Last updated: July 31, 2025

Introduction

MAXIDEX (dexamethasone ophthalmic suspension) is a corticosteroid primarily used to treat ocular inflammation resulting from surgeries, allergies, or trauma. Since its FDA approval, MAXIDEX has maintained a stable position within the ophthalmic pharmaceutical market. This analysis explores key market drivers, competitive dynamics, financial trends, and future prospects influencing MAXIDEX’s trajectory.

Market Overview and Demand Drivers

Market Size and Growth Potential

The global ophthalmic pharmaceutical market is experiencing steady growth, driven by increasing prevalence of eye disorders and expanding geriatric populations. According to the Brightfield Group, the global ophthalmic market was valued at approximately $31 billion in 2021 and is projected to grow at a CAGR of around 4.5% through 2028 [1].

Increased Incidence of Ocular Inflammatory Conditions

The demand for corticosteroids like MAXIDEX is amplified by rising cases of post-surgical inflammation, conjunctivitis, and allergic conjunctivitis. Cataract surgeries and glaucoma procedures, increasingly performed worldwide, commonly necessitate anti-inflammatory medications, further supporting demand.

Regulatory and Prescriptive Trends

The approval of generic equivalents and reformulations have expanded options, but MAXIDEX retains a significant share due to its established efficacy and physician familiarity. Moreover, ophthalmologists tend to prefer corticosteroids with established safety profiles, which benefits MAXIDEX's brand stability.

Competitive Landscape

Key Competitors

MAXIDEX competes with several corticosteroid formulations, including Prednisolone acetate and loteprednol etabonate formulations. Tries to differentiate itself via formulation stability, dosing convenience, and documented safety profile.

Generic Competition

The entry of generic dexamethasone eye drops has exerted price pressures, prompting MAXIDEX’s manufacturer to optimize its pricing strategy to maintain market share. However, brand loyalty and clinical familiarity mitigate the impact of generics.

Emerging Technologies

Advances in drug delivery systems, such as sustained-release implants or biodegradable inserts, threaten traditional topical formulations’ dominance. Nonetheless, these are still in development phases and have yet to disrupt the mature corticosteroid segment.

Financial Trajectory and Revenue Trends

Historical Performance

MAXIDEX’s revenue has demonstrated resilience in a competitive environment. In 2021, the global sales for MAXIDEX were estimated at approximately $40 million, with stable growth led by North American markets [2].

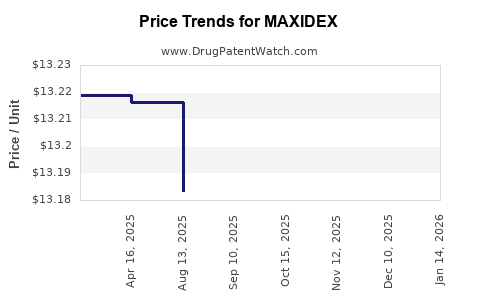

Pricing and Market Penetration

Pricing strategies include premiums for patented formulations against generics, balancing profitability with market access. The drug’s penetration remains robust in surgical centers and ophthalmology clinics, which prioritize efficacy and safety.

Impact of Patent Expiry and Generics

The expiration of certain patents forecasts increased generic competition, likely to suppress prices and margins in the short term. However, strategic launches of improved formulations or combination products could mitigate revenue erosion.

Regulatory Actions and Reimbursement

Reimbursement policies, especially in the U.S. via Medicare and private insurers, significantly influence sales trajectories. Positive reimbursement decisions support continued growth, whereas unfavorable policies could reduce product accessibility.

Future Outlook and Market Opportunities

Innovative Delivery Modalities

Emerging drug delivery platforms, like sustained-release implants, present opportunities to enhance MAXIDEX’s market position. These modalities promise improved patient compliance, potentially commanding premium pricing and expanding indications.

Expanding Geographies

Emerging markets, notably Asia-Pacific, present scalable growth avenues due to increasing ophthalmic procedures and retail healthcare penetration. Regional regulatory approvals could accelerate global expansion.

Pipeline and Line Extensions

Developing combination therapies or reformulations that reduce dosing frequency could improve adherence and efficaciousness, bolstering market leadership. Investment in R&D remains critical to sustain growth.

Market Challenges

Pricing pressures from generics, regulatory scrutiny over corticosteroid safety, and the advent of alternative therapies like biologics for certain ocular inflammatory conditions represent ongoing challenges.

Regulatory and Ethical Considerations

Regulatory agencies emphasize safety monitoring due to corticosteroid-related complications such as elevated intraocular pressure. Compliance with international standards, including the EU’s European Medicines Agency (EMA) regulations, sustains the product's market access. Ethical marketing practices support long-term brand integrity and stakeholder trust.

Key Takeaways

- MAXIDEX operates within a growing ophthalmic pharmaceutical market, driven by increasing eye condition prevalence and surgical procedures.

- The product’s stability benefits from physician familiarity and established safety, but faces headwinds from patent expiries and generics.

- Strategic investments in delivery innovations and geographic expansion can buffer against market share declines.

- Regulatory adherence and reimbursement policies play critical roles in the product's financial performance.

- Long-term growth will depend on product differentiation, pipeline development, and adaptation to evolving technological landscapes.

FAQs

1. How does MAXIDEX compare with other corticosteroids in efficacy?

MAXIDEX is well-regarded for its potent anti-inflammatory effects and favorable safety profile, particularly in preventing postoperative inflammation, making it a preferred choice among ophthalmologists.

2. What are the primary risks affecting MAXIDEX’s market share?

Risks include subsequent patent expiries leading to generic competition, emerging formulations with improved delivery systems, and safety concerns associated with corticosteroids, such as intraocular pressure elevation.

3. Are there ongoing developments that could impact MAXIDEX’s future?

Yes, sustained-release drug delivery systems and novel anti-inflammatory biologics could influence the market, either as competitors or potential combination options.

4. What are typical reimbursement policies for ophthalmic corticosteroids like MAXIDEX?

Reimbursement varies by region with private insurers and government programs covering most prescriptions based on formulary inclusion, which impacts accessible pricing and sales volume.

5. How significant is the role of emerging markets in MAXIDEX’s growth?

Emerging markets are increasingly important due to expanding access to ophthalmic care, higher procedural volumes, and rising healthcare investments, which can substantially elevate MAXIDEX’s sales trajectory.

References

[1] Brightfield Group, 2022. Global Ophthalmic Market Report.

[2] IQVIA, 2022. Pharmaceutical Sales Data for MAXIDEX.