LINZESS Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Linzess, and what generic alternatives are available?

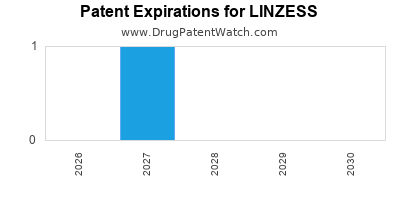

Linzess is a drug marketed by Abbvie and is included in one NDA. There are seven patents protecting this drug and two Paragraph IV challenges.

This drug has two hundred and twenty-four patent family members in forty-five countries.

The generic ingredient in LINZESS is linaclotide. There are ten drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the linaclotide profile page.

DrugPatentWatch® Generic Entry Outlook for Linzess

Linzess was eligible for patent challenges on August 30, 2016.

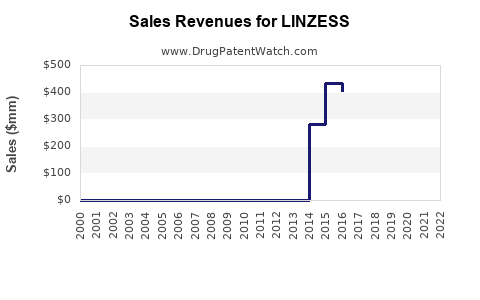

Annual sales in 2022 were $1.6bn, indicating a strong incentive for generic entry.

There have been eleven patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There is one tentative approval for the generic drug (linaclotide), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for LINZESS?

- What are the global sales for LINZESS?

- What is Average Wholesale Price for LINZESS?

Summary for LINZESS

| International Patents: | 224 |

| US Patents: | 7 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 19 |

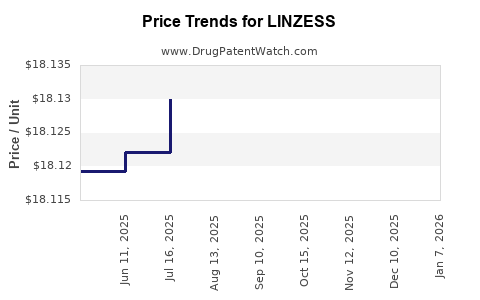

| Drug Prices: | Drug price information for LINZESS |

| Drug Sales Revenues: | Drug sales revenues for LINZESS |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for LINZESS |

| What excipients (inactive ingredients) are in LINZESS? | LINZESS excipients list |

| DailyMed Link: | LINZESS at DailyMed |

Recent Clinical Trials for LINZESS

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| AbbVie | Phase 2 |

| National Cancer Institute (NCI) | Early Phase 1 |

| RenJi Hospital | Phase 4 |

Pharmacology for LINZESS

| Drug Class | Guanylate Cyclase-C Agonist |

| Mechanism of Action | Guanylate Cyclase Activators |

Paragraph IV (Patent) Challenges for LINZESS

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| LINZESS | Capsules | linaclotide | 72 mcg | 202811 | 1 | 2017-11-07 |

| LINZESS | Capsules | linaclotide | 145 mcg and 290 mcg | 202811 | 4 | 2016-08-30 |

US Patents and Regulatory Information for LINZESS

LINZESS is protected by seven US patents and one FDA Regulatory Exclusivity.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Abbvie | LINZESS | linaclotide | CAPSULE;ORAL | 202811-003 | Jan 25, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | LINZESS | linaclotide | CAPSULE;ORAL | 202811-001 | Aug 30, 2012 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | LINZESS | linaclotide | CAPSULE;ORAL | 202811-003 | Jan 25, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for LINZESS

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Abbvie | LINZESS | linaclotide | CAPSULE;ORAL | 202811-002 | Aug 30, 2012 | ⤷ Get Started Free | ⤷ Get Started Free |

| Abbvie | LINZESS | linaclotide | CAPSULE;ORAL | 202811-001 | Aug 30, 2012 | ⤷ Get Started Free | ⤷ Get Started Free |

| Abbvie | LINZESS | linaclotide | CAPSULE;ORAL | 202811-002 | Aug 30, 2012 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for LINZESS

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| AbbVie Deutschland GmbH & Co. KG | Constella | linaclotide | EMEA/H/C/002490Constella is indicated for the symptomatic treatment of moderate to severe irritable-bowel syndrome with constipation (IBS-C) in adults. | Authorised | no | no | no | 2012-11-26 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for LINZESS

When does loss-of-exclusivity occur for LINZESS?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Canada

Patent: 46230

Patent: TRAITEMENTS POUR DES TROUBLES GASTRO-INTESTINAUX (TREATMENTS FOR GASTROINTESTINAL DISORDERS)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 4053449

Patent: Treatments for gastrointestinal disorders

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 76055

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 76055

Patent: TRAITEMENTS POUR DES TROUBLES GASTRO-INTESTINAUX (TREATMENTS FOR GASTROINTESTINAL DISORDERS)

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 32237

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 12592

Estimated Expiration: ⤷ Get Started Free

Patent: 14524444

Estimated Expiration: ⤷ Get Started Free

Patent: 18002740

Patent: 消化器疾患の治療 (TREATMENT OF GASTROINTESTINAL DISORDERS)

Estimated Expiration: ⤷ Get Started Free

Patent: 19085415

Patent: 消化器疾患の治療 (TREATMENT OF GASTROINTESTINAL DISORDERS)

Estimated Expiration: ⤷ Get Started Free

Patent: 20128424

Patent: 消化器疾患の治療 (TREATMENTS FOR GASTROINTESTINAL DISORDERS)

Estimated Expiration: ⤷ Get Started Free

Patent: 22010265

Patent: 消化器疾患の治療

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 7354

Patent: TRATAMIENTOS PARA TRASTORNOS GASTROINTESTINALES. (TREATMENTS FOR GASTROINTESTINAL DISORDERS.)

Estimated Expiration: ⤷ Get Started Free

Patent: 14001798

Patent: TRATAMIENTOS PARA TRASTORNOS GASTROINTESTINALES. (TREATMENTS FOR GASTROINTESTINAL DISORDERS.)

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 76055

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 14864

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering LINZESS around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Cyprus | 1122853 | ⤷ Get Started Free | |

| Russian Federation | 2353383 | СПОСОБЫ И КОМПОЗИЦИИ ДЛЯ ЛЕЧЕНИЯ ЖЕЛУДОЧНО-КИШЕЧНЫХ РАССТРОЙСТВ (METHODS AND COMPOSITIONS FOR GASTROENTERIC UPSET THERAPY) | ⤷ Get Started Free |

| South Korea | 20180137043 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for LINZESS

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1594517 | 1390024-6 | Sweden | ⤷ Get Started Free | PRODUCT NAME: LINAKLOTID; FIRST MARKETING AUTHORIZATION NUMBER SE: EG EU/1/12/801, 2012-11-28 |

| 1594517 | 2013/023 | Ireland | ⤷ Get Started Free | PRODUCT: LINACLOTIDE AND EVERY THERAPEUTICAL EQUIVALENT FORM THEREOF AS PROTECTED BY THE BASIC PATENT, INCLUDING PHARMACEUTICALLY ACCEPTABLE SALTS. REGISTRATION NO/DATE IRELAND EU/1/12/801/001, EU/1/12/801/002, EU/1/12/801/003, EU/1/12/801/004 / 26/11/2012 |

| 1594517 | C300593 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: LINACLOTIDE; REGISTRATION NO/DATE: EU/1/12/801/001-004 20121126 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for LINZESS (Linaclotide)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.