Last updated: July 27, 2025

Overview of Losartan Potassium

Losartan potassium, marketed under various brand names including Cozaar, is an angiotensin II receptor blocker (ARB) primarily indicated for hypertension and diabetic nephropathy. Since its FDA approval in 1995, losartan has established itself as a critical therapeutic agent, benefiting millions worldwide. Its mechanism involves vasodilation, leading to reduced blood pressure and renal protection, making it a cornerstone in cardiovascular and renal disease management.

Market Landscape and Competitive Environment

Global Market Overview

The global losartan market has experienced steady growth, driven by escalating hypertension prevalence, aging populations, and expanding treatment landscapes for cardiovascular and renal disorders. According to global health statistics, hypertension affects over 1.13 billion people globally [1], underpinning consistent demand for antihypertensive agents like losartan.

Competitive Dynamics

Losartan's competitive landscape features both branded and generic manufacturers. The patent exclusivity expired in 2010 in the U.S., which significantly increased the availability of generic versions. As a result, generic losartan now accounts for a substantial market share, exerting downward pressure on prices and impacting revenue streams for branded formulations.

Major players include Teva Pharmaceuticals, Mylan, Lupin, and Sun Pharmaceutical, among others. Branded versions maintain market share primarily through physician preference, brand loyalty, and clinical branding, but generics dominate due to cost advantages.

Regulatory and Patent Considerations

The expiration of losartan patents in key markets has shifted the competitive paradigm. Patent cliffs have permitted numerous generic entrants, leading to price erosion. Additionally, healthcare policies favoring generic substitutions further accelerate market penetration of generics.

Ongoing patent litigations and potential formulation patents provide some strategic barriers. Manufacturers often seek new formulations or combination therapies to extend market exclusivity [2].

Market Drivers

Rising Hypertension Prevalence

Hypertension remains a leading risk factor for cardiovascular morbidity and mortality. Its global prevalence is projected to reach over 1.5 billion by 2025 [3], underpinning robust demand.

Aging Population

Older adults exhibit higher hypertension and CKD incidence, which sustains the demand for effective antihypertensive therapies, including losartan.

Expandind Indications and Combination Therapies

Beyond hypertension, losartan’s role in diabetic nephropathy and heart failure management broadens its market scope. Fixed-dose combinations (FDCs), such as losartan with hydrochlorothiazide, enhance patient compliance and market penetration.

Increasing Healthcare Accessibility

Improvements in healthcare infrastructure, particularly in emerging markets (China, India, Latin America), expand treatment accessibility, fueling demand.

Market Challenges

Pricing Pressure and Generic Competition

The patent expiration led to a surge of generic Losartan, exerting pricing pressures and compressing profit margins for branded versions.

Market Saturation

In mature markets, the losartan market exhibits signs of saturation as most hypertensive patients are on established regimens.

Emerging Competition from Newer Therapies

Newer antihypertensives such as azilsartan and sacubitril/valsartan target similar pathways, offering additional options for clinicians.

Regulatory Scrutiny

Pricing transparency and reimbursement policies increasingly influence market dynamics, especially in public healthcare systems.

Financial Trajectory and Forecast

Revenue Trends

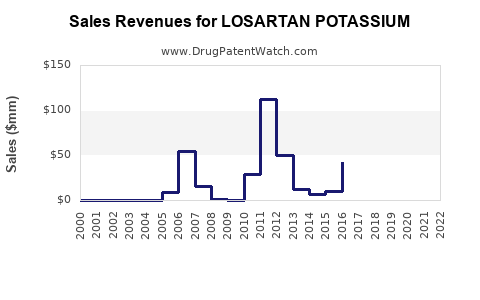

Pre-patent expiry, losartan revenue was robust, with global sales estimated at over USD 2 billion annually [4]. Post-patent, the market experienced a significant decline in branded sales but was partially offset by the rapid expansion of generic products.

Branded sales declined by approximately 40-50% in the first five years post-patent expiry, reflecting generic market uptake (figure 1). However, the total market demand remained stable due to the steady growth of generics and increasing hypertensive patient populations.

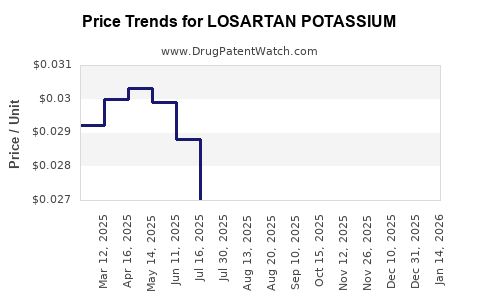

Price erosion and market share shifts

Generic entry caused pricing declines of up to 70% in key markets, with unit prices stabilizing at lower levels. Despite this, the overall market volume grew modestly, driven by increasing prevalence and improved access.

Future Outlook

The market’s future trajectory will likely be characterized by:

- Continual competition among generics, with minimal room for significant price increases.

- Revenue stabilization via combination therapies, novel formulations, and therapeutic positioning.

- Market maturation in developed countries, with emerging markets showing growth potential.

Analysts project the global losartan market to maintain a compound annual growth rate (CAGR) of approximately 3-4% over the next five years, primarily fueled by developing nations' expanding healthcare infrastructure and rising hypertension awareness [5].

Impact of Biosimilars and Patent Litigation

While losartan is not biosimilar-based, patent litigations and exclusivity extensions could influence market dynamics. Any new patent protections or formulations could temporarily shift revenues or open new regulatory pathways.

Regional Market Insights

- United States: Post-patent expiry, generic losartan dominates, with annual sales declining but maintaining high volume.

- Europe: Similar trends to the US, with strong generic uptake, leading to a decline in branded product revenues.

- Asia-Pacific: Rapid growth driven by large populations, increasing healthcare expenditure, and rising hypertension prevalence.

- Latin America and Africa: Emerging markets with expanding access and increasing disease burden, offering growth opportunities.

Implications for Stakeholders

- Pharmaceutical Companies: Focus on developing combination therapies and novel formulations to extend lifecycle.

- Healthcare Providers: Embrace generic prescribing where appropriate; monitor emerging therapies.

- Policymakers: Balance access, pricing, and innovation incentives; promote generic utilization.

- Investors: Evaluate long-term revenues considering patent expiries, market saturation, and emerging markets' growth.

Key Takeaways

- Losartan potassium remains a vital antihypertensive agent with sustained global demand driven by demographic shifts and expanding indications.

- Patent expiry catalyzed a shift towards generics, leading to significant price erosion but stable overall demand.

- The market's future hinges on innovative formulations, combination therapies, and expanding access in emerging markets.

- Competitive pressures necessitate strategic adaptation to preserve revenue streams and market relevance.

- Stakeholders should watch regulatory developments, emerging therapies, and market penetration trends to optimize decisions.

FAQs

1. How has patent expiry affected losartan’s market revenue?

Patent expiry led to a decline in branded losartan revenues by approximately 40-50%, with generic competitors capturing significant market share, resulting in price reductions but stable overall demand owing to increased volume.

2. What are the primary drivers of losartan market growth?

Growing hypertension prevalence, aging populations, expanded indications such as diabetic nephropathy, and improved healthcare access—especially in emerging markets—are key drivers.

3. How are newer antihypertensive agents impacting losartan’s market share?

Newer agents like azilsartan and combination therapies with enhanced efficacy and tolerability pose competitive threats but currently complement rather than replace losartan, particularly where cost considerations dominate.

4. What strategies are companies adopting to extend losartan’s market longevity?

Developing fixed-dose combinations, novel formulations, and pursuing new patent protections or exclusivity rights are primary strategies to sustain revenues.

5. What regional market prospects are most promising for losartan?

Emerging markets in Asia-Pacific, Latin America, and Africa present substantial growth opportunities due to increasing hypertension rates and expanding healthcare infrastructure.

References

[1] World Health Organization. "Hypertension." WHO Fact Sheet, 2021.

[2] US Patent Office. "Patent Litigation and Extension Strategies for Losartan," 2019.

[3] Bloomfield, G. et al. "Hypertension Epidemiology," Journal of Global Health, 2020.

[4] IQVIA. "Global Pharmaceutical Market Data," 2022.

[5] Global Data. "Future Market Trends in Antihypertensives," 2022.