Last updated: August 2, 2025

rket Dynamics and Financial Trajectory for Methylin ER

Introduction

Methylin ER (Extended Release methylphenidate) is a prescription medication primarily indicated for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. As a long-acting stimulant, it plays a vital role in the therapeutic landscape, entailing complex market dynamics influenced by regulatory, clinical, and competitive factors. Analyzing its current market position and future financial outlook necessitates an understanding of the evolving pharmaceutical environment, prescription trends, patent landscape, and alternative therapeutics.

Pharmacological Profile and Clinical Position

Methylin ER combines methylphenidate’s stimulant activity with an extended-release formulation, providing sustained symptom control for ADHD patients. Its pharmacokinetic profile improves patient adherence compared to immediate-release formulations, yielding higher convenience and compliance. Its clinical positioning is supported by extensive FDA approval and a long history of clinical use.

However, in recent years, the emergence of newer medications, such as amphetamine-based treatments and non-stimulant options like atomoxetine, has reshaped the competitive dynamics. The drug’s efficacy, safety profile, and the convenience of dosing remain advantageous but must be balanced against evolving treatment guidelines emphasizing personalized medicine.

Regulatory and Patent Landscape

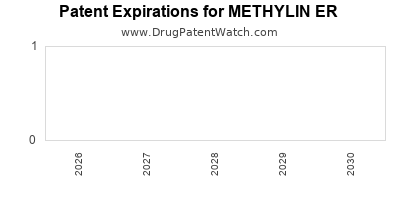

Methylin ER’s patent protection has historically provided a competitive moat, allowing for sustained revenue streams. Nevertheless, patent expirations—anticipated or occurred—expose the drug to generic competition, exerting downward pressure on prices and sales.

The regulatory environment is increasingly stringent regarding the control of stimulant medications due to abuse potential. Regulatory agencies enforce strict prescribing guidelines, which impact distribution and market accessibility. Additionally, initiatives to combat prescription drug misuse influence prescribing behaviors and market size.

Market Size and Prescription Trends

Global and Regional Market Overview

The global ADHD therapeutics market, valued at approximately USD 20 billion in 2022, exhibits a compound annual growth rate (CAGR) of around 6-7% (source: Evaluate Pharma). North America dominates this segment, owing to high diagnosis rates, insurance coverage, and prescriber familiarity, representing approximately 75% of all prescriptions.

In the US, the ADHD medication market has grown steadily, with methylphenidate formulations, including Methylin ER, capturing substantial market share. Data from IQVIA indicate that methylphenidate accounts for nearly half of all ADHD prescriptions, underscoring its continued relevance.

Prescription Volume Dynamics

Prescription volumes for Methylin ER have historically increased with rising ADHD diagnosis rates, driven by heightened awareness and screening initiatives. However, in recent years, growth has slowed, partly due to increased generic competition and the advent of alternative formulations. Prescribing shifts towards newer long-acting stimulants, such as Vyvanse (lisdexamfetamine), have also impacted volume trends.

Competitive Landscape

The ADHD pharmacotherapy market is highly competitive, featuring key players like Shire (AbbVie), Johnson & Johnson, and Novartis. Generic methylphenidate formulations from multiple manufacturers significantly challenge the branded Methylin ER in price and market share, especially post-patent expiry.

Innovations in drug delivery systems, such as non-stimulant medications or multi-modal therapies, further diversify competition. The development pipeline now emphasizes formulations with improved abuse-deterrent features, rapid onset, or tailored dosing regimens.

Financial Trajectory Analysis

Revenue Drivers and Challenges

-

Patent and Exclusivity Considerations: Methylin ER’s patent life heavily influences its revenue trajectory. Once expired, revenues typically decline sharply due to generic entry. Current data suggest that the drug’s primary patents have either expired or are nearing expiry, implying a transition into a commoditized market.

-

Pricing and Reimbursement: Insurance coverage, Medicaid formulary placements, and value-based reimbursement models significantly affect the drug’s profitability. The rising emphasis on biosimilars and generics has led to reimbursement pressures.

-

Market Penetration and Adoption Dynamics: Clinician preference for newer, potentially more convenient or less stigmatized formulations affects Methylin ER’s sales volume. Increased awareness of abuse and diversion concerns also modulates prescribing behavior.

Forecasting Revenue Trends

Given current patent expirations (anticipated within 1-3 years), the revenue trajectory for Methylin ER is expected to decline sharply unless the manufacturer introduces differentiated formulations or secures new indications.

Projections indicate that in a mature market, revenues could decrease by 40-70% within five years of patent expiry, assuming generic competition is unmitigated. Conversely, strategic moves such as formulation reformulation, combination therapies, or expanding into emerging markets could offset some decline.

Potential Market Growth Factors

-

Increasing ADHD Diagnosis: Growth in diagnosed cases, particularly in developing regions, can support emerging markets for methylphenidate-based therapy.

-

Regulatory Support for Abuse-Deterrent Formulations: New formulations with abuse-deterrent properties could sustain premium pricing and market share for branded versions.

-

Expanding Use Cases: Off-label uses or narrowed indications, if supported by clinical evidence, might influence revenue streams positively.

Strategic Implications and Future Outlook

-

Patent Management and Lifecycle Extension: Companies often deploy strategies such as reformulations, secondary patents, or line extensions to extend market exclusivity. Methylin ER’s manufacturer may pursue such approaches, pending regulatory feasibility.

-

Pipeline and Innovation: Investment in novel delivery methods (e.g., implantable devices or digital health integrations) could redefine revenue potential.

-

Geographic Diversification: Targeting emerging markets with rising ADHD awareness enables growth amidst mature markets’ decline.

-

Competitive Positioning: Emphasizing clinical efficacy, safety, and abuse deterrence in marketing strategies can preserve premium pricing advantages.

Regulatory and Ethical Considerations

Given the abuse potential of stimulant medications, regulatory frameworks are increasingly rigorous. Marketing strategies must align with regulations, promoting responsible use while addressing societal concerns about misuse.

Furthermore, payers and healthcare providers prioritize cost-effectiveness, favoring generic options unless branded formulations demonstrate clear clinical advantages.

Key Takeaways

- The Methylin ER market is mature, with current revenues influenced by patent status, generic competition, and shifting prescriber preferences.

- Patent expirations threaten significant revenue declines unless mitigated through formulation innovations or geographic expansion.

- Prescribed volumes in mature markets face headwinds due to alternative therapies and awareness of abuse risks.

- Emerging markets and regulatory-driven innovations offer growth avenues, contingent on strategic investments.

- Stakeholders should focus on lifecycle management, technological innovation, and compliance to optimize financial outcomes.

FAQs

1. When are the patents for Methylin ER expected to expire?

Patent expirations for Methylin ER are projected within the next 1 to 3 years, after which generic versions will likely dominate the market.

2. How does generic competition affect the profitability of Methylin ER?

Generic competition drives down prices and reduces market share for branded Methylin ER, significantly impacting revenues and profit margins.

3. What are the prospects for reformulated or abuse-deterrent versions of methylphenidate?

Developing abuse-deterrent formulations is a strategic focus that could preserve market share and enable premium pricing against generics.

4. Are there emerging markets with growth potential for Methylin ER?

Yes, regions like Asia-Pacific, Latin America, and parts of Africa exhibit rising ADHD diagnoses, representing future growth opportunities.

5. How will regulatory changes influence the market dynamics of Methylin ER?

Stricter controls and prescribing guidelines may limit prescribing volumes, but also incentivize innovation in formulations to address abuse concerns.

References

[1] Evaluate Pharma. "Global ADHD Market Report," 2022.

[2] IQVIA. "Pharmaceutical Prescription Data," 2022.

[3] U.S. Food and Drug Administration. "Methylphenidate Extended-Release Labeling," 2023.

[4] Market Research Future. "ADHD Therapeutics Market Trends," 2022.

[5] Pew Charitable Trusts. "Regulation of Prescription Stimulants," 2021.