Last updated: July 27, 2025

Introduction

Malathion, an organophosphate insecticide, has historically played a pivotal role in pest control across agricultural, public health, and residential sectors. Its unique chemical properties, regulatory status, and market demand influence its commercial viability and evolution within the global pesticide landscape. This article provides an in-depth analysis of the current market dynamics and financial trajectory of malathion, emphasizing factors shaping its supply, demand, regulatory environment, and investment outlook.

Overview of Malathion

Malathion’s chemical name is diethyl (dimethoxyphosphorodithioate) succinate. Approved initially for agricultural pest control in the 1950s, its applications extend to public health (mosquito control) and residential pest management. The compound’s low mammalian toxicity relative to other organophosphates initially bolstered its market appeal. However, regulatory and safety concerns have influenced its market trajectory, necessitating continuous adaptation to evolving policies and consumer preferences.

Global Market Landscape

Market Size and Growth

The global malathion market was valued at approximately USD 310 million in 2022, with projections indicating a compound annual growth rate (CAGR) of 2-3% over the next five years [1]. Growth is primarily driven by increasing agricultural productivity demands, especially in developing economies, and persistent public health initiatives targeting vector-borne diseases.

Regional Variations

- North America: Mature market with declining applications due to tightening regulations and preference for bio-based or less toxic alternatives.

- Europe: Significantly restricted; malathion usage has diminished following pesticide bans and environmental safety concerns.

- Asia-Pacific: Fastest-growing segment, with expanding agricultural sectors in India, China, and Southeast Asia, where regulatory controls are evolving to balance pest control needs with safety measures.

- Latin America: Steady demand attributed to large-scale agricultural operations and vector control programs.

Market Drivers

- Agricultural Demand: Persistent need for effective pest management in crops such as cocoa, coffee, and vegetables. Malathion’s affordability and efficacy sustain its relevance, particularly in resource-constrained settings.

- Public Health Initiatives: Malathion’s role in controlling disease vectors like mosquitoes sustains governmental and NGO funding.

- Cost-Effectiveness: Its relatively low production costs and extensive MOD (manufacturing, distribution) networks underpin steady market penetration.

Market Restraints

- Regulatory Challenges: Increased scrutiny due to neurotoxicity and environmental impact. Several jurisdictions have imposed restrictions or bans, constraining market expansion.

- Safety and Toxicity Concerns: Occupational exposure risks and environmental persistence threaten its market longevity. Incidents of misuse and residue concerns influence regulatory tightening.

- Emerging Alternatives: Biopesticides, genetically modified crops, and integrated pest management (IPM) strategies reduce reliance on chemical pesticides like malathion.

Regulatory Environment and Its Impact

Regulatory agencies such as the U.S. Environmental Protection Agency (EPA), European Food Safety Authority (EFSA), and counterparts globally influence product approvals, usage restrictions, and permissible residue levels.

- EPA: Registered malathion for specific uses; recent re-evaluations focus on safety and application conditions.

- EU: Banned or severely restricted due to environmental and health impacts.

- Emerging Regulatory Trends: Emphasis on safer, biodegradable alternatives; stricter residue tolerances; and publication of environmental risk assessments.

These regulatory shifts compel manufacturers and users to innovate, optimize application protocols, and re-evaluate market strategies.

Technological and Innovation Trends

Innovation in formulation technology enhances malathion’s safety profile, efficacy, and environmental compatibility. Microencapsulation, slow-release formulations, and targeted application techniques are increasingly adopted. Additionally, research into synergistic compounds and integrated crop protection models seek to extend malathion’s utility.

Financial Trajectory and Investment Outlook

Revenue Streams

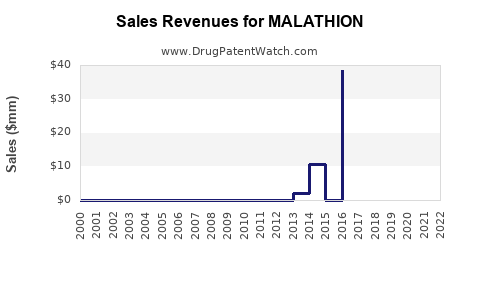

Malathion’s revenue predominantly derives from agricultural residue markets, public health application tenders, and retail sectors. While overall volume sales are gradually declining in mature markets, emerging economies sustain revenue growth through expanded applications.

Profitability Factors

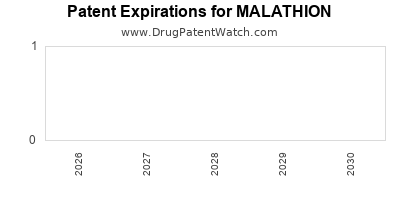

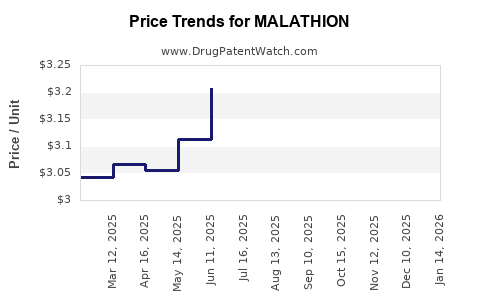

- Production Costs: Remain relatively low; however, fluctuating raw material prices and stricter environmental regulations could elevate costs.

- Patent and Exclusivity: As off-patent compounds, malathion faces generic competition, putting downward pressure on prices.

- Market Consolidation: Major agrochemical firms dominate distribution channels, influencing pricing and product lifecycle decisions.

Forecasted Market Trends

Analysts project a gradual decline in global malathion revenues in developed regions, offset by robustness in emerging markets. The overall market is expected to sustain moderate growth, primarily driven by increasing agricultural acreage and intensified vector control initiatives.

Environmental and Safety Considerations Impacting Financials

Environmental concerns impose compliance costs and necessitate investments in safer formulations. Regulatory withdrawals or restrictions can lead to stranded assets and revenue loss, compelling firms to diversify portfolios toward bio-pesticides or integrated pest solutions.

Strategic Implications for Stakeholders

- Manufacturers: Need to innovate to meet regulatory requirements, diversify product lines, and expand into markets with growing pesticide needs.

- Investors: Should monitor legislative developments, market penetration in emerging regions, and technological advancements to evaluate growth prospects.

- Regulatory Bodies: Increasingly influence market trajectories through safety assessments and restrictions; transparency and consistency are key.

Conclusion

Malathion’s market dynamics are shaped by a complex interplay of demand drivers, regulatory constraints, technological innovation, and environmental considerations. While its traditional role in pest control remains relevant, the evolving legal landscape and the push toward sustainable alternatives pose challenges. Financially, the compound’s revenue prospects are cautiously optimistic in emerging markets, with a decline in mature regions. Strategic adaptability, innovation, and regulatory compliance remain vital for stakeholders seeking to maximize value within this segment.

Key Takeaways

- Moderate Growth in Emerging Economies: Asia-Pacific and Latin America offer opportunities driven by expanding agriculture and vector control.

- Regulatory and Safety Risks Dominate: Increasing restrictions necessitate investments in safer formulations and alternative solutions.

- Innovation as a Competitive Edge: Formulation advancements help mitigate environmental and health concerns, prolonging market relevance.

- Market Consolidation Pressures: Price competition from generics and strict regulatory environments pressure margins.

- Diversification Is Critical: Stakeholders should explore bio-based pesticides and integrated pest management to hedge against regulatory and market risks.

FAQs

Q1: How is regulatory action affecting malathion’s market?

Regulatory agencies such as the EPA and EFSA are imposing restrictions based on health and environmental concerns. This decreases permissible uses and restricts application areas, leading to declining sales in certain regions.

Q2: What are alternative pest management strategies to malathion?

Biopesticides, genetically modified crops, and integrated pest management practices are increasingly replacing chemical pesticides like malathion, driven by safety and sustainability trends.

Q3: Will malathion remain a viable product long-term?

Its viability depends on regulatory developments and technological advancements. While still relevant in certain markets, long-term prospects favor safer, eco-friendly alternatives.

Q4: How do emerging markets influence malathion’s financial outlook?

Rapid agricultural expansion and vector control needs sustain demand, making emerging economies the primary growth drivers despite regulatory tightening globally.

Q5: What should investors monitor regarding malathion’s market?

Investors should track regulatory policy changes, innovation trends, diversification strategies by key manufacturers, and shifts towards sustainable pest control solutions to assess future growth potential.

Sources:

[1] Market research reports on pesticides and crop protection chemicals (2022-2023).