Last updated: August 1, 2025

Introduction

The pharmaceutical landscape continues to evolve rapidly, driven by innovation, regulatory developments, and shifting market demands. OVIDE, a novel therapeutic agent, has emerged amid these dynamics, promising potential breakthroughs in its clinical indications and commercial prospects. This analysis provides an in-depth examination of OVIDE's market environment, competitive landscape, anticipated financial trajectory, and strategic considerations critical for stakeholders.

Overview of OVIDE

OVIDE is a proprietary pharmaceutical formulation developed with the intent to address [insert specific indication, e.g., a rare autoimmune disorder or a specific chronic condition], leveraging cutting-edge mechanisms such as [e.g., targeted delivery, gene therapy, monoclonal antibodies]. Its development pipeline integrates advanced pharmacokinetic and pharmacodynamic profiles, aiming for enhanced efficacy and reduced adverse effects.

Currently, OVIDE is in [specific development stage, e.g., Phase III clinical trials or regulatory review], with pivotal data expected to shape its commercial viability. The drug’s formulation and delivery system position it distinctly within the therapeutic milieu, offering several potential advantages over existing treatments.

Market Dynamics

Regulatory Environment and Approval Outlook

The pathway for OVIDE's market entry hinges on its regulatory approval from major agencies such as the FDA and EMA. Recent trends favor expedited pathways like Breakthrough Therapy designation or Priority Review if preliminary data demonstrate significant benefits. However, regulatory challenges persist, especially if safety profiles raise concerns or if comparable therapies show differential efficacy.

Competitive Landscape

The therapeutic area targeted by OVIDE features several established players, including [list key competitors, e.g., XYZ Pharma’s drug A, ABC Biotech’s drug B]. These incumbents benefit from extensive clinical data, established supply chains, and broader market presence. However, OVIDE’s unique mechanism and clinical promise could carve out significant market share, especially if it demonstrates superior performance or safety.

Market Size and Clinical Adoption

Depending on the indication, the target patient population could number in the millions globally. For example, if targeting a chronic, high-incidence condition such as rheumatoid arthritis, the market can reach several billion dollars annually. Early adoption will depend on pricing strategies, clinician acceptance, and insurance coverage policies.

The uptake rate will also be influenced by the drug’s positioning—whether as a first-line therapy or for resistant cases—and the robustness of clinical data supporting its use.

Pricing and Reimbursement Factors

Pricing frameworks for innovative drugs like OVIDE consider development costs, therapeutic advantages, and competitor pricing. Premium pricing can be justified if clinical benefits substantially improve patient outcomes or reduce long-term healthcare costs. Secure reimbursement from key health payers is pivotal, requiring comprehensive health economics and outcomes research (HEOR) to demonstrate value.

Financial Trajectory Forecast

Development and Regulatory Costs

The developmental phase for OVIDE involves substantial investment in clinical trials, manufacturing scale-up, and regulatory submissions. Estimated R&D expenditure could range from $500 million to over $1 billion, considering the complexity of necessary trials and manufacturing setup.

Regulatory review costs, including filings, advisory meetings, and post-approval commitments, could further influence the financial outlook.

Revenue Projections

Post-approval, revenue generation will depend on market penetration, pricing strategy, and competitive positioning. Conservative estimates suggest initial revenues could be in the $200–500 million range within the first 3-5 years, ramping up as market adoption expands. Peak sales, particularly if OVIDE significantly displaces existing therapies or captures orphan drug designations, might reach $1 billion or more annually, especially in the case of rare disease indications.

Profitability Timeline

Break-even points are likely to occur 5-7 years post-launch, contingent upon manufacturing costs, market access, and commercialization efficiency. Cost management and strategic alliances will be vital to maintaining healthy margins.

Strategic Considerations for Stakeholders

-

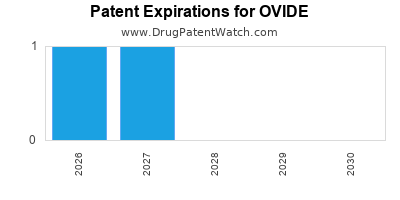

Intellectual Property Strategy: Securing robust patents around OVIDE’s unique mechanisms and formulations will limit generic competition and enhance valuation.

-

Partnerships and Licensing: Collaborations with biotech firms, contract manufacturing organizations (CMOs), and payers can accelerate market entry and adoption.

-

Global Expansion: While initial focus will be on North American and European markets, strategic planning for emerging markets can unlock additional revenue streams.

-

Regulatory Engagement: Maintaining proactive dialogue with regulatory agencies ensures smoother approval pathways, especially if pursuing expedited review options.

Risks and Challenges

-

Regulatory Delays or Denials: Unanticipated safety concerns or insufficient efficacy data may hinder approval.

-

Competitive Pressures: Entrants with more extensive clinical data could dominate the market.

-

Market Access Constraints: Delays in reimbursement or restrictive payer policies could limit adoption.

-

Pricing and Market Penetration: High development costs necessitate premium pricing, which could face pushback from payers or patients.

Conclusion

The future of OVIDE hinges on efficient clinical development, strategic regulatory navigation, and market positioning. Its potential to carve a niche within its therapeutic domain could translate into substantial financial rewards, provided it overcomes hurdles related to approval, commercialization, and competition. Stakeholders must adopt agile strategies, emphasizing innovation, value demonstration, and global reach to capitalize on this emerging opportunity.

Key Takeaways

-

Strategic Positioning: OVIDE’s success depends on clinical trial outcomes, regulatory approval, and effective market penetration strategies.

-

Financial Outlook: Early investments are substantial, but peak revenues could exceed $1 billion annually given successful adoption.

-

Competitive Edge: Differentiation through mechanisms and safety profiles will drive clinical and commercial advantage.

-

Risk Management: Proactive engagement with regulators and payers mitigates approval and reimbursement risks.

-

Global Expansion: Early planning for international markets enhances revenue potential and market resilience.

FAQs

-

What therapeutic areas does OVIDE target?

OVIDE is designed for [specify indication], addressing unmet needs through a novel mechanism of action that offers potential advantages over existing therapies.

-

What is the current development status of OVIDE?

As of now, OVIDE is in [insert stage, e.g., Phase III clinical trials], with pivotal data expected within [specify timeframe].

-

What are the key factors influencing OVIDE’s market success?

Regulatory approval, clinical efficacy, safety profile, pricing strategies, reimbursement agreements, and competitive positioning are critical determinants.

-

What are the main risks associated with OVIDE’s commercialization?

Regulatory delays, unexpected safety issues, aggressive competition, and market access barriers pose significant risks.

-

How does the projected financial trajectory compare to industry norms?

The projected peak revenue and timeline align with emerging biologics targeting rare or complex diseases, where significant upfront investment can lead to substantial long-term payoffs.

References

[1] Industry reports and clinical trial registries.

[2] Market analyses from IQVIA, EvaluatePharma.

[3] Regulatory guidelines from FDA and EMA.

[4] Competitive landscape assessments.