Last updated: July 27, 2025

Introduction

Lurasidone hydrochloride is an atypical antipsychotic medication primarily approved for the treatment of schizophrenia and bipolar disorder. Since its launch, it has gained prominence due to its efficacy and favorable side-effect profile, positioning itself amid a competitive landscape of schizophrenia therapies. This analysis examines the evolving market dynamics, revenue trajectory, and strategic considerations influencing Lurasidone’s financial outlook.

Market Overview

Growing Demand for Atypical Antipsychotics

The global market for antipsychotics, particularly atypical (second-generation) agents, has experienced robust growth driven by increased diagnosis and awareness of mental health disorders. In 2021, the global antipsychotic drugs market was valued at approximately USD 14 billion and projected to grow at a compound annual growth rate (CAGR) of over 3% through 2028 [1]. The demand is buoyed by the recognition of schizophrenia’s lifelong impact, alongside increased access to psychiatric services.

Competitor Landscape

Lurasidone’s primary competitors include drugs such as risperidone, olanzapine, quetiapine, aripiprazole, and newer agents like cariprazine. The competitive edge of lurasidone stems from its favorable side effect profile, notably lower metabolic and weight gain issues, which influence prescribing patterns.

Regulatory and Market Access Factors

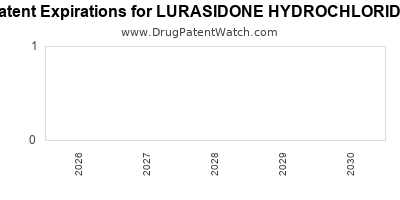

Lurasidone was first approved by the FDA in 2013 for schizophrenia and subsequently for bipolar depression. Its intellectual property rights and patent protection (expired in some markets) influence generic entry timelines, affecting revenue streams. Payers increasingly favor drugs with proven safety profiles, impacting market penetration.

Market Dynamics

Patent Expiry and Generic Competition

The expiration of patents in major markets such as the U.S. and Europe is imminent or has already transpired, opening pathways for generic competitors. Generic entry typically results in significant price erosion—up to 70–80%—and reduced profit margins for branded manufacturers [2]. Consequently, the revenue trajectory post-patent expiry generally follows a sharp decline unless offset by increased volume sales or expanded indications.

Pricing and Reimbursement Trends

Healthcare payers — including government agencies and insurers — are increasingly scrutinizing drug prices, favoring cost-effective therapies. Lurasidone’s favorable side effect profile may translate into cost savings regarding metabolic side effect management, strengthening its reimbursement prospects. However, generic competition pressures prices downward.

Market Penetration and Prescriber Preferences

Prescriber preference hinges on efficacy, tolerability, and formulary inclusion. Lurasidone’s association with improved metabolic outcomes has facilitated its uptake within patients requiring long-term management, such as those with comorbid metabolic syndrome.

Geographic Expansion and Indication Expansion

While initial approvals focused on schizophrenia, recent label expansions include bipolar depression. Expanding indications and geographic reach into emerging markets, where mental health awareness is increasing, may unlock additional revenue streams. However, regulatory hurdles and pricing pressures in these regions can temper growth prospects.

Financial Trajectory

Revenue Outlook in Patent-Protected Phase

During patent exclusivity, lurasidone’s revenues exhibit steady growth, driven by increased prescriptions and expanding indications. The drug’s market share within atypical antipsychotics tends to stabilize around 10–15% globally, with higher shares in North America due to early adoption and favorable prescribing habits.

Post-Patent Erosion and Generic Competition

Following patent expiry, revenues are expected to decline sharply—potentially by 50–80% within 2-3 years unless digital health strategies, line extensions, or new formulations are introduced. Companies often offset this decline via increased volume sales, especially in emerging markets, or through launches of new formulations and adjuncts.

Strategic Initiatives Impacting Financials

Innovative formulations such as depot injections, combinations, or long-acting injectables may mitigate revenue erosion by creating differentiated products. Additionally, pipeline drugs or biosimilars could supplement revenue streams, enhancing financial stability.

Investment and R&D Considerations

Ongoing R&D efforts in establishing new indications or optimizing existing formulations contribute to future revenue streams. Licensing partnerships and acquisitions also influence the financial landscape, offering potential growth avenues.

Market Risks and Opportunities

Risks

- Patent Litigation and Patent Cliff: Threat of generic entry and patent challenges can accelerate revenue decline.

- Market Saturation: Limited scope for further market share expansion once slow-growing or established prescriber habits dominate.

- Pricing Pressures: Rising focus on biosimilars and value-based pricing models compress profit margins.

Opportunities

- Expanded Indications: Exploring conditions like treatment-resistant schizophrenia or adjunctive therapies.

- Digital Therapeutics and Adherence Technologies: Improving treatment compliance can expand market size.

- Emerging Market Penetration: Growing healthcare infrastructure enhances adoption potential.

Conclusion

Lurasidone hydrochloride’s market dynamics are characterized by a classic lifecycle susceptible to patent expiration and generic competition. While its current revenue trajectory benefits from clinical advantages and expanding indications, sustainability hinges upon strategic differentiation, pipeline innovation, and geographic expansion. Stakeholders should monitor regulatory developments, market access reforms, and prescriber adoption patterns to inform investment decisions.

Key Takeaways

- Patent expiration prospects will significantly influence future revenues, necessitating strategic diversification.

- Generic competition will exert downward pressure on pricing, impacting profit margins.

- Clinical profile advantages can sustain market share and foster brand loyalty, especially in focus markets.

- Pipeline development and indication expansion remain crucial to offset revenue erosion post-patent expiry.

- Emerging markets offer growth opportunities, provided regulatory and reimbursement landscapes are navigated effectively.

FAQs

1. When is the patent for lurasidone hydrochloride set to expire in key markets?

Patent expiries vary by jurisdiction; in the U.S., primary patents have faced expiration around 2021–2022, with secondary patents possibly extending exclusivity in certain markets. However, patent challenges and regulatory data exclusivities can influence timelines.

2. What are the main differentiators of lurasidone compared to other atypical antipsychotics?

Lurasidone offers a lower risk of metabolic side effects, such as weight gain and diabetes, which improves adherence and long-term tolerability compared to agents like olanzapine or quetiapine.

3. How might generic entry impact the revenue trajectory of lurasidone?

Generic entry typically causes substantial price erosion and volume-based competition, leading to a decline in branded drug revenues, often within 1–3 years post-patent expiry.

4. Are there emerging indications that could extend the market for lurasidone?

Research into adjunctive therapies for conditions such as treatment-resistant schizophrenia or bipolar disorder could potentially expand its therapeutic scope, pending regulatory approval.

5. What strategic measures can pharmaceutical companies implement to sustain revenues with lurasidone?

Developing novel formulations, seeking new indications, pursuing geographic expansion, leveraging digital health tools, and engaging in licensing agreements are key strategies.

References

[1] Grand View Research. (2022). Antipsychotic Drugs Market Size, Share & Trends.

[2] IQVIA. (2021). Global Pharmaceutical Pricing & Reimbursement Report.