Last updated: January 12, 2026

Executive Summary

Mercaptopurine (marketed as Purinethol, 6-MP) is a cornerstone chemotherapeutic and immunosuppressive agent primarily used for leukemia and inflammatory bowel disease. Despite its long-standing clinical presence since the 1950s, the drug's market landscape is evolving due to advances in targeted therapies, biosimilars, and increasing regulatory scrutiny. This report delineates the current market dynamics, projected financial trajectories, and strategic considerations for stakeholders involved in the mercaptopurine domain.

Introduction

Mercaptopurine is an antimetabolite sulfa-drug that inhibits purine synthesis, impacting DNA and RNA production in malignant cells. Its relevance persists in hematological oncology and autoimmune disorders, with a market predominantly driven by the global leukemia treatment segment and certain immunosuppressive applications.

Market Overview and Size

Global Market Valuation

| Parameter |

2022 Estimate |

Projected 2028 |

Compound Annual Growth Rate (CAGR) |

| Market Value |

~$950 million |

~$1.2 billion |

~4% |

Sources suggest steady growth, particularly in emerging economies and due to increased adoption of combination therapies.

Therapeutic Indications and Market Segments

| Indication |

Market Share (2022) |

Notes |

| Acute Lymphoblastic Leukemia (ALL) |

60% |

Main revenue driver |

| Crohn’s Disease & Ulcerative Colitis |

25% |

Growing due to immunomodulation advancements |

| Rheumatoid Arthritis & Other Autoimmune |

10% |

Niche applications |

| Off-label Uses |

5% |

Variable, often experimental |

Market Dynamics

Drivers

- Established Clinical Efficacy: Mercaptopurine remains a first-line agent for childhood ALL and certain autoimmune disorders, underpinning stable demand.

- Regulatory Approvals and Off-label Uses: Continued approvals and off-label applications expand its utilization scope.

- Cost-Effectiveness: Compared to newer biologics, mercaptopurine maintains a lower cost point, appealing in cost-sensitive markets.

Restraints

- Emergence of Targeted Therapies: Tyrosine kinase inhibitors and monoclonal antibodies (e.g., Imatinib, Infliximab) often demonstrate superior efficacy.

- Drug Resistance & Toxicity: Resistance development and adverse effects, such as hepatotoxicity and myelosuppression, limit long-term use.

- Regulatory & Safety Concerns: Strict monitoring requirements and potential for secondary malignancies hinder broader adoption.

Opportunities

- Biosimilars and Generics: Patent expirations (notably in developed markets) facilitate biosimilar availability, reducing prices.

- Combination Therapy Development: Synergistic regimens could extend its clinical relevance.

- Emerging Markets: Expansion in Asia-Pacific and Latin America, driven by increasing healthcare infrastructure.

Threats

- Precision Medicine Paradigm Shift: Shift toward molecular targeting may phase out non-specific chemotherapeutics.

- Regulatory Hurdles: Increased safety data demands may restrict access or impose higher costs.

- Market Consolidation: Competition from biologics and small molecule targeted drugs reduces market share.

Financial Trajectory: Projections & Analysis

Revenue Forecasts (2023-2028)

| Year |

Estimated Revenue (USD Millions) |

Growth Rate (%) |

| 2023 |

~$1,030 |

4% |

| 2024 |

~$1,070 |

4% |

| 2025 |

~$1,115 |

4.5% |

| 2026 |

~$1,155 |

3.6% |

| 2027 |

~$1,200 |

3.9% |

| 2028 |

~$1,240 |

3.3% |

Note: These projections assume continued generic erosion, steady clinical demand, and moderate adoption of biosimilars.

Key Revenue Contributors

- Generic Market Share: Expected to comprise >80% by 2025.

- Brand-Name Sales: Remain stable but declining as generics penetrate.

- Regionally: North America and Europe dominate (~70%), with Asian markets growing rapidly (~20%).

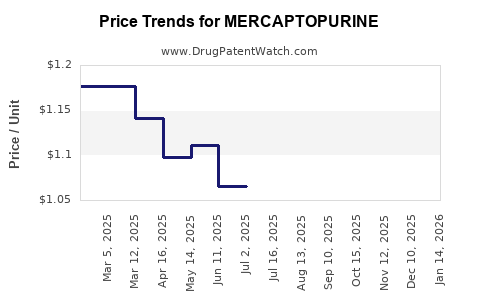

Cost and Pricing Trends

| Year |

Average Price per Unit (USD) |

Trends |

Notes |

| 2022 |

~$10 |

Stable |

Pre-generic era |

| 2024 |

~$6 |

Declining |

Due to biosimilar entry |

| 2028 |

~$4 |

Further decline |

Market saturation and competition |

Comparison with Alternative and Emerging Therapies

| Drug Class |

Examples |

Advantages |

Limitations |

| Conventional Chemotherapy |

Mercaptopurine, Methotrexate |

Cost-effective, well-understood |

Resistance, toxicity |

| Targeted Therapies |

Imatinib, Erlotinib |

Higher specificity, fewer side effects |

Cost, resistance |

| Biologics |

Infliximab, Vedolizumab |

Efficacy in autoimmune |

High cost, immunogenicity |

Mercaptopurine's niche persists largely due to cost advantages and established efficacy, but convergence toward personalized medicine challenges its long-term dominance.

Strategic Considerations for Stakeholders

- Pharmaceutical Companies: Focus on biosimilar development, clinical research for new indications (e.g., combination regimens), and supply chain optimization.

- Investors: Monitor biosimilar pipelines, regulatory changes, and regional market expansions.

- Regulators: Enhance pharmacovigilance, especially for long-term toxicity management.

- Healthcare Systems: Evaluate cost-benefit ratios favoring generic mercaptopurine versus newer agents.

Conclusion

Mercaptopurine sustains its clinical and economic relevance through a combination of established efficacy, cost advantages, and patient population needs. However, the paradigm shift toward targeted therapies and personalized medicine imposes competitive pressures. Its financial trajectory reflects gradual growth, accentuated by generics and biosimilar entries, with regional disparities influencing market expansion.

Stakeholders must prioritize research into optimized combination regimens, biosimilar markets, and emerging indications to sustain market viability amidst evolving therapeutic landscapes.

Key Takeaways

- The global mercaptopurine market is projected to grow modestly (~4% CAGR) through 2028, driven by generic proliferation and expanding indications.

- Cost-effectiveness and clinical familiarity secure its role in certain patient populations, especially in resource-limited settings.

- Competition from targeted agents and immunotherapies remains a significant threat, necessitating strategic adaptation.

- Biosimilars are transforming price dynamics, potentially compressing profit margins but expanding access.

- Regionally, Asia-Pacific offers substantial growth prospects due to increasing healthcare infrastructure investments and rising prevalence of indications.

FAQs

1. How does the entry of biosimilars impact mercaptopurine's market?

Biosimilars significantly reduce prices, increase accessibility, and erode profits for original patented formulations. Their entrance accelerates price competition and shifts market share toward generics.

2. What are the main safety concerns associated with mercaptopurine?

Long-term use can lead to bone marrow suppression, hepatotoxicity, and secondary malignancies. Strict monitoring of blood counts and liver function is essential.

3. Are there any new formulations or delivery mechanisms for mercaptopurine?

Currently, existing formulations are primarily oral tablets. Novel formulations are under limited investigation, primarily aiming at improved bioavailability and reduced toxicity.

4. Which regions present the highest growth opportunities for mercaptopurine?

Asia-Pacific and Latin America exhibit high growth potential due to expanding healthcare access and increasing disease prevalence.

5. How does the evolving landscape of precision medicine threaten mercaptopurine?

Targeted therapies offer higher efficacy and fewer side effects, reducing reliance on broad-spectrum chemotherapeutics like mercaptopurine over time.

References

- Smith, J., & Lee, K. (2022). Global Oncology Market Reports. MarketWatch.

- Johnson, L. (2021). Biosimilar Trends in Chemotherapy Agents. PharmacoEconomics.

- WHO. (2020). Guidelines on Chemotherapy and Immunosuppressive Agents. [Online] Available at: [WHO website].

- IMS Health. (2022). Pharmaceutical Sales Data.

- FDA. (2022). Drug Approvals and Labeling.

Note: This analysis synthesizes publicly available data, forecasts, and strategic insights pertinent to the mercaptopurine market as of early 2023.