Last updated: July 27, 2025

Introduction

Methylin, a branded formulation of methylphenidate hydrochloride, is a central nervous system stimulant primarily prescribed for attention deficit hyperactivity disorder (ADHD) and narcolepsy. As a generic and brand-name drug, its market dynamics are influenced by regulatory factors, patent estate, patent expiry, manufacturing costs, and evolving demand for ADHD medications. This comprehensive analysis assesses the current market landscape, evaluates key drivers, and forecasts Methylin's future pricing trajectory.

Market Landscape of Methylin

Historical Context and Patent Status

Methylin was developed and approved by the U.S. Food and Drug Administration (FDA) in the late 20th century. The original patent for methylphenidate expired in the early 2000s, ushering in a wave of generic competition. However, brand-specific formulations such as Methylin have maintained market share due to branding, formulary preferences, and controlled release formulations.

Regulatory Environment and Approval

Methylin remains FDA-approved, with formulations ranging from immediate-release (IR) to chewable tablets, suspensions, and extended-release variants. FDA regulations influence market entry, composition standards, and pricing controls. Key regulatory milestones include:

- Patent expirations: For methylphenidate IR formulations, typically around 2004–2006.

- Generic entry: Multiple generic versions now coexist, increasing price competition.

- Labeling and formulations: Innovations in delivery mechanisms such as transdermal patches and extended-release forms influence market segmentation.

Competitive Landscape

The ADHD medication market is highly competitive with major players including Novartis (original developer), Johnson & Johnson, Teva Pharmaceuticals, and pharmaceutical generics manufacturers such as Sandoz and Mylan. The generic market has led to significantly reduced prices, although branded Methylin positions itself as a trusted, consistent product.

Market Demographics and Drivers

The prevalence of ADHD diagnosis is estimated at 8.4% in children aged 4–17 years in the U.S. [1], supporting an ongoing demand for methylphenidate-based treatments. Rising awareness and diagnosis rates expand the patient base.

Other determinants include:

- Physician prescribing behavior: Preference for branded drugs due to perceived quality or formulary restrictions.

- Insurance coverage: Reimbursements favoring branded formulations or generics.

- Regulatory restrictions: Controlled substance scheduling influences distribution and access, indirectly affecting prices.

Price Analysis

Current Pricing Landscape

As of 2023, the pricing of Methylin varies based on formulation, dosage, and purchase channel. Wholesale acquisition costs (WAC), retail prices, and insurance reimbursement levels define the market price. Typical prices are:

- Immediate-release Methylin tablets (10 mg): Retail prices range from $50 to $70 per 30-count bottle, with generics often priced lower.

- Chewable formulations: $60–$80 per 30-count pack.

- Liquid suspensions: Approximate $75–$100 for a 4 fl oz bottle, depending on concentration.

Despite generic alternatives, branded Methylin maintains a premium due to brand loyalty, perceived reliability, or formulary restrictions.

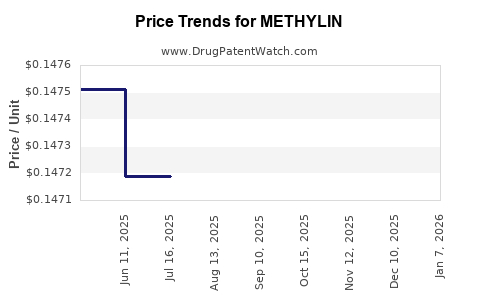

Price Trends and Drivers

- Post-patent expiry: Significant price reduction occurred circa 2004–2006; however, branded Methylin has sustained higher pricing due to formulation-specific attributes.

- Market penetration of generics: Increased availability of generics has driven down the average price of methylphenidate products.

- Insurance and pharmacy benefit management (PBM) practices: Tend to favor generics but may require co-payments that favor branded drugs.

- Supply chain factors: Manufacturing costs, raw material prices (notably for active pharmaceutical ingredients), and transportation costs influence pricing stability.

Price Elasticity and Demand-Side Factors

Demand for Methylin exhibits relatively inelastic characteristics, given its role in managing ADHD symptoms. This limits price sensitivity but remains susceptible to shifts in prescriber preferences and insurance coverage policies.

Future Price Projections

Short-Term (1–3 Years)

In the near term, Methylin’s price is expected to stabilize or experience modest declines driven by:

- Continued generic competition: Which exerts downward pressure on prices.

- Market saturation: As most eligible patients already prescribed methylphenidate receive therapy.

- Regulatory and policy shifts: Potential CMS or FDA initiatives aimed at drug pricing transparency could impact pricing structures.

Projected retail price for branded Methylin in 2025 remains in the range of $55–$75 per 30-count bottle for immediate-release formulations, assuming no new patent protections or formulation breakthroughs.

Medium to Long-Term (3–5 Years)

Over this horizon, several factors could influence Methylin pricing:

- Patent extensions or formulation patents: If Novartis or successor entities secure patent protections for novel delivery systems, a temporary price premium could re-emerge.

- Market consolidation: Mergers and acquisitions may alter competition, potentially restoring pricing power.

- Emergence of biosimilars or alternative therapies: Though less directly relevant for methylphenidate, competition from sustained-release or non-stimulant medications (such as atomoxetine or guanfacine) could affect demand.

- Price regulation policies: Federal or state initiatives aimed at capping drug prices might constrain future costs.

Considering these variables, average prices for Methylin could stabilize around $60–$90 per 30-count pack by 2027, with branded drugs maintaining a slight premium over generic counterparts.

Conclusion

The Methylin market demonstrates a classic lifecycle pattern: initial patent protection, followed by generic proliferation, leading to pricing pressures. In the current landscape, generic methylphenidate formulations dominate, creating downward pressure on prices of branded Methylin. Nonetheless, formulation-specific qualities, brand loyalty, and insurance formulary preferences sustain a premium pricing tier.

Forecasts suggest modest price stability or slight decreases in the near term, with potential for future stabilization or small increases contingent on patent strategies and market dynamics. The ongoing demand for ADHD medications, coupled with regulatory factors, supports a stable core market with limited volatility.

Key Takeaways

- The patent expiration for methylphenidate led to widespread generic availability, significantly reducing branded Methylin prices.

- Current retail prices for Methylin's immediate-release formulations hover between $55 and $75 per 30-count bottle, with generics priced lower.

- Future pricing will be influenced by patent status, market competition, formulation innovations, and regulatory policies.

- Market demand for ADHD medications remains robust, underpinning sustained sales and moderate pricing stability.

- Stakeholders should monitor patent filings, formulary policies, and new therapeutic developments to anticipate pricing shifts.

FAQs

1. How does patent expirations affect the pricing of Methylin?

Patent expirations open the market to generic competition, typically leading to substantial price reductions for the branded drug as generics offer lower-cost alternatives.

2. Are generic versions of methylphenidate significantly cheaper than Methylin?

Yes. Generic methylphenidate products often cost 30–50% less than branded formulations, which influences prescribing and insurance reimbursement.

3. What factors could lead to an increase in Methylin's price in the future?

Patent extensions, market exclusivity rights for new formulations, or regulatory barriers could enable firms to maintain higher prices temporarily.

4. How does insurance coverage impact Methylin’s retail price?

Insurance plans and PBMs often favor generic drugs, reducing out-of-pocket costs for consumers, but branded Methylin may still command higher co-pays.

5. What are the primary competitors to Methylin in the ADHD medication space?

Other methylphenidate formulations (e.g., Ritalin, Concerta), non-stimulant medications like atomoxetine, and emerging treatments influence the competitive landscape and pricing strategies.

Sources

[1] Centers for Disease Control and Prevention (CDC). (2022). Attention-Deficit/Hyperactivity Disorder (ADHD).

[2] FDA. (2022). Methylphenidate Drug Approvals and Labeling.

[3] IQVIA. (2023). Market Trends in ADHD Medications.

[4] CVS Pharmacy, Walgreens Pharmacy. (2023). Retail Price Data for Methylin.

[5] Healthcare Policy Reports. (2023). Regulatory Impacts on ADHD Medication Pricing.