Last updated: July 28, 2025

Introduction

Maraviroc, a CCR5 antagonist developed by Pfizer, is an antiretroviral drug approved for the treatment of HIV-1 infection. Since its initial approval in 2007, the drug's market landscape has undergone significant shifts driven by evolving treatment guidelines, emerging therapies, and strategic patent decisions. This analysis explores the current market dynamics, key factors influencing its financial trajectory, and emerging opportunities for growth or decline within the global HIV therapy market.

Market Overview

The global HIV treatment market is estimated to reach approximately USD 41 billion by 2026, driven by increasing HIV prevalence, advancements in antiretroviral therapy (ART), and expanding access in emerging markets [1]. Maraviroc, branded as Selzentry (North America only), occupies a niche within this domain as part of combination therapy regimens, but faces intense competition from newer agents with improved tolerability and efficacy profiles.

Product Profile and Regulatory Status

Maraviroc’s mechanism targets the CCR5 receptor, blocking HIV entry into host cells. It was a pioneering entry inhibitor with a unique mechanism at approval; however, its prescribed use is limited to CCR5-tropic HIV-1 strains confirmed via tropism testing, constraining its market appeal relative to more universally applicable agents against both CCR5- and CXCR4-tropic strains [2].

Currently, Maraviroc retains regulatory approval in major markets, including the U.S., Europe, and Japan, primarily as part of combination therapies for treatment-experienced patients. Its market exclusivity extends until the expiration of relevant patents, with non-exclusive licensing and biosimilar entrants poised to impact its revenues.

Market Dynamics

Steady Decline Amidst Competitive Pressures

The market share of maraviroc has declined since its peak in the late 2000s. This trend results from multiple factors:

-

Emergence of Fixed-Dose Combinations (FDCs): Newer FDCs combining integrase inhibitors (e.g., dolutegravir, bictegravir) with other agents have overtaken maraviroc due to simplified dosing and improved tolerability.

-

Shift Toward Potent, Once-Daily Regimens: Innovator drugs offer a once-daily, single-pill regimen with fewer side effects, reducing the prescription of maraviroc, which often requires tropism testing and multiple pills.

-

Limited Broader Spectrum Activity: Maraviroc’s specificity for CCR5-tropic strains limits its use, especially as dual- or pan-tropic options are preferred.

-

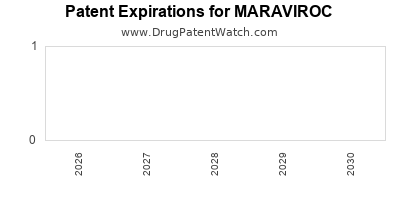

Patent Expirations & Biosimilars: Pfizer's patents for maraviroc are nearing expiration in key markets. The rise of biosimilars or generics, particularly outside the U.S., threatens future revenue streams.

Geographic Market Trends

-

United States: Maraviroc retains a niche status primarily for treatment-experienced patients with CCR5-tropic virus. Its prescribing is declining due to the dominance of integrase inhibitors.

-

Europe: Similar trends apply, with shifting guidelines favoring newer agents.

-

Emerging Markets: Rising HIV prevalence in Africa, Asia, and Latin America creates potential demand; however, cost considerations and resource constraints favor generic, cheaper options over branded maraviroc.

Pipeline and Off-label Use

Currently, no significant pipeline initiatives target expanding the scope of maraviroc's indications. Some exploratory studies consider its role in inflammatory diseases, leveraging CCR5’s involvement in immune regulation, yet these remain experimental with limited commercialization prospects [3].

Financial Trajectory Analysis

Revenue Trends and Forecast

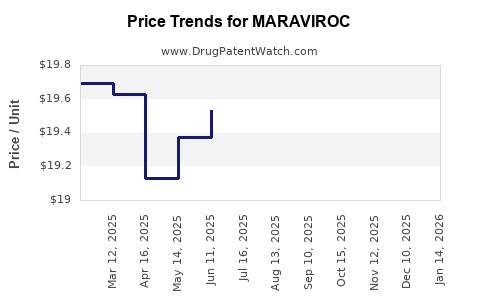

Historical financial data indicate a peak annual revenue exceeding USD 1 billion in the late 2000s, followed by a steady decline. Pfizer reported that in 2020, maraviroc revenues fell below USD 250 million globally, a downward trajectory expected to continue as patent protections wane.

Industry analysts project that by 2025, revenues could diminish further, approaching USD 100 million annually, primarily driven by legacy sales in constrained markets. The absence of new formulations or indications limits upside potential unless significant development or licensing opportunities materialize.

Impact of Patent Expiry and Biosimilars

Patent expiration in key jurisdictions (e.g., January 2023 in the U.S.) opens the door for biosimilar competition, which could rapidly erode revenues. Historically, genericization in antiretrovirals reduces market prices substantially—by up to 80%—as seen with other classes like NRTIs and NNRTIs.

Pfizer’s strategic response—to license or offload maraviroc rights—may influence future profitability. Additionally, potential partnerships for developing novel formulations or combination products could temporarily buffer revenue declines.

Strategic Opportunities and Risks

-

Off-label and Expanded Use: Limited but ongoing clinical research into maraviroc’s immunomodulatory effects could unlock niche markets in inflammatory or fibrotic diseases, although commercialization risks remain high.

-

Combination Therapy Development: Partnering with emerging biotech firms to develop fixed-dose regimens including maraviroc remains a longshot due to pharmacodynamic incompatibilities and market preferences.

-

Geographic Expansion: Targeted efforts in low-income countries could sustain a baseline revenue, especially where generic options are less accessible.

Risks

-

Market Saturation and Obsolescence: The rapid adoption of integrase inhibitors renders maraviroc increasingly obsolete in traditional HIV care.

-

Pricing Pressures: Biosimilar entry will likely lead to steep price reductions.

-

Limited Patent Life: The approaching patent cliffs diminish revenue potential unless new uses or formulations are explored.

Future Outlook

Maraviroc’s financial trajectory appears set on a decline unless Pfizer or partner companies identify innovative uses or formulations that can rejuvenate its market appeal. The drug’s niche status within HIV therapy suggests that, in the short to medium term, it will serve a small segment of treatment-naïve or treatment-experienced patients with specific tropism profiles.

Long-term growth may be facilitated by research into off-label indications, especially in immune-mediated and fibrotic diseases involving CCR5 pathways. Otherwise, the drug’s financial potential remains confined within legacy markets, with sustained revenues dependent on strategic licensing, patent management, and geographic expansion.

Key Takeaways

-

Maraviroc faces an increasingly competitive market landscape, driven by newer, more convenient antiretroviral agents.

-

Patent expiration and biosimilar competition threaten future revenues, emphasizing the need for strategic licensing or repositioning.

-

Geographic and demographic factors may sustain limited sales in certain markets, especially where access to generics is constrained.

-

Research into additional therapeutic indications offers potential, though significant commercial returns are speculative.

-

The overall financial trajectory underscores the importance of innovation and strategic partnerships to extend maraviroc’s lifecycle.

FAQs

1. What are the primary factors contributing to the decline in maraviroc’s market share?

The advent of more effective, tolerable, and convenient antiretroviral regimens—particularly integrase inhibitors—has displaced maraviroc. Furthermore, its requirement for tropism testing limits widespread applicability, and patent expirations facilitate generic competition, further eroding market share.

2. Are there emerging indications that could revitalize maraviroc’s market?

Preliminary studies explore maraviroc’s role in inflammatory and fibrotic diseases involving CCR5 pathways; however, these are early-stage and not expected to significantly impact its HIV-focused market in the near term.

3. How does patent expiration influence the future revenues for maraviroc?

Patent expiration typically opens the door for biosimilar competition, drastically reducing drug prices and sales volume, thereby significantly diminishing future revenues unless new licensing deals or formulations are introduced.

4. What strategic options are available for Pfizer regarding maraviroc?

Pfizer could license the drug to emerging markets, develop combination products, or reposition maraviroc in niche therapeutic areas. Alternatively, a sale or relinquishment of rights could occur if commercial prospects diminish further.

5. Which markets hold the highest potential for maraviroc amid emerging competition?

Emerging economies with limited access to affordable generics may sustain some sales, especially where HIV prevalence is high and healthcare resources are constrained. However, overall, these markets are unlikely to generate substantial revenues in the face of low-cost alternatives.

References

- Global HIV Market Analysis, 2021. Market Research Future.

- Maraviroc FDA Approval Document. U.S. Food & Drug Administration, 2007.

- CCR5 Antagonists in Immune Modulation. Journal of Immunology Research, 2019.