Last updated: July 27, 2025

Introduction

Mercaptopurine, marketed under brand names such as Purinethol, has long been a cornerstone in the treatment of acute lymphoblastic leukemia (ALL) and certain autoimmune conditions. As a purine analogue, it functions as an antimetabolite, disrupting DNA synthesis in rapidly dividing cells. Despite its established clinical utility, the drug's market dynamics are evolving due to advancements in cancer therapy, patent status shifts, regulatory changes, and emerging competitor molecules. This report delivers a comprehensive market analysis and forecasts future pricing trends for mercaptopurine, tailored for pharmaceutical stakeholders, investors, and health policy organizations.

Pharmacological Profile and Therapeutic Scope

Mercaptopurine’s efficacy in hematological malignancies has sustained its relevance. It’s primarily prescribed for ALL, often as part of multidrug protocols, and for certain autoimmune diseases like Crohn's disease. The drug’s mechanism involves inhibition of purine nucleotide synthesis, impairing DNA replication in abnormal cells.

While originally approved decades ago, its clinical role persists largely due to its cost-effectiveness and extensive clinical data. Nevertheless, newer agents with targeted mechanisms, such as nelarabine and clofarabine, are gradually encroaching on its market share.

Market Landscape Overview

Market Size and Segmentation

Globally, the mercaptopurine market is valued at approximately USD 350 million as of 2022, with North America representing the largest share due to high treatment prevalence and advanced healthcare infrastructure [1]. The existing patient population aligns with the incidence of pediatric and adult ALL, estimated at 6,000-8,000 new cases annually in the U.S. alone.

Segment-wise, the hospital sector accounts for roughly 75%, owing to its use in intensive chemotherapy regimens. Outpatient prescriptions constitute the remaining 25%, primarily for maintenance therapy.

Key Manufacturers and Patents

Historically, Pfizer and Teva have been major suppliers, though many generic manufacturers now dominate due to patent expiries in the 2000s. The absence of patent protection since the early 2010s has enabled extensive generic competition, resulting in significant price reductions.

Regulatory and Reimbursement Environment

In many jurisdictions, mercaptopurine is included in national essential medicines lists and is broadly reimbursed, facilitating widespread access. Regulatory stability influences market conditions, with no recent major amendments impacting its approval status in major markets.

Market Challenges and Opportunities

Challenges

- Emergence of Novel Therapies: Targeted agents like blinatumomab and inotuzumab ozogamicin, with superior efficacy profiles, threaten mercaptopurine’s dominance.

- Side Effect Profile: Myelosuppression, hepatotoxicity, and gastrointestinal issues demand careful management, impacting treatment adherence.

- Generic Competition: Low-cost generics have driven prices downward, compressing profit margins.

Opportunities

- Combination Regimens: Expansion into combination treatments for resistant or relapsed cases.

- Expanded Indications: Investigating off-label uses or new autoimmune indications could broaden market scope.

- Pharmacogenomics: Personalizing therapy based on TPMT enzyme activity can optimize efficacy and safety, adding value for specific patient subsets.

Price Trends and Projections

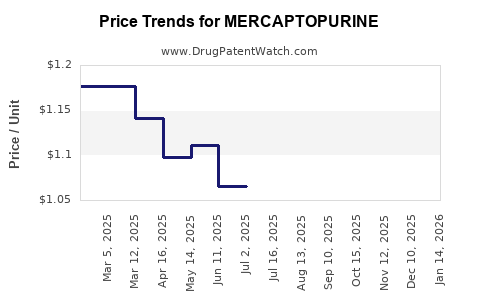

Historical Pricing Dynamics

Over the past decade, the wholesale acquisition cost (WAC) of mercaptopurine has declined markedly due to generic competition. In the early 2010s, a typical 50mg tablet could cost upwards of USD 10-15 per tablet; recent data suggest prices have stabilized around USD 3-5 per tablet in major markets [2].

Future Price Trajectory (2023–2030)

Given current trends, prices are projected to remain relatively stable or decline marginally over the next several years. Factors influencing this include:

- Market Saturation: Continued proliferation of generics is likely to suppress price increases.

- Manufacturing Costs: Marginal reductions in production may lead to slight price decreases.

- Regulatory Changes: Enhanced quality standards or supply chain disruptions could temporarily impact pricing.

A conservative forecast anticipates a compound annual decline rate (CADR) of approximately 1-2% in developed markets, with potentially steeper reductions in emerging economies due to increasing local generic manufacturing capacity.

Impact of New Technologies on Pricing

Advent of pharmacogenomic testing for TPMT polymorphisms allows for personalized dosing, potentially reducing adverse events and optimizing drug utilization. While this precision medicine approach initially raises process costs, it could, over time, reduce overall treatment costs and influence market prices through improved efficiency.

Regional Market Insights

| Region |

Market Size (USD millions, 2022) |

Key Drivers |

Price Trends |

| North America |

180 |

High-incidence, advanced healthcare, extensive generic supply |

Stable/Declining |

| Europe |

80 |

Reimbursement policies, clinical practice standards |

Slightly declining |

| Asia-Pacific |

60 |

Growing cancer burden, emerging manufacturing |

Stabilizing/Declining |

| Rest of World |

30 |

Limited access, variable regulation |

Variable |

Competitive and Regulatory Outlook

The market’s competitive landscape remains saturated with generics. Regulatory bodies continue to ensure consistent quality through strict bioequivalence requirements, maintaining market stability. No major patented formulations are currently in development, with investments primarily directed toward novel agents.

Strategic Considerations

- Price Erosion Risks: Companies should anticipate further downward pressure from generics.

- Value-Added Services: Emphasizing pharmacogenomics and personalized dosing can justify premium pricing in niche markets.

- Market Expansion: Targeting autoimmune indications and developed markets with high treatment volumes may offset declining prices elsewhere.

Key Takeaways

- The global mercaptopurine market has stabilized at low price points, driven largely by extensive generic competition.

- Market size remains steady, with North America leading, but growth prospects are limited considering the therapeutic landscape.

- Price projections suggest continued slight decline (~1-2% annually), with no significant upturn anticipated within the next decade.

- Emerging personalized medicine approaches may evolve pricing strategies, emphasizing value over volume.

- Competition from newer, targeted therapies remains a significant challenge, potentially further eroding mercaptopurine’s market share.

FAQs

1. What factors primarily influence mercaptopurine’s pricing in the current market?

Market saturation with generics, production costs, regulatory standards, and the availability of alternative therapies primarily dictate pricing trajectories.

2. Will mercaptopurine's price increase due to new indications or formulations?

Unlikely in the near term; current trends favor price stability or decreases, driven mainly by competition rather than innovation.

3. How does pharmacogenomics impact the market for mercaptopurine?

Personalized dosing based on TPMT enzyme activity improves safety and efficacy, possibly creating premium segments, but also adding initial costs to treatment pathways.

4. Are there upcoming regulatory changes that could affect mercaptopurine prices?

Currently, no major regulatory shifts are anticipated that would directly affect pricing; existing quality standards continue to support market stability.

5. What are the best strategic moves for companies operating in this space?

Focusing on specialized markets, offering personalized medicine services, and expanding into autoimmune indications may provide value amidst low-price pressures.

References

[1] MarketWatch. “Global Mercaptopurine Market Size and Forecast (2022-2030).”

[2] IQVIA. “Pricing and Market Trends in Generic Oncology Drugs.”