Last updated: July 28, 2025

Introduction

Methylphenidate, commercially known as METHYLIN, is a stimulant medication primarily prescribed for Attention Deficit Hyperactivity Disorder (ADHD) and Narcolepsy. Developed in the mid-20th century, METHYLIN has established itself within psychiatric and neurological pharmacotherapy, shaping a significant segment of the psychostimulant market. Its market dynamics and financial trajectory are driven by a confluence of regulatory, clinical, and socioeconomic factors, which warrant a comprehensive analysis for stakeholders.

Pharmacological Profile and Market Position

Methylphenidate functions as a dopamine and norepinephrine reuptake inhibitor, exerting central nervous system stimulant effects that improve focus and reduce impulsivity. Its long-standing approval by agencies like the FDA has entrenched it as a standard treatment for ADHD, with an extensive clinical evidence base supporting its efficacy.

In the United States, METHYLIN was among the first formulations introduced, with its patent dating back to 1955. However, the original patent has since expired, resulting in generic versions that dominate the market, leading to price competition and increased accessibility. Despite this, branded products continue to maintain a foothold due to brand loyalty and perceived efficacy.

Market Dynamics

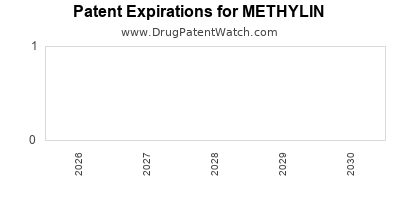

Regulatory Environment and Patent Expiry

The expiration of METHYLIN's core patents has been a pivotal factor influencing market dynamics. Generic manufacturers have flooded the market, driving down prices and expanding accessibility. The FDA’s regulatory framework for generics has facilitated rapid market entry for competitors, intensifying price competition and constraining revenue growth for brand manufacturers.

Regulatory scrutiny regarding abuse potential has also shaped the market. Methylphenidate’s classification as a Schedule II controlled substance imposes strict prescribing and dispensing regulations, impacting sales channels and distribution logistics.

Epidemiological Trends

The prevalence of ADHD diagnosis has surged globally. According to the CDC, approximately 9.4% of children in the U.S. are diagnosed with ADHD, a figure that has steadily increased over the past two decades. This uptick correlates with heightened awareness, improved diagnostic criteria, and broader recognition across age groups.

The adult ADHD market is expanding, with methylphenidate formulations increasingly prescribed beyond pediatric populations. This demographic shift stimulates sustained demand, particularly for long-acting formulations that offer convenience and compliance.

Competitive Landscape

METHYLIN faces stiff competition from other stimulant medications, including methylphenidate extended-release formulations (e.g., Concerta, Ritalin LA) and non-stimulant options like atomoxetine (Strattera). The advent of novel pharmacotherapies, such as viloxazine (Qelbree), introduces additional competitive pressures, especially in terms of efficacy, safety profiles, and dosing convenience.

Online pharmacies, telemedicine, and increasing clinician familiarity with generics have further democratized access, intensifying price competition and influencing prescribing patterns.

Financial Trajectory

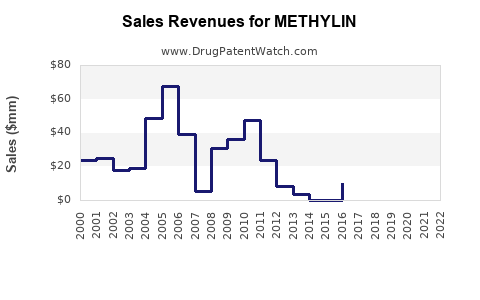

Revenue Trends

Given patent expiries and market saturation, METHYLIN's revenue streams have shifted. The original patented formulation was a cash cow for its manufacturer until generic competition eroded its market share. Post-expiry, revenues declined substantially in many markets, with generics capturing most of the volume at markedly lower prices.

In emerging markets, patent protections are often weaker, leading to immediate generic penetration, which constrains profit margins of branded METHYLIN. Conversely, in regions with robust patent enforcement, market exclusivity maintains higher revenue potential for branded formulations, though limited by regulatory approvals and market access barriers.

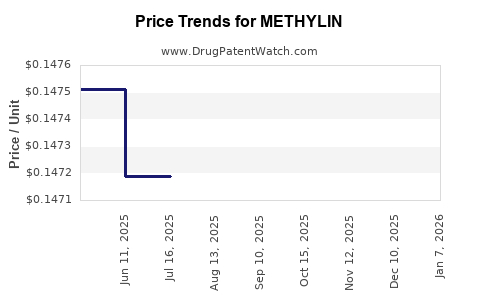

Pricing and Reimbursement

Pricing strategies are critical; the lower-cost generics have significantly reduced costs for healthcare systems, augmenting access but diminishing profit margins for original branded products. Reimbursement policies, particularly in the U.S., heavily influence prescribing behaviors. Favorable formulary placements for generics under Medicare and Medicaid reduce out-of-pocket costs, further pushing physicians toward prescribing lower-cost options.

Future Financial Outlook

The future financial trajectory hinges on several factors:

- Innovative formulations: Extended-release or implantable versions could command premium pricing, offsetting declines from patent expiries.

- Regulatory approvals: Approval of biosimilars or new indications might rejuvenate revenues.

- Market expansion: Growing adult ADHD diagnosis and treatment adoption can stabilize or grow revenues, despite generic competition.

However, overall revenue growth for METHYLIN in mature markets is expected to decline, given the prevalence of generics and price erosion trends.

Emerging Trends and Impact Factors

Generic Competition and Price Erosion

Generic entry has been the dominant factor suppressing revenues. The cost-effective nature of generics incentivizes widespread use but limits profitability for original manufacturers. Consequently, companies are exploring new formulations, combination therapies, or patenting adjacent compounds to sustain revenue streams.

Digital Health and Monitoring

Integration of digital health tools facilitates adherence and monitoring, potentially augmenting the value proposition of branded METHYLIN formulations. Enhanced patient engagement may support niche premium markets or tailored delivery systems.

Regulatory and Legal Challenges

Strict controls on stimulant medications, including prescription monitoring programs, restrict misuse and diversion. These frameworks may shape prescribing practices and impact volume.

Global Market Considerations

Emerging markets, characterized by less stringent patent protections, primarily consume generic methylphenidate, leading to limited revenue potential for patent-holders. Conversely, developed markets continue to be lucrative for branded formulations due to higher willingness-to-pay and regulation.

Conclusion and Prognosis

METHYLIN’s market has transitioned from a proprietary blockbuster to a largely generic-based landscape characterized by price competition and regulatory controls. While global ADHD diagnoses propel consistent demand, margin pressures from generics mean that overall revenues trend downward in mature markets.

Pharmaceutical companies are innovating around methylphenidate, seeking formulations with extended patent protection or digital integration to sustain profitability. Conversely, policymakers emphasizing affordability and abuse mitigation continue to influence market dynamics.

The key to profitability in this segment hinges on innovation, market expansion into underdiagnosed populations, and strategic positioning within prescription and reimbursement frameworks.

Key Takeaways

- Patent expirations have driven a shift from branded to generic methylphenidate, significantly impacting revenue streams.

- Growing ADHD diagnoses, especially among adults, present opportunities for market growth amid fierce generic competition.

- Revenue prospects are increasingly reliant on innovation, including extended-release formulations and digital health integration.

- Regulatory and reimbursement policies profoundly influence prescribing trends and pricing strategies.

- Emerging markets offer volume opportunities but limited margins due to generic penetration and patent limitations.

FAQs

1. What are the main competitors to METHYLIN in the ADHD treatment market?

Extended-release methylphenidate formulations, non-stimulant medications like atomoxetine, and emerging therapies such as viloxazine (Qelbree) serve as principal competitors.

2. How has patent expiration affected METHYLIN’s market share?

Patent expiry led to widespread generic entry, dramatically reducing prices and market share for the branded formulation, shifting revenues towards generics.

3. What future developments could revive METHYLIN’s revenues?

Introduction of new formulations with extended patent protection, novel administration methods (e.g., implants), and potential new indications could provide revenue growth avenues.

4. How do regulatory controls influence methylphenidate sales?

Strict scheduling limits prescribing to authorized healthcare providers, implementing monitoring programs that may reduce diversion and affect volume but enhance safety.

5. Is METHYLIN a sustainable long-term investment?

Current trends suggest declining revenues due to generic competition. Investment viability depends on innovation pipelines and market expansion strategies.

Sources:

[1] Federal Drug Administration (FDA). "Methylphenidate Drug Listing."

[2] CDC. "CDC ADHD Surveillance Data."

[3] IMS Health. "Global ADHD Medication Market Report."

[4] U.S. Patent Office. "Patent Expirations & Generic Entry Data."

[5] MarketWatch. "Pharma Industry Outlook for Psycho-stimulants."