Last updated: July 28, 2025

Introduction

MAXIDEX (dexamethasone ophthalmic suspension) is a corticosteroid used primarily for reducing inflammation following ocular surgery, managing uveitis, or treating allergic conjunctivitis. Its market positioning hinges on its efficacy, safety profile, competitive landscape, regulatory status, and pricing strategies. As a well-established treatment, MAXIDEX maintains a significant role within ophthalmic therapeutics, particularly in North America and Europe. This analysis provides an in-depth review of the current market and project future price trajectories, supporting informed decision-making for stakeholders.

Current Market Landscape

Market Overview

The global ophthalmic drug market was valued at approximately USD 30 billion in 2022, with corticosteroids representing a substantial segment owing to their critical role in inflammatory ocular conditions. MAXIDEX, as a branded topical corticosteroid, faces competition from both generic dexamethasone formulations and alternative anti-inflammatory agents. The rise in surgical procedures, such as cataract surgeries, propels demand for post-operative anti-inflammatory drugs, bolstering MAXIDEX’s market position.

Key Market Drivers

- Growing Prevalence of Ocular Inflammatory Conditions: Age-related macular degeneration and uveitis prevalence increases globally, especially in aging populations, fueling demand for anti-inflammatory medications.

- Increased Surgical Procedures: Advancements in ophthalmic surgeries augment post-operative care needs, augmenting prescriptions of corticosteroids like MAXIDEX.

- Regulatory Approvals and Indications Expansion: Ongoing clinical trials and expanded indications can boost market footprint.

- Patient Preference for Topical Corticosteroids: High efficacy and ease of administration support continued utilization.

Competitive Dynamics

MAXIDEX's principal competition includes generic dexamethasone eye drops and other corticosteroids like prednisolone acetate and loteprednol. While generics exert pricing pressure, MAXIDEX benefits from brand recognition and formulary placement in certain healthcare settings. Notably, the introduction of biosimilars or new formulations may influence market share in the future.

Regulatory and Patent Landscape

- Patent Expiry: MAXIDEX's primary patents have expired or are nearing expiration in major markets, enabling generics entry, which significantly impacts pricing.

- Regulatory Approvals: Sustained approvals by the FDA and EMA support current market presence and can serve as barriers for newcomers.

Pricing Strategies and Trends

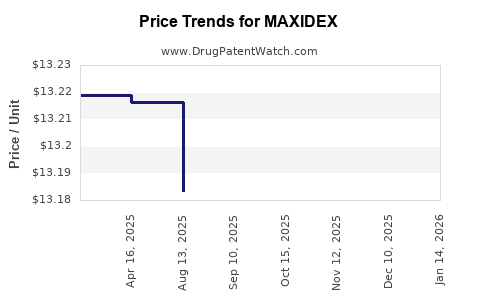

Historical Pricing

Historically, MAXIDEX has been priced at a premium compared to generics, justified by clinical efficacy, delivery device advantages, and brand loyalty. In the U.S., the retail price for a 0.1% suspension has typically ranged from USD 150–250 per bottle, with variations arising from pharmacy markups and insurance coverage.

Factors Influencing Price

- Patent Status: Pending patent expirations may precipitate price reductions due to generic competition.

- Manufacturing Costs: Cost efficiencies and scale effects influence retail pricing.

- Market Access and Reimbursement Policies: Payers' formulary decisions and reimbursement rates significantly impact actual consumer prices.

- Supply Chain Dynamics: Price fluctuations in raw materials and distribution logistics also affect net pricing strategies.

Price Projections (2023–2030)

Near-term (2023–2025)

In the immediate future, the introduction of generic dexamethasone formulations is anticipated to exert downward pressure on MAXIDEX's price. Wholesale acquisition costs (WAC) are likely to decline by 20–30%, aligning with typical generic launches. Despite this, branded formulations may retain a premium due to brand affinity and perceived quality, stabilizing prices in select markets.

Mid to Long-term (2026–2030)

As patent protections lapse fully and multiple generics enter the market, competition could drive prices down further, potentially by 40–50%. However, factors like patent life extensions through formulations or delivery devices, as well as regulatory barriers for newer entrants, could moderate these declines.

In this period, manufacturers might shift focus toward value-added services, differentiated formulations, or combination therapies, possibly maintaining higher price points for advanced or proprietary versions. Furthermore, price stabilization may occur if MAXIDEX secures additional indications or if formulary exclusivity bolsters its market position.

Potential Market Influencers

- Introduction of Biosimilars or Novel Formulations: Could reduce prices further.

- Reimbursement Policy Changes: Favoring cost-effective generics might accelerate price declines.

- Healthcare Policy Trends: Emphasis on value-based care may influence prescribing behaviors and pricing models.

- Emergence of Alternative Therapies: Non-steroidal anti-inflammatory drugs (NSAIDs) or biologic agents could challenge corticosteroid dominance.

Regional Market Differences

- North America: High reimbursement rates and robust healthcare infrastructure support premium pricing; however, patent expirations will likely impact prices over time.

- Europe: More aggressive pricing controls and centralized drug approval processes may lead to lower prices; however, multiple generics will also influence market dynamics.

- Emerging Markets: Lower price points are prevalent, with increased access due to local manufacturing and approval.

Potential Risks and Opportunities

- Risks: Rapid generic entry, regulatory changes, shifts in treatment guidelines favoring non-steroid anti-inflammatory agents, and reimbursement pressures.

- Opportunities: Developing combination formulations, expanding indications, and strategic alliances for broader access can sustain or enhance pricing strategies.

Key Takeaways

- The upcoming patent expirations are poised to accelerate generic competition, leading to a significant decrease in MAXIDEX prices over the next decade.

- Current premium pricing is likely to decline by approximately 20–50%, depending on regional factors and market dynamics.

- Market growth will be driven by increasing ocular inflammatory conditions and surgical procedures, but price erosion due to generics will necessitate strategic adaptations.

- Stakeholders should monitor patent statuses, regulatory shifts, and competitive launches to optimize pricing and market positioning.

- Innovation in formulation and indications can counterbalance pricing pressures and sustain revenue streams.

FAQs

1. When are the patents for MAXIDEX expected to expire?

The primary patents protecting MAXIDEX are expected to expire between 2024 and 2026 in major markets, opening the door for generic competitors.

2. How will generic entry affect MAXIDEX’s pricing?

Generic competitors typically reduce retail prices significantly, with declines of 20–50% expected depending on market and the number of entrants.

3. Are there ongoing efforts to develop formulations that could extend MAXIDEX’s market exclusivity?

Yes. Manufacturers may pursue formulations with novel delivery systems or additional indications, which can provide patent extensions and pricing advantages.

4. How does the current regulatory environment influence MAXIDEX pricing?

Stringent pricing regulations in certain regions and reimbursement policies favoring cost-effectiveness tend to suppress prices, especially for off-patent drugs.

5. What strategies can MAXIDEX manufacturers adopt to retain market share amid price erosion?

Focus on differentiated formulations, expanding indications, developing combination therapies, and engaging with payers for favorable formulary placement are key to maintaining profitability.

References

[1] Market Research Future. (2022). Ophthalmic Drugs Market Report.

[2] EvaluatePharma. (2023). Ophthalmic Drugs Annual Review.

[3] U.S. FDA Database. (2023). Approved Ophthalmic Medications.

[4] Global Data. (2023). Ophthalmic Drug Market Trends.

[5] IMS Health. (2022). Pharmaceutical Pricing Trends.

Note: The price projections and market insights are based on current trends, patent statuses, and competitive landscapes as of early 2023, and are subject to change based on future developments.