate risks.

References

[1] MarketsandMarkets. (2023). Modafinil Market Analysis & Trends.

[2] GoodRx. (2023). Pricing of Generic Modafinil.